Table of Contents

1. IPO Snapshot

Symbol: INFLUX

IPO Open Date: June 18, 2025

IPO Close Date: June 20, 2025

IPO Allotment Date: June 23, 2025

IPO Listing Date: June 25, 2025

Issue Size: ₹58.57 crore (fresh and offer-for-sale combined)

Issue Type: Book-built issue (SME IPO)

Price Band: ₹91 to ₹96 per share

Lot Size: 1,200 shares per application

Minimum Investment: ₹109,200

Listing Exchange: NSE SME

2. Company Overview

Influx Healthtech Ltd is involved in the business of pharmaceutical manufacturing. The company focuses on the development and distribution of a wide range of pharmaceutical products catering to various therapeutic segments. The company operates with a strong emphasis on quality standards, regulatory compliance, and modern manufacturing practices.

The manufacturing facility is set up with the required certifications and quality processes. The firm also engages in contract manufacturing and serves both domestic and international clients. Its product line includes tablets, capsules, powders, and syrups. The team consists of professionals with domain expertise and experience in pharma operations.

One of the key strengths of the company is its focus on affordable healthcare. It aims to serve smaller towns and rural areas by ensuring timely and cost-effective delivery of medicines. With the funds raised through this IPO, Influx Healthtech plans to invest in working capital, marketing expansion, and upgrading its infrastructure to meet growing demand.

3. Grey Market Premium (GMP)

As of the latest update on June 19, 2025 (Day 2) at around 06:00 PM, the grey market premium (GMP) for Influx Healthtech IPO is trading at around ₹38. The GMP fluctuates based on demand and market conditions and gives a rough idea of how the stock might list. Currently, the GMP suggests a good premium over the IPO price. However, it is important to remember that grey market trends are unofficial and should not be solely relied upon for investment decisions.

4. Shariah Compliance Status

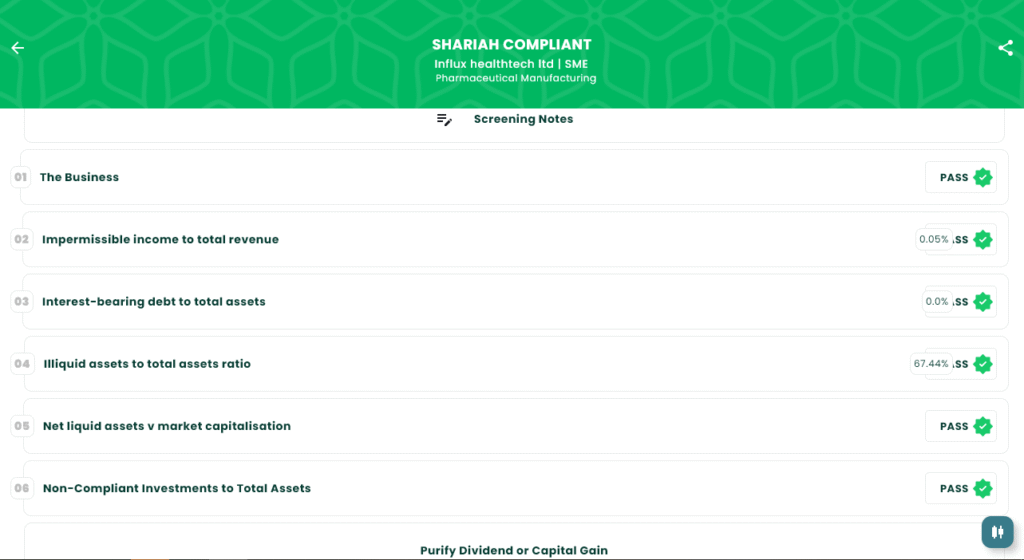

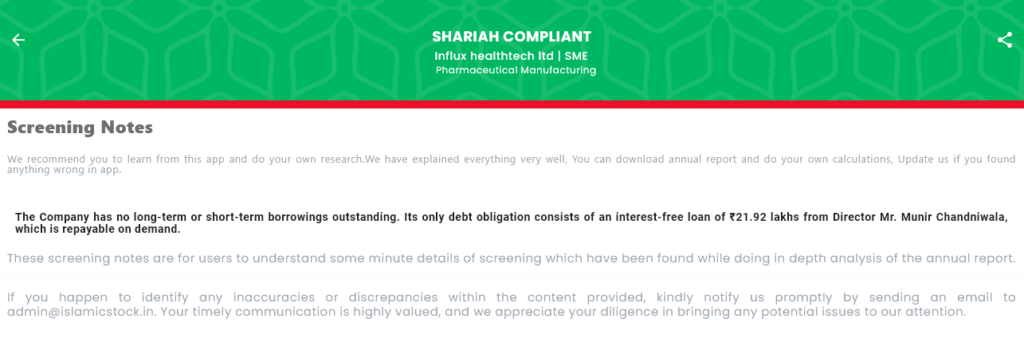

Influx Healthtech Ltd is confirmed as Shariah Compliant according to the IslamicStock screening criteria. Below are the results based on the standard six-point Shariah screening criteria:

✅ The business activities are halal, and the company has passed all key financial filters.

✅ The impermissible income to total revenue is less than 5 percent.

✅ The interest-bearing debt to total assets is less than 33 percent.

✅ The illiquid assets to total assets ratio is greater than 20 percent.

✅ The net liquid assets compared to market capitalisation meet Shariah standards.

✅ The non-compliant investments to total assets ratio is less than 33 percent.

The company does not have any long-term or short-term borrowings. It only has an interest-free loan from a director, repayable on demand. This makes the company a suitable option for investors looking for ethical, Shariah-compliant opportunities.

5. Subscription Status

As of June 19, 2025 (Day 2) at around 06:00 PM, the Influx Healthtech Ltd IPO has been subscribed 25.42 times overall. The retail category showed strong interest, getting subscribed 36.04 times. The Non-Institutional Investors (NII) portion was subscribed 32.28 times, while the Qualified Institutional Buyers (QIB) portion was subcribed 1.69 times.

Here is a breakdown of the Day 2 subscription figures:

- QIB: 1.69x (11,59,200 shares offered; 19,58,400 shares bid for)

- NII: 32.28x (8,70,000 shares offered; 2,80,80,000 shares bid for)

- Retail: 36.04x (20,29,200 shares offered; 7,31,24,400 shares bid for)

- Total Applications Received: 65,571

These numbers reflect early trends and may change as more bids are placed before the IPO closes.

Full subscription numbers will only be available after June 20. Following this, exchanges and financial platforms will release categorized statistics.

Subscription numbers help understand market sentiment but are not the only factor for evaluating an IPO. Investors should always look at the business model and financials before making a decision.

6. Final Thoughts

Influx Healthtech Ltd appears to be a promising player in the growing pharmaceutical sector. The company’s focus on affordability, rural outreach, and strong manufacturing processes makes it stand out among SME IPOs. The clean balance sheet with no interest-bearing debt is a significant plus.

The Shariah compliance status further increases its appeal to ethical investors. Good GMP signals cautious optimism in the market.

If you are a long-term investor looking for a pharmaceutical company that aligns with both commercial and ethical values, Influx Healthtech Ltd could be worth considering. Still, due diligence and proper financial planning are always advised before investing.

7. Disclaimer

This article is intended for educational purposes only and should not be considered as financial advice. Investors are requested to consult with their financial advisors and thoroughly read the red herring prospectus before making any investment decisions. IPO investments are subject to market risk, and past performance does not guarantee future results.