Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Bharat Coking Coal Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Bharat Coking Coal Ltd

Listing At: NSE & BSE (Mainboard)

Overview

Bharat Coking Coal Limited (BCCL), operating as a Public Sector Undertaking under Coal India Limited (CIL), represents a cornerstone of India’s industrial and energy infrastructure. The organization is mandated to mine and supply high-grade coking coal, serving as a critical supplier to India’s steel sector, which depends substantially on BCCL’s coal for production and manufacturing operations.

During the early 1970s, India’s coal industry faced considerable challenges, characterized by fragmented private ownership, unregulated mining practices, labour issues, and environmental degradation. This fragmentation created operational inefficiencies, resource mismanagement, and safety concerns, while private sector dominance threatened national energy security.

In response, the Government of India enacted transformative legislation: the Coking Coal Mines (Emergency Provisions) Act, 1971, and the Coal Mines (Nationalization) Act, 1973. These landmark acts brought all coking and non-coking coal mines under government control, establishing Coal India Limited and its subsidiaries, including BCCL. The latter was entrusted with managing the Jharia and Raniganj coalfields—regions abundant in high-grade coking coal essential for steel production—positioning BCCL as a vital contributor to India’s industrial growth and energy resilience.

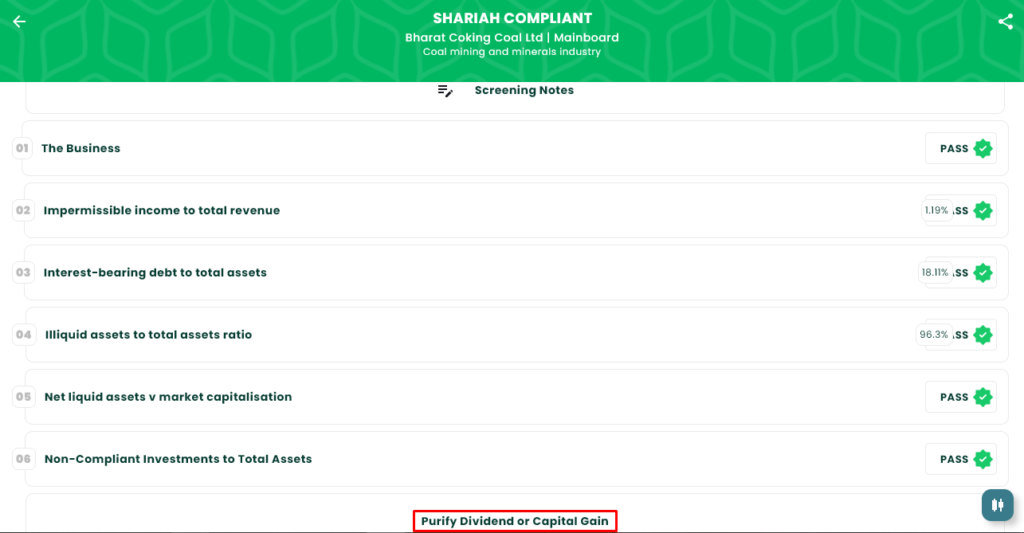

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 09, 2026 |

| IPO Close Date | Jan 13, 2026 |

| Tentative Allotment | Jan 14, 2026 |

| Initiation of Refunds | Jan 15, 2026 |

| Credit of Shares to Demat | Jan 15, 2026 |

| Tentative Listing Date | Jan 16, 2026 |

Financials

Bharat Coking Coal Limited’s restated consolidated financials show growth in scale and recurring profitability, though with some volatility year-on-year. Total assets rose steadily from ₹13,312.86 crore (FY23) to ₹17,283.48 crore (FY25) and further to ₹18,711.13 crore as of 30 Sep 2025, reflecting capacity expansion or capital investments. Total income peaked at ₹14,652.53 crore in FY24, modestly declining to ₹14,401.63 crore in FY25 and to ₹6,311.51 crore for the six months to Sep-25 (half-year run-rate appears consistent with prior years). EBITDA was ₹2,493.89 crore in FY24, eased to ₹2,356.06 crore in FY25, and stood at ₹459.93 crore for H1 FY26, indicating operating margins under pressure but still positive. Profit after tax fell from ₹1,564.46 crore (FY24) to ₹1,240.19 crore (FY25) and was ₹123.88 crore for H1 FY26, showing weaker near-term PAT. Net worth strengthened from ₹3,791.01 crore (FY23) to ₹6,551.23 crore (FY25), supported by higher reserves and retained earnings (reserves moved from negative in FY23 to ₹1,805.73 crore in FY25). Total borrowings were reported at ₹1,559.13 crore (Sep-25), a modest leverage given the asset base. Overall, BCCL demonstrates balance-sheet improvement and operational scale, but recent income and PAT softness warrant monitoring of margins, cash flows, and capital expenditure execution.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.