Belrise Industries Ltd, a Pune-based automotive component manufacturer, is launching its Initial Public Offering (IPO) on the NSE and BSE mainboards. The company specializes in producing a diverse range of auto components and engineering solutions for various vehicle segments.

- IPO Code: BELRISE

- Issue Type: Book Built Issue

- Issue Size: ₹2,150 crore

- Price Band: ₹85 to ₹90 per share

- Face Value: ₹5 per equity share

- Lot Size: 166 shares (₹14,940 minimum investment)

- IPO Opening Date: May 21, 2025

- IPO Closing Date: May 23, 2025

- Allotment Date: May 26, 2025

- Listing Date: May 28, 2025

- Listing Platform: NSE and BSE

Company Overview

Belrise Industries Ltd is a leading manufacturer of automotive components, offering a wide range of products and engineering solutions across various vehicle segments. The company has established a significant market presence, particularly in the two-wheeler segment, where it enjoys approximately 24% market share. Belrise Industries is known for its diversified product portfolio and robust manufacturing capabilities, catering to both domestic and international markets.

As of May 21, 2025, the Grey Market Premium (GMP) for Belrise Industries Ltd’s IPO is reported to be around ₹13, indicating a potential listing gain of approximately 14% over the upper end of the price band. This suggests a neutral investor sentiment towards the company’s shares ahead of its listing.

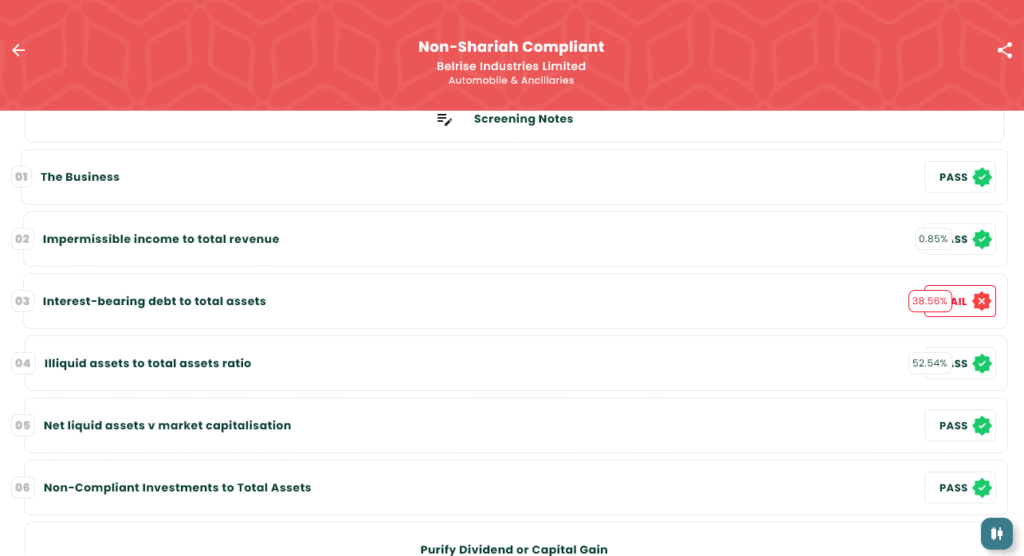

According to IslamicStock, Belrise Industries Ltd’s IPO is classified as “Non-Compliant” concerning Shariah principles. The image below indicate that the company fails to meet certain financial criteria essential for Shariah compliance. Specifically, the company’s interest-bearing debt exceeds the permissible threshold, which is a key factor in determining Shariah compliance.

Final Thoughts

Belrise Industries Ltd’s IPO presents an opportunity to invest in a well-established automotive component manufacturer with a significant market presence and a strong track record of innovation and customer satisfaction. However, for investors considering Shariah-compliant investments, it’s important to note that the IPO has been classified as non-compliant due to its financial structure.

As always, prospective investors are encouraged to conduct their own research, read the official prospectus, and consider professional advice before making any decisions.

Disclaimer

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or subscribe to any securities. Readers are advised to consult with a SEBI-registered investment advisor before making any investment decisions. The information related to Shariah compliance is based on publicly available sources, including IslamicStock, and is intended solely for educational and general awareness purposes.