Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Bhadora Industries Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Bhadora Industries Ltd

Company Name: Bhadora Industries Ltd

Industry: Industrial Products

Listing At: NSE SME

Overview:

Vidhut Cables, a trusted brand under Bhadora Industries Limited, is a leading manufacturer of premium industrial and power cables. Established in 1988, the company has earned a reputation for delivering innovative, reliable, and eco-friendly cable solutions tailored to diverse industrial requirements. With state-of-the-art manufacturing facilities and a steadfast commitment to quality, Vidhut Cables adheres to BIS and international standards. Its extensive product range includes Armoured Cables, XLPE Cables, AB Cables, ACSR Conductors, and more. Partnering with Government Discoms, Private Clients, and Multinational Corporations, Vidhut Cables is a name synonymous with quality, trust, and excellence in the cable manufacturing industry.

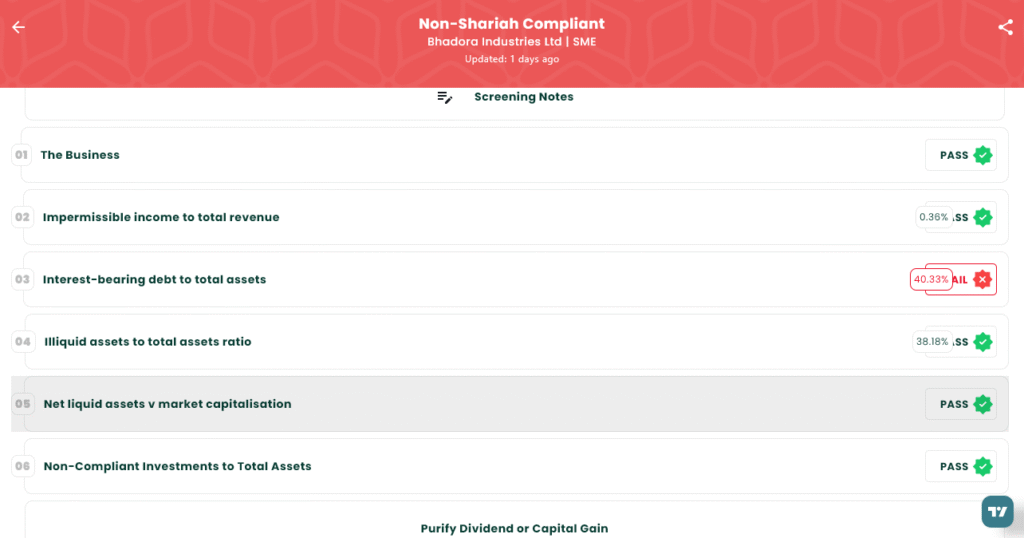

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 4, 2025 |

| IPO Close Date | Tue, Aug 6, 2025 |

| Tentative Allotment | Wed, Aug 7, 2025 |

| Initiation of Refunds | Thu, Aug 8, 2025 |

| Credit of Shares to Demat | Thu, Aug 8, 2025 |

| Tentative Listing Date | Fri, Aug 11, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 6, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,47,200 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,47,200 |

| S-HNI (Min) | 3 | 3,600 | ₹3,70,800 |

| S-HNI (Max) | 8 | 9,600 | ₹9,88,800 |

| B-HNI (Min) | 9 | 10,800 | ₹11,12,400 |

Financials

Based on the provided financial data, Bhadora Industries Ltd.’s performance presents a mixed and potentially concerning picture, despite some seemingly positive metrics. While the company’s revenue increased by 33% and profit after tax (PAT) rose by 118% between the financial years ending March 31, 2024, and March 31, 2025, a closer look reveals some red flags. The dramatic rise in total borrowing, more than doubling from ₹9.47 crore in 2024 to ₹19.67 crore in 2025, suggests that the company’s growth may be heavily reliant on debt. This significant increase in leverage could expose the company to considerable financial risk. Furthermore, while the net worth has grown, the increase in reserves and surplus has not kept pace with the borrowing, raising questions about the sustainability of its growth and its ability to service this growing debt burden in the long run.

KPI

| KPI | Values |

|---|---|

| ROE | 51.51% |

| ROCE | 42.41% |

| Debt/Equity | 0.94 |

| RoNW | 51.51% |

| PAT Margin | 9.80% |

| EBITDA Margin | 15.42% |

| Price to Book Value | 6.49 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.