Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Armour Security (India) Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Armour Security (India) Ltd

Listing At: NSE (SME)

Overview

Armour Security India Limited is a premier consultancy firm based in New Delhi, India, specializing in comprehensive security and facility management services. The company offers a broad range of solutions including transition and deputation process services, mechanical cleaning, housekeeping, fire fighting, supervision services, and service reviews. Through maintaining a comprehensive database of efficient professionals, Armour Security caters to the exact manpower requirements of clients across various industries.

Service Approach & Quality Standards

The company’s security and safety services are developed through detailed assessments of client locations, ensuring tailored solutions for specific operational needs. Armour Security provides comprehensive training to hired security guards and supervisors on the latest safety devices, enabling personnel to prevent accidents and industrial hazards at client sites. The organization has also expanded its capabilities by employing expert web designers, advertising managers, and creative artists to produce attractive promotional content, animation clips, and banners for customers.

Quality serves as the primary objective since the company’s establishment. Armour Security ensures professional services meet industry-specified standards through a team of qualified and experienced professionals who deliver security, manpower, event promotion, and project consultancy services. Team members operate under three core principles: integrity, honesty, and vigilance, supported by project supervisors who assist operational staff in delivering quality services at economical prices.

Mission & Vision

Armour Security’s mission focuses on delivering reliable, professional, and client-centric facility and security services through highly trained personnel, innovative solutions, and commitment to excellence. The company aims to create safe, clean, and efficient environments that enable clients to focus on core operations with confidence and peace of mind.

The organization’s vision is to become a trusted leader in the facility management and security services industry, recognized for integrity, quality standards, and customer satisfaction. Armour Security envisions building long-term partnerships by continuously enhancing services, empowering the workforce, and embracing innovation to exceed expectations.

Core Values & Client Focus

The company’s core values drive commitment to excellence and service integrity, emphasizing honesty, transparency, and ethical conduct across all operations. Focus on quality, reliability, and accountability ensures consistent and professional service delivery. With a customer-centric approach, Armour Security strives to understand and exceed client expectations, maintaining ethical business practices and a professional work environment that has helped achieve total customer satisfaction over several years of operation.

Shariah Status

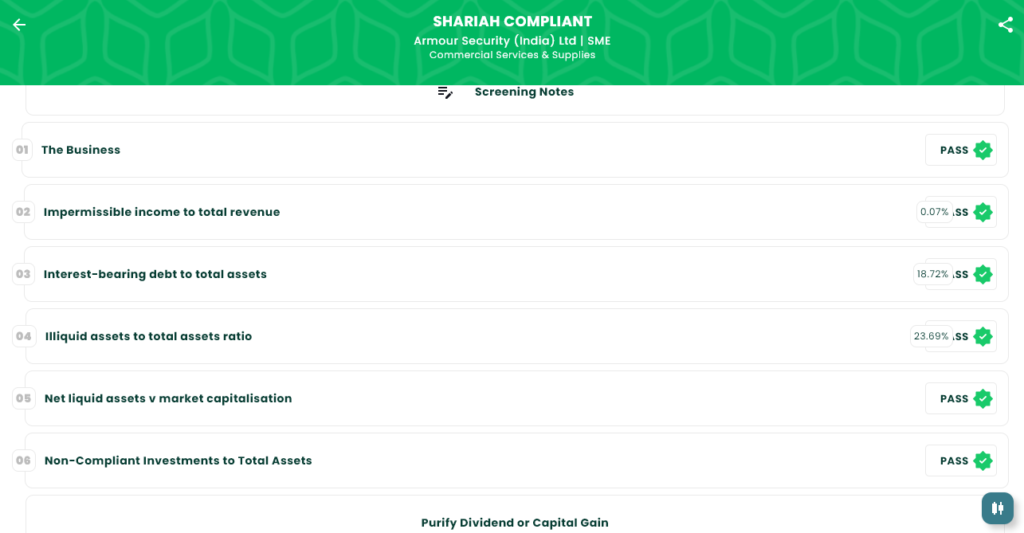

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 14, 2026 |

| IPO Close Date | Jan 19, 2026 |

| Tentative Allotment | Jan 20, 2026 |

| Initiation of Refunds | Jan 21, 2026 |

| Credit of Shares to Demat | Jan 21, 2026 |

| Tentative Listing Date | Jan 22, 2026 |

Financials

Armour Security India Limited demonstrates consistent financial growth across key metrics through the periods ending 30 September 2025, 31 March 2025, 31 March 2024, and 31 March 2023 (amounts in ₹ Crore).

Asset & Income Growth: The company’s total assets grew from ₹15.51 crore in March 2023 to ₹32.10 crore by September 2025, reflecting strong expansion. Total income increased from ₹28.97 crore to ₹19.69 crore in the latest period, though this represents a decline from the ₹36.56 crore recorded in March 2025.

Profitability & Operational Efficiency: Profit after tax improved from ₹2.26 crore in March 2023 to ₹2.90 crore by September 2025. EBITDA shows healthy operational performance, growing from ₹3.12 crore to ₹4.30 crore, indicating strong operational cash generation and cost management.

Balance Sheet Strength: Net worth improved significantly from ₹3.49 crore to ₹21.34 crore, demonstrating substantial equity growth and financial stability. Reserves and surplus increased from ₹3.48 crore to ₹9.12 crore, reflecting retained earnings and financial resilience.

Leverage Position: Total borrowing increased moderately from ₹0.85 crore to ₹6.01 crore, remaining at manageable levels relative to assets and equity. This indicates prudent debt management while supporting operational and growth activities.

Overall, Armour Security exhibits solid financial health with growing profitability and strengthened balance sheet fundamentals.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.