Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Globtier Infotech Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Globtier Infotech Ltd

Industry: IT Enabled Services

Listing At: BSE SME

Overview:

Founded in 2012, Globtier was established with the goal of providing advanced IT services to both small and medium-sized enterprises and large corporations. The company’s areas of expertise include Managed IT Services, Enterprise Application Support, bespoke custom app development, Cloud Services, Security Services, and Staffing Services. Since its inception, Globtier has helped clients improve efficiency, streamline operations, and achieve growth through its cost-effective and innovative IT solutions.

Currently, Globtier is a leading industry player serving clients globally through its headquarters in India and an office in the USA. The company focuses on core IT practices while maintaining high-quality standards. Over the years, Globtier has overcome various challenges, achieving significant milestones annually. Its innovative services empower clients to optimize resources and gain a competitive edge. Globtier has partnered with several prominent companies and continues to flourish as a service-based business.

Vision, Philosophy, Mission, and Strategy

Globtier’s vision is to help businesses maximize the benefits of its IT services, becoming their most trusted service provider and ensuring their success in the market. The company’s philosophy centers on delivering high-quality solutions quickly, while incorporating current trends and sustainability principles. Its mission is to provide enterprises with a mix of excellence and innovation through its top-tier solutions, guaranteeing a competitive advantage. Finally, Globtier’s strategy involves combining its skills, technical resources, dedication, and ambition to ensure maximum returns for its clients.

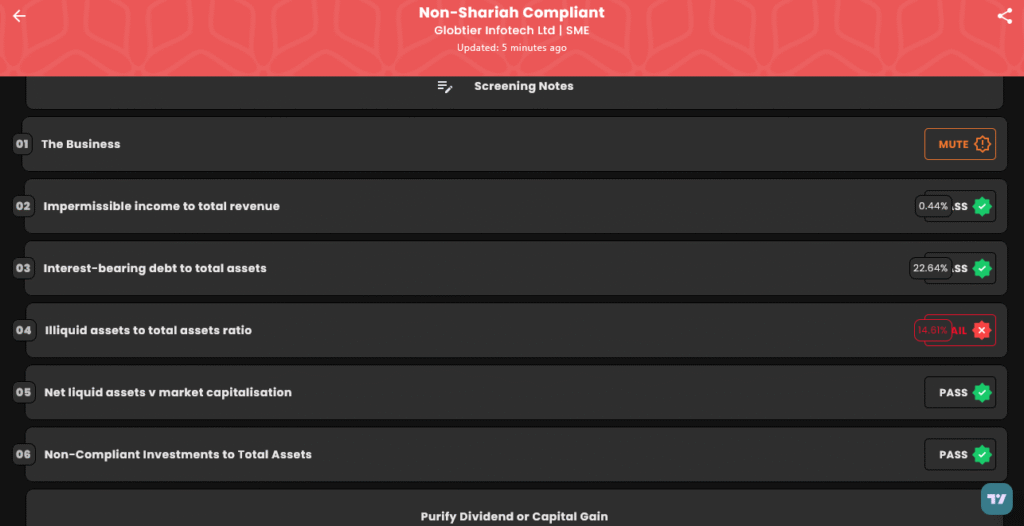

Shariah Status

The IPO is Non-Shariah Compliant, with business as MUTE please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Mon, Aug 25, 2025 |

| IPO Close Date | Thu, Aug 28, 2025 |

| Tentative Allotment | Fri, Aug 29, 2025 |

| Initiation of Refunds | Mon, Sep 1, 2025 |

| Credit of Shares to Demat | Mon, Sep 1, 2025 |

| Tentative Listing Date | Tue, Sep 2, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 28, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,30,400 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,30,400 |

| HNI (Min) | 3 | 4,800 | ₹3,45,600 |

Financials

The company’s performance is not that much impressive. While revenue saw a modest 7% increase and profit after tax (PAT) rose by 47% between March 31, 2024, and March 31, 2025. The company’s Total Borrowing has soared, jumping from ₹8.06 crore in 2023 to ₹12.21 crore in 2025. Furthermore, its Reserves and Surplus, which are crucial for a company’s financial health, have been steadily declining from ₹10.79 crore in 2024 to ₹8.80 crore in 2025. The high debt and diminishing reserves indicate a precarious financial position. The slight increase in profit, likely fueled by debt, appears unsustainable and masks the company’s underlying weaknesses, painting a grim picture of its long-term viability.

KPI

| KPI | Values |

|---|---|

| ROE | 31.55% |

| ROCE | 47.68% |

| Debt/Equity | 0.60 |

| RoNW | 31.55% |

| PAT Margin | 5.82% |

| EBITDA Margin | 12.47% |

| Price to Book Value | 1.86 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.