Crafting a Legacy for a Sparkling Future

India’s Most Prominent B2B CZ Gold Jewellery Company, SHANTIGOLD’s journey of excellence and innovation began in 2003. The company prides itself on brilliantly combining exquisite designs with flawless craftsmanship in the world of Gold Jewellery. All their jewellery products are assayed and tested for Gold Purity. Each jewellery item is BIS Hall Marked and carries a HUID number, ensuring the purity of the Gold metal used to manufacture their products.

Table of Contents

Shariah Status

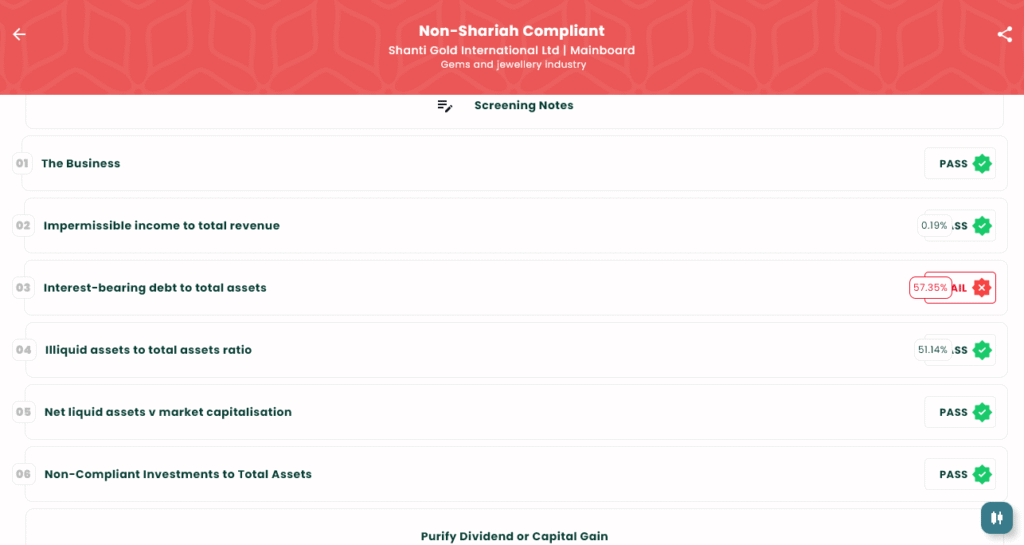

Based on our screening metod, Shanti Gold International Ltd is currently Non-Shariah Compliant.

The company’s financials raise concerns from a Shariah compliance perspective, primarily due to its overall reliance on impermissible debt. As per its FY 2024-25 disclosures, while certain interest-free components were excluded for screening purposes, the company still falls in Rule 3 due to its overall reliance on impermissible debt. This indicates the presence of interest-based borrowings that exceed the allowable threshold under Shariah norms, with the interest-bearing debt to total assets ratio being 57.35%.

Note: We recommend you to learn from the IslamicStock app and do your own research. We have explained everything very well. You can download detailed reports and do your own calculations. Update us if you find anything wrong in the app.

Valuable Insights for Users

Shanti Gold International Ltd is engaged in the wholesale trading of gold, silver, and studded jewellery, offering a range of ornaments and investment-grade bullion products. Despite its presence in the precious metals space, the company’s financials raise concerns from a Shariah compliance perspective due to an overall reliance on impermissible debt. Specifically, the company has taken ₹14.10 million as interest-free inter-corporate deposits and ₹12.16 million as interest-free unsecured loans and advances from related parties. Even after excluding these, the company’s interest-bearing debt to total assets ratio of 57.35% exceeds the allowable threshold under Shariah norms.

About the Company

Shanti Gold International is one of the leading manufacturers of high-quality 22kt CZ casting gold jewellery, in terms of installed production capacity, specializing in the design and production of all types of gold jewellery. The company offers a wide range of high-quality, intricately designed pieces, including bangles, rings, necklaces, and complete jewellery sets across various price points, ranging from jewellery for special occasions like weddings to festive and daily-wear jewellery.

Founded as a partnership firm in 2003, the business was established by Promoters Pankajkumar H. Jagawat and Manojkumar N. Jain, both with over 20 years of experience in the jewellery industry. They currently offer a wide range of designs and products in 22kt CZ gold jewellery.

Our Ethos

At Shanti Gold, the focus is not just on making gold jewellery but on creating timeless beauty through expert craftsmanship. Their brand values emphasize precision, sophistication, and the art of transformation, turning the raw beauty of gold into cherished jewellery that reflects their creative ethos.

Vision

To become the most sought-after gold jewellery brand in India and beyond, synonymous with timeless elegance, exceptional craftsmanship, and unparalleled customer satisfaction.

Mission

To consistently offer unparalleled Indian and international gold jewellery of exceptional quality to clients, intricately weaving the allure of tradition with the threads of innovation and modernity. To build a legacy as a trusted brand, not only offering high-quality gold products but also fostering an extraordinary buying experience that leaves clients feeling valued and happy.

IPO Snapshots

Shanti Gold International IPO Details

- IPO Dates: July 25, 2025 to July 29, 2025

- Face Value: ₹10 per share

- Issue Price Band: ₹189 to ₹199 per share

- Lot Size: 75 Shares

- Sale Type: Fresh Capital

- Total Issue Size: 1,80,96,000 shares (aggregating up to ₹360.11 Cr)

- Issue Type: Bookbuilding IPO

- Listing At: BSE, NSE

- Share Holding Pre Issue: 5,40,00,000 shares

- Share Holding Post Issue: 7,20,96,000 shares

Shanti Gold International IPO Timeline (Tentative Schedule)

- IPO Open Date: Fri, Jul 25, 2025

- IPO Close Date: Tue, Jul 29, 2025

- Tentative Allotment: Wed, Jul 30, 2025

- Initiation of Refunds: Thu, Jul 31, 2025

- Credit of Shares to Demat: Thu, Jul 31, 2025

- Tentative Listing Date: Fri, Aug 1, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on July 29, 2025

Lot Size

Investors can bid for a minimum of 75 shares and in multiples thereof. The following table depicts the minimum and maximum investment by Individual Investors (Retail) and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 75 | ₹14,925 |

| Retail (Max) | 13 | 975 | ₹1,94,025 |

| S-HNI (Min) | 14 | 1,050 | ₹2,08,950 |

| S-HNI (Max) | 67 | 5,025 | ₹9,99,975 |

| B-HNI (Min) | 68 | 5,100 | ₹10,14,900 |

Financials

For the financial year ended March 31, 2025, Shanti Gold International Ltd reported Assets of ₹419.83. Their Revenue stood at ₹1,112.47, with a Profit After Tax of ₹55.84. The company’s EBITDA was ₹97.71, and its Net Worth was ₹152.37. Comparing to the previous fiscal years, the company has shown growth in all these key financial metrics. For instance, in FY2024, Assets were ₹325.40, Revenue was ₹715.04, Profit After Tax was ₹26.87, EBITDA was ₹53.45, and Net Worth was ₹96.67. In FY2023, Assets were ₹256.88, Revenue was ₹682.28, Profit After Tax was ₹19.82, EBITDA was ₹45.57, and Net Worth was ₹69.81.

KPI

The market capitalization of Shanti Gold International IPO is ₹1434.71 Cr.

| KPI | Values |

| ROCE | 25.70% |

| Debt/Equity | 1.60 |

| RoNW | 44.85% |

| PAT Margin | 5.05% |

| EBITDA Margin | 8.83% |

| Price to Book Value | 7.05 |

Objective of the IPO

The Company Shanti Gold International IPO proposes to utilise the Net Proceeds from the Issue towards the following objects:

- Funding of capital expenditure requirements towards setting up of the Proposed Jaipur Facility, with an expected amount of ₹46.30 crores.

- Funding working capital requirements of the Company, with an expected amount of ₹200.00 crores.

- Repayment and/or pre-payment, in full or part, of certain borrowings availed by the Company, with an expected amount of ₹17.00 crores.

- General corporate purposes.

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Shanti Gold International IPO is currently ₹37, representing an 18.59% premium over the issue price (based on the upper end of the price band).

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock.in & consider opening a demat account from below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.