Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Aritas Vinyl Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Aritas Vinyl Ltd

Listing At: BSE (SME)

Overview

Aritas Vinyl Limited: Company Profile

Incorporated in 2020, Aritas Vinyl Limited (AVL) is a specialized manufacturer and trader of technical textiles, focusing on artificial leather products including PU synthetic leather and PVC-coated leather. The company utilizes advanced Transfer Coating Technology to produce high-quality synthetic leather alternatives that serve as eco-conscious substitutes for traditional animal leather across multiple industries.

Product Portfolio & Applications

Aritas Vinyl manufactures PVC leather—a synthetic material created by coating fabric (typically polyester or cotton) with polyvinyl chloride layers. This process creates a soft, flexible alternative that mimics genuine leather’s appearance and feel while offering superior durability, waterproof properties, easy maintenance, cost-effectiveness, and customization options. The company produces fabric with thickness ranging from 0.35mm to 6mm, customized to client specifications including shade, embossing patterns, and prints.

The product applications span diverse sectors:

- Automotive Upholstery: Polyethylene leather and PVC vinyl for seats, door trims, steering wheel covers, and interior components

- Fashion Accessories: Artificial leather materials for bags, wallets, laptop sleeves, and purses in various colors and textures

- Interior Design: PVC vinyl solutions for wall coverings and upholstery in residential and commercial spaces

- Additional Markets: Furniture, footwear, healthcare, hospitality, marine, and outdoor applications

Manufacturing Excellence

AVL operates a state-of-the-art manufacturing facility at Survey No. 1134, Village Kubadthal, Taluka Daskroi, Ahmedabad, spanning 6,067 square meters. The facility boasts an impressive annual production capacity of 7.8 million square meters, enabling efficient service delivery across diverse client requirements. The fully integrated plant is strategically located for optimal logistics and market access.

Quality Assurance & Innovation

The company maintains rigorous quality standards through an in-house accredited testing laboratory that ensures consistent monitoring and control over product quality. AVL’s quality control and quality assurance teams conduct comprehensive technical and manual testing on finished products to eliminate defections and ensure defect-free delivery. The facility specializes in durability testing, supporting continuous product development based on customer samples and specifications.

Market Presence & Growth

Aritas Vinyl serves a broad customer base including distributors, wholesalers, manufacturers, and international markets. The company exports to Greece, Oman, UAE, Sri Lanka, USA, and Special Economic Zones (SEZs), actively promoting synthetic leather adoption over traditional animal leather. As of December 26, 2025, AVL employs 89 people, including 54 permanent employees.

Competitive Advantages

The company’s competitive strengths include superior quality and customization capabilities, experienced promoters with deep market knowledge, a fully integrated manufacturing setup at a strategic location, enhanced production capacity achieved within three years of operation, and long-standing relationships with customers across diverse industries. These factors position Aritas Vinyl as a reliable partner in the growing technical textile and synthetic leather market.

Shariah Status

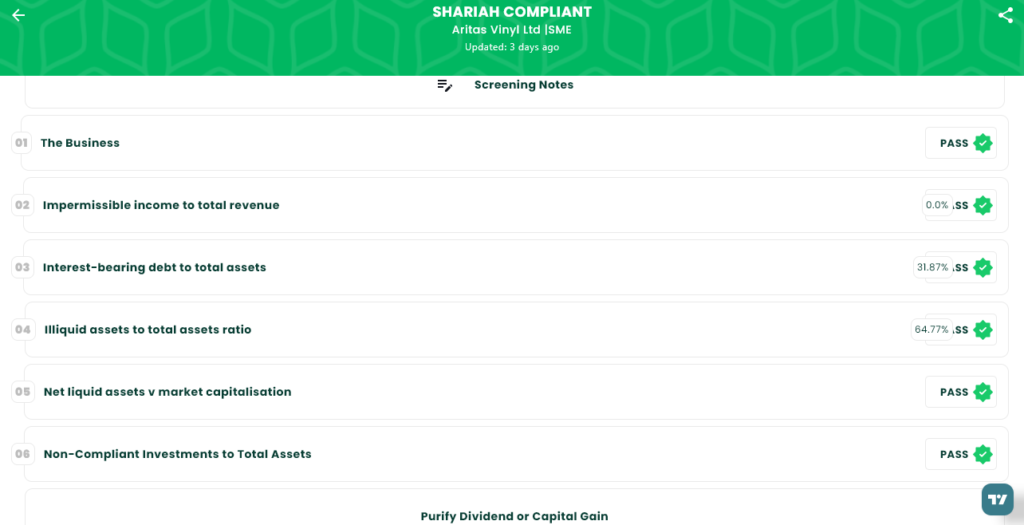

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 16, 2026 |

| IPO Close Date | Jan 20, 2026 |

| Tentative Allotment | Jan 21, 2026 |

| Initiation of Refunds | Jan 22, 2026 |

| Credit of Shares to Demat | Jan 22, 2026 |

| Tentative Listing Date | Jan 23, 2026 |

Financials

Aritas Vinyl Limited’s restated financials (amounts in ₹ crore) show steady growth and improving profitability through 31 Aug 2025. Total assets increased from ₹57.95 crore (Mar 2023) to ₹98.25 crore (Aug 2025), reflecting capacity expansion and working-capital buildup. Total income rose from ₹51.42 crore (Mar 2023) to ₹40.58 crore as of Aug 2025, after peaking at ₹98.02 crore in Mar 2025 — indicating seasonality or one-off revenue swings. Profit after tax improved consistently from ₹0.99 crore (Mar 2023) to ₹2.42 crore (Aug 2025), supported by expanding EBITDA, which grew from ₹3.09 crore to ₹4.55 crore over the same periods. Net worth strengthened markedly from ₹4.32 crore to ₹22.77 crore, underpinned by higher reserves and surplus (₹1.82 crore to ₹10.21 crore), signalling retained earnings and capital accretion. Total borrowings rose to ₹37.78 crore (Aug 2025) from ₹33.10 crore (Mar 2023), reflecting increased leverage to fund growth but remaining manageable relative to assets. Overall, the company exhibits improving margins, stronger equity base, and asset growth while managing higher but reasonable leverage.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.