Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Bai-Kakaji Polymers Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Bai-Kakaji Polymers Ltd

Industry: Plastics & Polymer

Listing At: BSE SME

Overview

Bai-kakaji Group founded in 2013 in Latur, Maharashtra has emerged as the leading manufacturer of Alaska (Water bottle) Closures, CSD CAP 1881, and PET preforms manufacturers in India.

The group started its journey with a single preform manufacturing unit in 2013. Presently, its manufacturing capabilities boast advanced SACMI, HUSKY, and ASB machines. This enables the company to achieve an annual production capacity of 400 million units of HDPE Alaska caps, 200 million units of PP caps for carbonated drinks, and 24K MT of PET preforms utilized in packaging drinking water and various beverages.

The production of its closures utilizes state-of-the-art SACMI compression mould machines, while PET preforms and HDPE Alaska Closure are crafted using top-of-the-line Husky and ASB Nissei Injection Moulding machines. The outcome is flawless, flash-free, tailless, dust-free, leak-proof preforms with uniformly thick walls, offering high clarity, superior quality, and minimal rejection. The 26/22 pet preform, bottle cap closures, HDPE Caps for Warm Fill Juice, and more are meticulously manufactured to ensure uniform material distribution upon blowing, resulting in exceptional sturdiness and transparency.

At Bai-kakaji Polymers Limited, preforms and closures along with HDPE Short Neck Caps 26/22, CSD CAP 1881, 26/22 Caps and Closures, etc undergo rigorous quality control tests, guaranteeing trouble-free blowing with near-zero rejection of PET preforms and HDPE Alaska closure, ultimately saving time and costs for clients. Advanced laboratory facilities ensure that products not only meet but exceed international quality standards.

As a leading PET preform and Bottle Cap Manufacturer including Leading Manufacturer of Alaska (water bottle) closures, HDPE Alaska closures, and CSD 1881 closures, the group is dedicated to providing top-quality products. Its extensive range covers HDPE short-neck caps 26/22, Water 26/22 caps and closures, CSD Closure short-neck 1881, and HDPE caps for warm-fill juice. The company takes pride in being a reliable supplier of high-quality caps and closures, offering a comprehensive selection of PET preforms and Bottle Cap Manufacturers, Water 26/22 caps and closures.

Pan India supplies solidify the commitment to delivering excellence in the domain of PET preforms and bottle cap Manufacturers.

Shariah Status

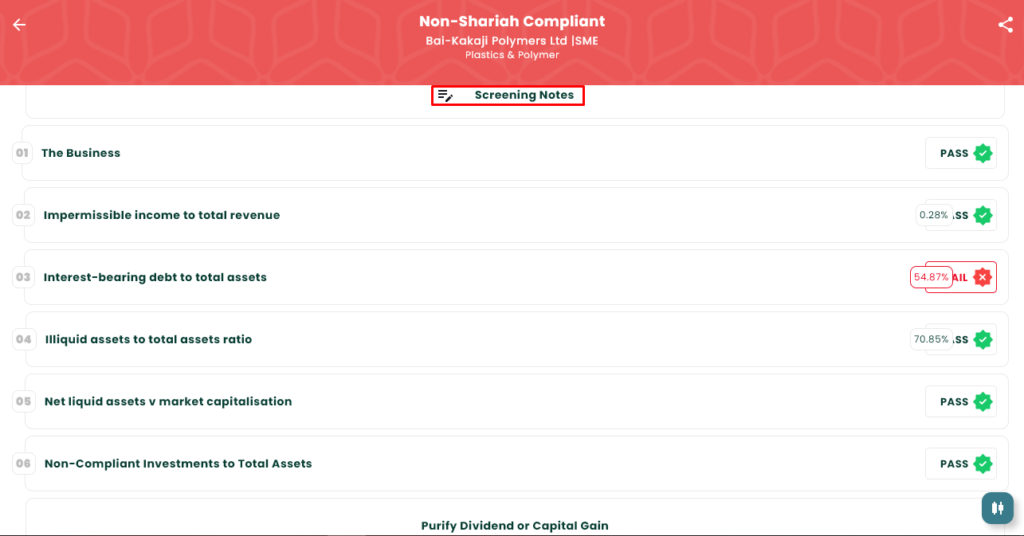

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Dec 23, 2025 |

| IPO Close Date | Dec 26, 2025 |

| Tentative Allotment | Dec 29, 2025 |

| Initiation of Refunds | Dec 30, 2025 |

| Credit of Shares to Demat | Dec 30, 2025 |

| Tentative Listing Date | Dec 31, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Dec 26, 2025 |

Financials

Bai Kakaji Polymers Ltd. demonstrated solid growth in FY25. Revenue increased 12% to ₹332.12 crore from ₹296.42 crore in FY24, while profit after tax surged 96% to ₹18.37 crore from ₹9.38 crore. EBITDA improved to ₹33.51 crore versus ₹20.75 crore, reflecting enhanced operational efficiency in PET preforms and bottle cap manufacturing.

The company’s balance sheet strengthened with assets growing to ₹203.69 crore from ₹98.00 crore in FY24. Net worth expanded to ₹53.74 crore from ₹35.37 crore, supported by higher reserves of ₹51.49 crore (₹33.12 crore). Total borrowings increased to ₹109.27 crore from ₹40.71 crore, indicating expansion financing.

For the six months ending September 30, 2025, performance remained steady with total income at ₹168.56 crore, PAT at ₹12.81 crore, and EBITDA at ₹24.35 crore. Assets stood at ₹195.45 crore with net worth at ₹66.55 crore. The consistent growth reflects the company’s strong position in India’s packaging industry, manufacturing Alaska closures, CSD caps, and PET preforms.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.