Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of ANB Metal Cast Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing The Company

Company Name: ANB Metal Cast Ltd

Industry: Aluminium

Listing At: NSE SME

Overview:

ANB Metal Cast Ltd. is a leading foundry specializing in the production of high-quality aluminium extrusion parts. Established in 2019 by Mr. Avnish Gajera, the company has quickly built a strong reputation within the industry. As an ISO 9001:2015 and ISO 14001 certified organization, ANB Metal Cast Ltd. is dedicated to providing reliable, precise, and cost-effective products while consistently meeting tight deadlines.

The company operates with state-of-the-art infrastructure and a team of highly skilled professionals committed to continuous improvement and innovation. Their goal is to deliver aluminium extrusion products that excel in performance, durability, and reliability.

Vision:

To be a reputable organization known for delivering customized aluminium extrusion solutions with service excellence.

Mission:

To develop and manufacture high-quality aluminium extrusion products that meet or exceed customer expectations.

Key Milestones:

- 2019: Started with Pressure Die Cast Machines and a small setup

- 2020: Acquired 1400T & 650T Aluminium Extrusion Presses

- 2021: Established in-house Die Development Department

- 2023: Planned expansion with 3200T Press

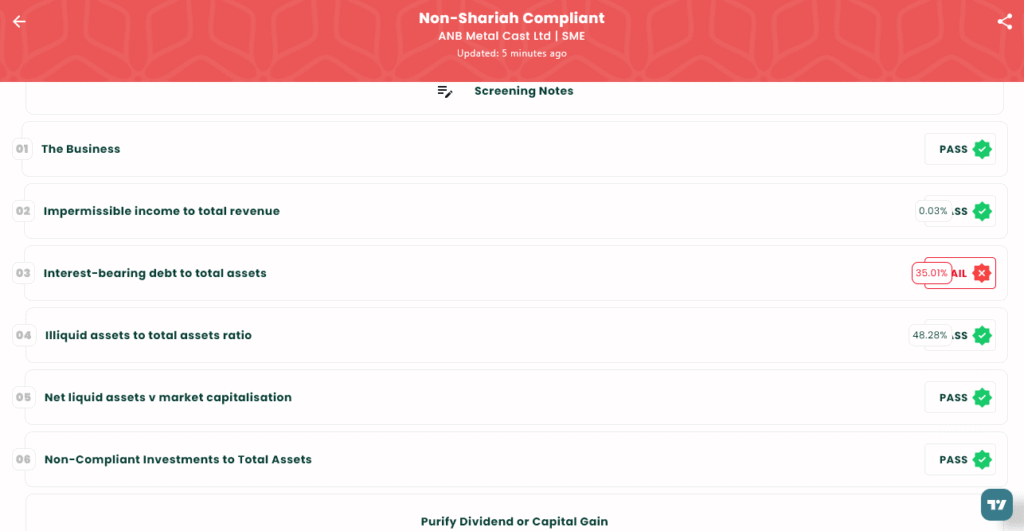

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 8, 2025 |

| IPO Close Date | Tue, Aug 12, 2025 |

| Tentative Allotment | Wed, Aug 13, 2025 |

| Initiation of Refunds | Thu, Aug 14, 2025 |

| Credit of Shares to Demat | Thu, Aug 14, 2025 |

| Tentative Listing Date | Mon, Aug 18, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 12, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 1,600 | ₹2,49,600 |

| Individual investors (Retail) (Max) | 2 | 1,600 | ₹2,49,600 |

| S-HNI (Min) | 3 | 2,400 | ₹3,74,400 |

| S-HNI (Max) | 8 | 6,400 | ₹9,98,400 |

| B-HNI (Min) | 9 | 7,200 | ₹11,23,200 |

Financials

The financial data for ANB Metal Cast Ltd. paints a troubling picture despite the reported revenue and profit growth. While the company boasts a 45% increase in revenue and a staggering 92% rise in profit after tax, a closer look at the balance sheet reveals significant underlying issues. The massive increase in total borrowings from ₹15.92 crore in 2023 to ₹34.33 crore in 2025 is deeply concerning. This substantial reliance on debt to fuel growth raises serious questions about the company’s financial stability and long-term sustainability. The company’s expansion seems to be built on a precarious foundation of debt, which could make it highly vulnerable to economic downturns and rising interest rates. The rapid accumulation of debt suggests that the company’s growth may not be as organic or healthy as the top-line numbers suggest, hinting at a potential house of cards waiting to collapse.

KPI

| KPI | Values |

|---|---|

| ROE | 45.91% |

| ROCE | 24.13% |

| Debt/Equity | 1.01 |

| RoNW | 45.91% |

| PAT Margin | 6.30% |

| EBITDA Margin | 10.74% |

| Price to Book Value | 3.72 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.