Prostarm Info Systems Ltd IPO: GMP, Dates, Business Details, and Shariah Compliance

Prostarm Info Systems Ltd, an electrical equipment company based in Pune, has announced its Initial Public Offering (IPO). The company specializes in providing power solutions, including uninterruptible power supply (UPS) systems, batteries, and energy storage solutions. With a growing presence across India, Prostarm aims to raise ₹168 crore through its Prostarm Info Systems IPO, which will be listed on the BSE and NSE platforms.

Table of Contents

Overview of Prostarm Info Systems Ltd IPO

The Prostarm Info Systems IPO represents a significant opportunity for investors seeking to engage with a company that is innovating in the energy sector.

This article covers all the key information about the Prostarm Info Systems IPO, including the Grey Market Premium (GMP), issue dates, business overview, and Shariah compliance status.

IPO Snapshot

Here are the key details for the Prostarm Info Systems Ltd IPO:

- IPO name: Prostarm Info Systems Ltd IPO

- IPO code: PROSTARM

- Issue type: Book-built issue

- Price band: ₹95 to ₹105 per equity share

- Face value: ₹10 per share

- Issue size: 1.60 crore equity shares (₹168 crore)

- Lot size: 142 shares

- Minimum investment: ₹13,490

- IPO opening date: May 27, 2025

- IPO closing date: May 29, 2025

- Basis of allotment: May 30, 2025

- Refunds initiation: June 2, 2025

- Demat credit: June 2, 2025

- Listing date: June 3, 2025

- Listing platform: BSE and NSE

This information is sourced from Chittorgarh and the official prospectus. Investors can verify details and changes on the company’s website and stock exchange portals.

Company Overview

Prostarm Info Systems Ltd was founded to provide reliable power backup solutions and energy storage products for industrial and commercial clients. The company offers a range of products including:

- Uninterruptible Power Supply (UPS) systems

- Inverters

- Batteries

- Solar energy products

- Related services such as installation, maintenance, and support

Prostarm has built a strong presence across multiple sectors including healthcare, banking, education, and government projects. The company has shown steady financial performance with consistent revenue growth, improving profitability, and a diversified customer base. As of December 2024, Prostarm has been managing its resources well and has maintained low debt levels, which is seen as a positive indicator for potential investors.

More information about the company’s products and services can be found on the official website: prostarm.com

Grey Market Premium (GMP)

The Grey Market Premium (GMP) is an unofficial indicator of demand for an IPO before it lists on the stock exchange. As of the latest update on May 27, 2025, the GMP for the Prostarm Info Systems Ltd IPO is reported at around ₹25. This means the estimated listing price could be ₹130, assuming the upper price band of ₹105.

It is important to note that the GMP is based on market sentiment and may change before the listing date. GMP should not be used as the sole factor for making investment decisions.

Shariah Compliance Status

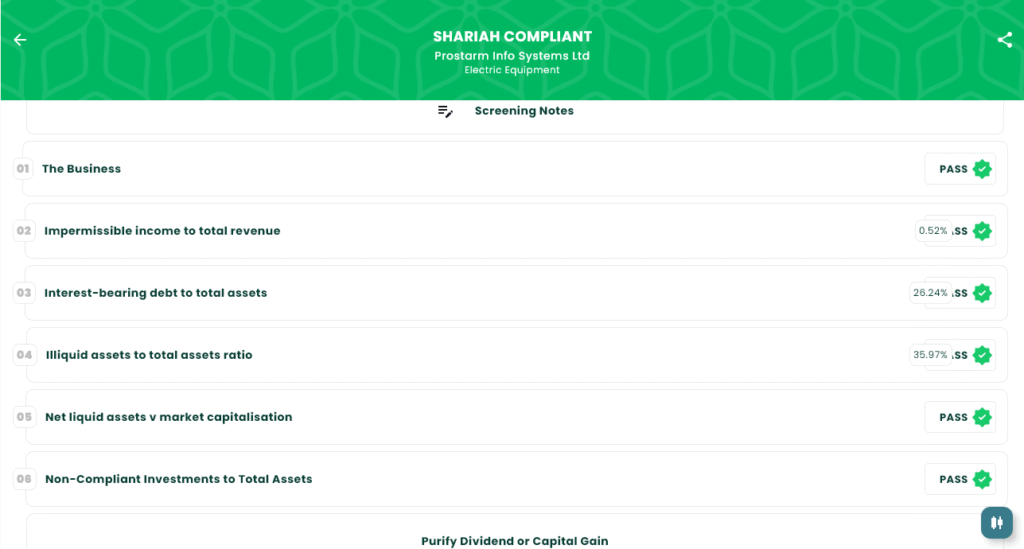

According to IslamicStock, the Prostarm Info Systems Ltd IPO has been screened and classified as Shariah compliant. This means the company meets the key financial and business activity criteria required under Islamic finance principles.

The Shariah compliance screening results for Prostarm show:

- Business activity: Pass

- Impermissible income to total revenue: 0.52 percent (Pass)

- Interest-bearing debt to total assets: 26.24 percent (Pass)

- Illiquid assets to total assets: 35.97 percent (Pass)

- Non-compliant investments: 8.05 percent (Pass)

The screening notes mention that Prostarm Info Systems Ltd is financially strong as of December 2024, with solid revenue, stable growth, and low debt. This further supports its compliance status.

Investors who prefer Shariah-compliant investments may find this information useful, but they should always do their own research and consult financial advisors.

Final Thoughts

The Prostarm Info Systems Ltd IPO brings a company focused on essential power and energy solutions to the market. With a growing customer base, stable financials, and a Shariah-compliant status, the IPO may attract interest from a wide range of investors.

However, as with any investment, it is important to review the company’s fundamentals, understand market risks, and read the official prospectus before making any decisions. GMP trends can give a hint of demand, but they are not a guarantee of returns.

For more details, visit the company’s website or review information on trusted IPO platforms such as Chittorgarh and InvestorGain.

Disclaimer

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or subscribe to any securities. Please consult a SEBI-registered investment advisor before making any financial decisions. Shariah compliance information is based on publicly available data from IslamicStock and is intended for general awareness only.