Table of Contents

1. IPO Snapshot

Symbol: PATILAUTOM

IPO Open Date: June 16, 2025

IPO Close Date: June 18, 2025

IPO Allotment Date: June 19, 2025

IPO Listing Date: June 23, 2025

Issue Size: ₹69.61 Crore (Fresh issue of 58,00,800 shares)

Issue Type: SME Book-built Issue

Price Band: ₹114 – ₹120 per share

Lot Size: 1,200 shares

Minimum Investment: ₹1,36,800 per lot

Listing Exchange: NSE SME

2. Company Overview

Patil Automation Ltd is a leading Indian automation solutions provider, established in 2015 with a vision to deliver world‑class standards in welding and line automation. The company operates five state‑of‑the‑art facilities across India, including two dedicated manufacturing plants in Pune, with a total covered area of approximately 460,000 square feet. Their core offerings include turnkey solutions for welding lines, assembly lines, robotic handling, gantry systems, special-purpose machines, and precision jigs and fixtures, catering primarily to automotive OEMs and Tier-1/Tier-2 suppliers.

Built on a strong foundation of in-house engineering, production, and quality assurance capabilities, Patil Automation’s 650-plus workforce includes specialized teams for mechanical and electrical design, PLC and robotic programming, vision systems, and project management. They leverage advanced tools such as Solid Edge, Catia, AutoCAD, Delmia Robot Studio, and offline programming for reliability and precision. Their manufacturing units are equipped with CNC plasma cutters, laser machines, bending cells, milling and drilling centers, welding stations, and coordinate measurement systems to support turnkey deployment.

The company’s mission is to ensure complete customer satisfaction by delivering high-quality, competitively priced automation solutions on time, supported by continuous improvement through quality management systems. Their objective is “to be the industry leader through innovation, delivering exceptional value to customers and stakeholders”.

Serving clients across at least ten Indian states including Maharashtra, Karnataka, Haryana, Gujarat, Madhya Pradesh, and Tamil Nadu. Patil Automation has executed over 1,450 robot integrations, more than 500 welding and assembly SPM installations, and over 600 robotic cell deployments in a year. This track record highlights their ability to undertake large-scale, repetitive projects with standardized and modularized design approaches.

The management team includes experienced professionals: Managing Director Manoj Pandurang Patil brings over 25 years of domain expertise, supported by Executive Directors Aarti Manoj Patil (HR and administration) and Prafulla Pandurang Patil (finance), along with independent directors who bolster corporate governance.

Patil Automation is well-positioned to expand in its key focus areas- welding automation and assembly line solutions, while exploring new verticals such as electric vehicles, pharmaceuticals, and packaging, leveraging its capable in-house R&D, engineering, and service teams.

3. Grey Market Premium (GMP)

As per current grey market data, Patil Automation Ltd is commanding a premium of around ₹22 per share. This suggests a strong demand for the IPO in the unofficial market. The GMP indicates that investors are expecting the stock to list at a higher price compared to its issue price of ₹120. However, GMP is unofficial and speculative. It does not guarantee listing gains and should be considered along with other fundamental factors. The active trading in the grey market also reflects investor interest and market sentiment for this IPO. The premium is being supported by the company’s growth potential, niche business model, and strong client relationships. Still, investors should remain cautious and look at the fundamentals before making any investment decision.

4. Shariah Compliance Status

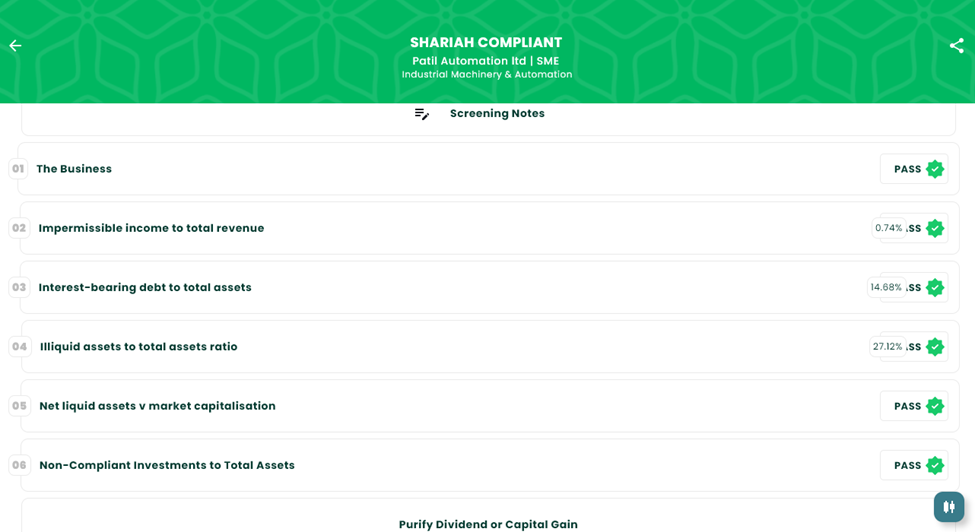

According to the IslamicStock Screener, Patil Automation Ltd has been marked as Shariah compliant.

✅ The business activity of the company aligns with ethical investing principles as required under Shariah norms.

✅ The impermissible income to total revenue is less than 5 percent.

✅ The interest-bearing debt to total assets is less than 33 percent.

✅ The illiquid assets to total assets ratio is greater than 20%.

✅ The net liquid assets compared to market capitalization is less, which is the requirement for this rule.

✅ The non-compliant investments to total assets have also passed the screening as it’s less than 33%.

An important note to highlight is that an interest-free loan of ₹600 lakh from the promoter, Mr. Manoj Patil, has been excluded from the total interest-bearing debt. This clarification shows transparency in IslamicStock’s screening and helps investors make informed decisions. All key financial ratios fall within the Shariah limits, ensuring that the investment is permissible for faith-based investors. The compliance status adds an extra layer of confidence for those who strictly follow Islamic finance principles.

5. Subscription Status

As of Day 2 (June 17, 2025 at 11:30 AM), the Patil Automation IPO has been subscribed 1.11 times overall. Among the categories, the retail and NII segments show decent participation, while QIB interest remains very low so far.

Here’s the detailed category-wise breakdown:

- QIB: 0.01x (11,01,600 shares offered; 8,400 shares bid for)

- NII: 1.82x (8,26,800 shares offered; 15,04,800 shares bid for)

- Retail: 1.43x (19,28,400 shares offered; 27,63,600 shares bid for)

- Total Applications Received: 2,463

This early data suggests strong retail and HNI demand, while institutional participation is expected to build closer to the final day. You may check the status by clicking here.

6. Final Thoughts

Patil Automation Ltd presents itself as a promising player in the automation segment, especially with its strong focus on the automotive industry. The company has built a solid reputation for delivering reliable and innovative solutions, which gives it a competitive edge in the growing industrial automation market. The issue size is moderate, and the pricing seems fair considering the company’s revenue, profits, and order book strength. From a Shariah compliance perspective, the IPO is suitable for faith-based investors, which also increases its appeal in that segment. The automation industry in India is expected to grow as companies increasingly look to improve efficiency and reduce costs, providing long-term opportunities for Patil Automation. While the IPO seems attractive, investors must remember that SME IPOs are generally more volatile and less liquid compared to mainboard listings. Those considering investing should assess their risk appetite and investment goals. Long-term investors who believe in the sector and company’s execution capabilities may find this IPO worth considering.

7. Disclaimer

This article is for informational purposes only and does not constitute investment advice or a recommendation. Please consult with a qualified financial advisor before making any investment decisions. Investing in IPOs is subject to market risk, and past performance is not indicative of future results. Always read the Red Herring Prospectus (RHP) and do your own research before applying.