Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of All Time Plastics Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing All Time Plastics Ltd

Company Name: All Time Plastics Ltd

Industry: Plastic Products – Industrial

Listing At: NSE & BSE Mainboard

Overview:

All Time Plastics Ltd. is a global producer of dependable homeware, supplying retailers internationally with products made from a variety of materials. The company’s operations are characterized by a focus on technological innovation, while its commitment to safety and quality remains a core principle. With over 650 employees and more than 140 injection molding machines, the company exports to over 25 countries.

The company’s mission is to surpass customer expectations by delivering high-quality, value-added products, guided by its core values. Its vision is to become a globally preferred choice for home goods while also fulfilling its social and environmental responsibilities. With a legacy spanning over 50 years, All Time Plastics Ltd. operates on pillars of quality, ingenuity, ethical values, and adaptability.

The company’s expertise covers design, tooling, and high-volume production, enabling it to deliver cost-effective products. It offers private label products, allowing clients to either select from its existing range or customize products to meet specific requirements, and is equipped to handle orders of all sizes. All Time Plastics Ltd. emphasizes its use of automation and advanced injection molding to enhance operational efficiency. These modern and conscious practices are supported by industry-compliant standards, ensuring the consistent delivery of high-quality products and services.

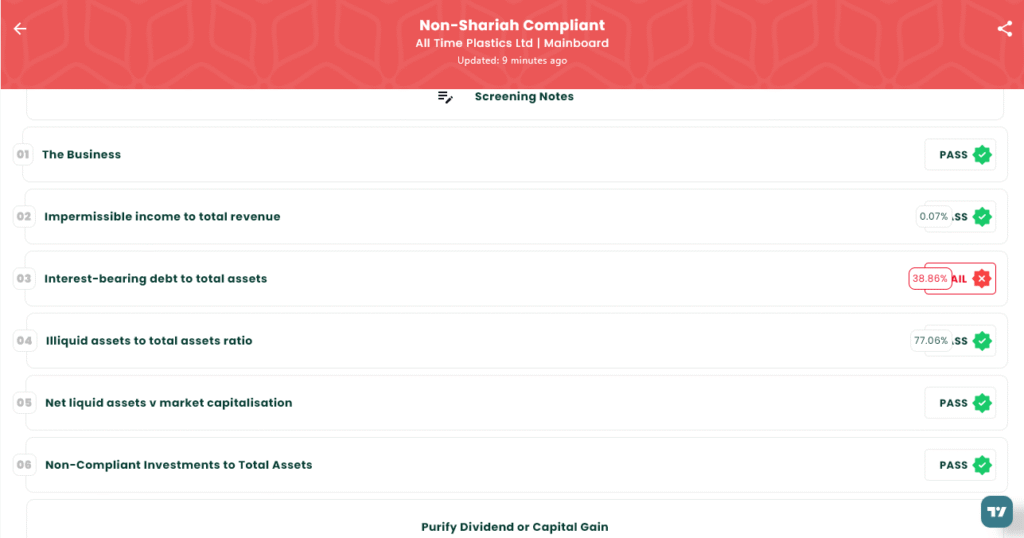

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Thu, Aug 7, 2025 |

| IPO Close Date | Mon, Aug 11, 2025 |

| Tentative Allotment | Tue, Aug 12, 2025 |

| Initiation of Refunds | Wed, Aug 13, 2025 |

| Credit of Shares to Demat | Wed, Aug 13, 2025 |

| Tentative Listing Date | Thu, Aug 14, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 11, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 54 | ₹14,850 |

| Retail (Max) | 13 | 702 | ₹1,93,050 |

| S-HNI (Min) | 14 | 756 | ₹2,07,900 |

| S-HNI (Max) | 67 | 3,618 | ₹9,94,950 |

| B-HNI (Min) | 68 | 3,672 | ₹10,09,800 |

Financials

Based on the financial data, All Time Plastics Ltd. appears to be facing a period of questionable financial health despite some growth metrics. While the company’s revenue increased by 8% and profit after tax (PAT) grew by 6% between the fiscal years ending March 31, 2024, and March 31, 2025, these gains are overshadowed by a substantial increase in its debt burden. Total Borrowing skyrocketed from ₹142.35 crore to ₹218.51 crore, representing a precarious 53.5% surge. This aggressive accumulation of debt raises serious concerns about the company’s long-term sustainability and financial stability, suggesting that its growth may be fueled by leverage rather than robust operational performance.

KPI

| KPI | Values |

|---|---|

| ROE | 19.01% |

| ROCE | 16.99% |

| Debt/Equity | 0.88 |

| RoNW | 19.01% |

| PAT Margin | 8.46% |

| EBITDA Margin | 18.16% |

| Price to Book Value | 7.15 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.