The world of IPOs is always buzzing, bringing new opportunities for investors. This time, we’re taking a closer look at the Adcounty Media India Ltd IPO, an offering from the dynamic advertising and media sector. In this article, we’ll give you a clear, easy-to-understand overview, covering the key details of the IPO, how its subscription is performing, what the Grey Market Premium (GMP) suggests, and most importantly, its Shariah compliance status.

For anyone considering an investment, especially in a specialized field like ad-tech, it’s vital to grasp the company’s core business, its financial health, and ethical considerations. Let’s explore what makes Adcounty Media India Ltd stand out.

Table of Contents

About Adcounty Media India Ltd: Powering Performance Marketing in the Digital Age

Adcounty Media India Ltd, recognized by its IPO symbol ADCOUNTY, operates as a global ad-tech and performance marketing company. They offer a fully integrated suite of services that span across performance marketing, programmatic advertising, and brand marketing. Their advertising solutions cater to a broad range of industries, including e-commerce, ed-tech, automotive, BFSI (Banking, Financial Services and Insurance), FMCG (Fast-Moving Consumer Goods), travel, entertainment, and gaming.

The company uses its own proprietary platforms like Bidcounty, Opsis, Genwin, iSearch Ads, and SeeTV to deliver targeted marketing and user acquisition services. Essentially, Adcounty acts as an advertising facilitator, connecting businesses with their target audiences across these various sectors.

Adcounty Media India IPO Snapshot: Key Details You Should Know

The Adcounty Media India Ltd IPO is a BSE SME Bookbuilding issue. Here’s a snapshot of the important details, based on the tentative schedule:

- IPO Open Date: Friday, June 27, 2025

- IPO Close Date: Tuesday, July 1, 2025

- Issue Price Band: ₹80 to ₹85 per equity share

- Face Value: ₹10 per share

- Sale Type: Fresh Capital

- Total Issue Size: 59,63,200 shares, aiming to raise up to ₹50.69 Crore

- Reserved for Market Maker: 3,36,000 shares (up to ₹2.86 Crore), with Prabhat Financial Services Ltd. as the market maker

- Net Offered to Public: 56,27,200 shares, aggregating up to ₹47.83 Crore

- Minimum Lot Size for Retail Investors: 1,600 Shares, meaning an investment of ₹1,36,000 at the upper price band

- Listing At: BSE SME

- Tentative Allotment Date: Wednesday, July 2, 2025

- Tentative Listing Date: Friday, July 4, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on July 1, 2025

(Source: Chittorgarh IPO Details – Adcounty Media India IPO)

Crucial Insight: Shariah Status of Adcounty Media India Ltd IPO

For investors who prioritize Islamic finance principles, the Shariah compliance of an investment is a key factor. Shariah law has specific guidelines on acceptable business activities and financial ratios, especially concerning interest-bearing debt and earnings from non-permissible sources.

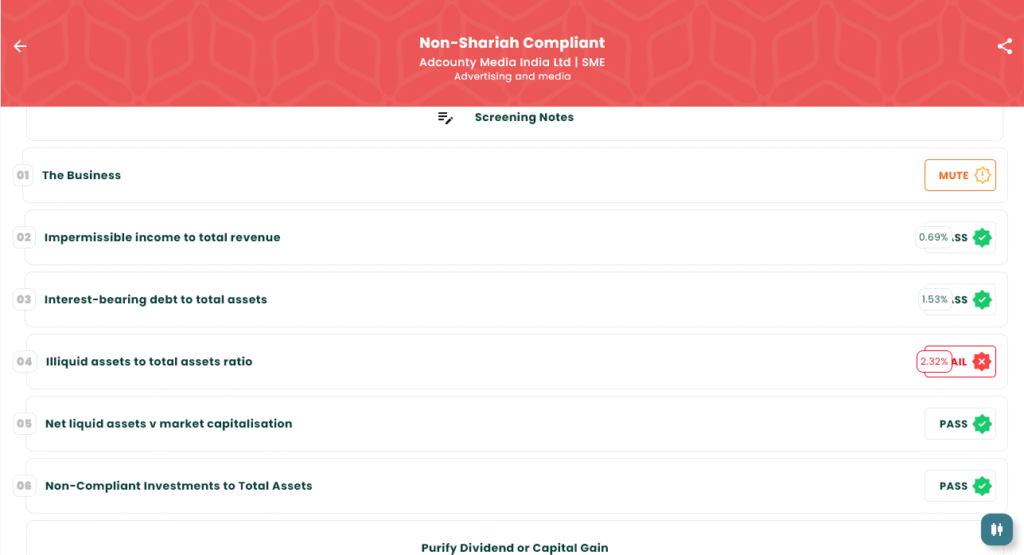

Based on our detailed screening, Adcounty Media India Ltd is classified as “Non-Shariah Compliant.”

Here’s a breakdown of the screening results:

- The Business: Is marked as “MUTE”. While Adcounty acts as an advertising facilitator and does not directly engage in financial, entertainment, or other operational activities of its clients, the nature of advertising itself can sometimes involve promoting impermissible products or services. Due to this potential ambiguity, and without explicit disclosures, the business activity is noted as “MUTE”.

- Impermissible income to total revenue: Passes.

- Interest-bearing debt to total assets: Passes.

- Illiquid assets to total assets ratio: Fails. This is a significant point of non-compliance.

- Net liquid assets vs market capitalisation: Passes.

- Non-Compliant Investments to Total Assets: Passes.

The “Non-Shariah Compliant” status is primarily due to the failure of the illiquid assets to total assets ratio and the “MUTE” status of the business activity due to potential concerns within the broader advertising sector. This means that for investors strictly following Shariah principles, this IPO might not be a suitable choice.

IPO Subscription Status: What We’ve Seen So Far

The subscription status gives us a real-time picture of how much demand there is for the shares from different investor groups: Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs).

As of June 27, 2025, at around 03:45 PM (Day 1), here’s how the Adcounty Media India IPO Subscription Status (Bidding Detail) looks:

- QIB (Qualified Institutional Buyers): 0.00 times subscribed

- NII (Non-Institutional Investors): 0.81 times subscribed

- Retail Individual Investors (RII): 2.18 times subscribed

- Total Subscription: 1.26 times

- Total Applications: 3,249

(Source: Chittorgarh IPO Subscription – Adcounty Media India)

On its first day, the IPO has already seen a healthy overall subscription, mainly driven by strong interest from retail investors who have subscribed over twice their allotted portion. It will be interesting to see how these numbers develop over the remaining bidding days.

Grey Market Premium (GMP) Insights

The Grey Market Premium (GMP) is an unofficial, speculative price at which IPO shares trade before they officially list on the stock exchange. Think of it as an early, informal peek into market sentiment, showing how much more (or less) investors are willing to pay for the shares in the unofficial market, compared to the IPO’s issue price.

For the Adcounty Media India Ltd IPO, the current GMP is:

- Adcounty Media India IPO GMP Today (as per image): ₹38

- Expected Listing Price (Upper Band + GMP): ₹85 (Upper Price Band) + ₹38 (GMP) = ₹123

- Expected % Gain/Loss: Based on the GMP, this suggests a potential gain of 44.71%.

Important Note: Please remember that GMP is not an official or regulated indicator. It’s highly speculative and can change dramatically based on market news, sentiment, and other factors. It should only be used as a very rough guide and not as a guarantee of how the shares will perform once they list. Always base your investment decisions on thorough research into the company’s fundamentals, financials, and the overall market conditions.

Making a Smart Investment Decision

Deciding whether to invest in an IPO like Adcounty Media India Ltd’s requires careful thought. Here are some key factors to consider:

- Company Fundamentals: Take a deep dive into Adcounty Media’s business model, how well it’s performed financially, its growth strategies, and its competitive position in the ad-tech and performance marketing landscape.

- Industry Outlook: Evaluate the future prospects of the digital advertising and media industries. Are there trends, technological shifts, or regulatory changes that could impact the company?

- IPO Valuations: Consider if the IPO’s price band offers a reasonable valuation when compared to its industry peers and its growth potential.

- Risk Factors: Make sure you understand the specific risks outlined in the company’s Red Herring Prospectus (RHP), particularly those related to market competition, technological changes, and client acquisition.

- Shariah Compliance: For investors strictly adhering to Shariah principles, the “Non-Shariah Compliant” status is a crucial point. The failure in the illiquid assets ratio and the “MUTE” status of the business due to potential ambiguities in advertising activities mean this might not align with their investment criteria.

Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. Investing in IPOs carries inherent risks, and there is no guarantee of returns. We strongly encourage you to conduct your own thorough due diligence, consult with a SEBI-registered financial advisor, and carefully read the Red Herring Prospectus (RHP) before making any investment decisions. The information on Shariah compliance is based on the provided screening and common interpretations of Islamic finance principles.

Ready to explore more investment opportunities?

To learn more about IPOs, get detailed company analyses, and find Shariah-compliant investment options, visit our website at IslamicStock Website, explore insightful articles on our blog at IslamicStock Blog, and download our application, IslamicStock, for in-depth screenings and investment guidance tailored for you.