Brigade Hotel Ventures Ltd. (BRIGHOTEL) , a prominent subsidiary of Brigade Enterprises Ltd., is opening its doors to public investment with an upcoming IPO. Established with an innovative vision for the hospitality sector, BRIGHOTEL has grown to encompass a diverse portfolio of hotels and serviced apartments. This deep dive will provide you with essential insights into the company, its Shariah compliance, IPO specifics, financial health, and more.

Table of Contents

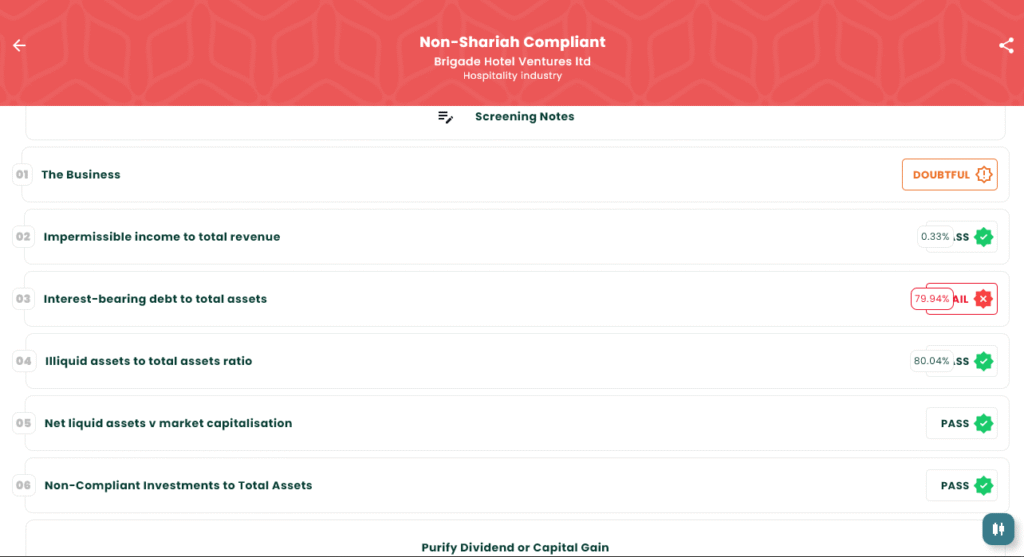

1. Shariah Compliance Status & Screening Notes

Brigade Hotel Ventures Ltd. (BRIGHOTEL) is classified as Non-Shariah Compliant.

2. About Brigade Hotel Ventures Ltd.

Brigade Hotel Ventures Limited (BRIGHOTEL) is a well-established subsidiary of Brigade Enterprises Ltd. Officially incorporated in June 2004, BHVL pioneered the innovative concept of professionally operated and branded serviced apartments in India through its renowned ‘Brigade Homestead’ brand. Over the years, the organization has significantly broadened its scope, expanding its presence across various segments within the dynamic hospitality industry, reflecting its growth and adaptability.

3. Vision & Mission

Vision: To be a world-class organization in its Products, Processes, People, and Performance.

Mission: To constantly endeavor to be the Preferred Developer of Residential, Commercial & Hospitality spaces in the markets in which it operates, without compromising on its Core Values, for the benefit of all its Stakeholders.

4. Brigade Hotel Ventures IPO Details

The Brigade Hotel Ventures IPO is a Bookbuilt issue and will be listed on both BSE and NSE.

| IPO Details | Information |

| IPO Dates | July 24, 2025 – July 28, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹85 – ₹90 per share |

| Lot Size | 166 Shares |

| Sale Type | Fresh Capital |

| Total Issue Size | 8,44,00,000 shares (aggregating up to ₹759.60 Cr) |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 29,54,30,000 shares |

| Share Holding Post Issue | 37,98,30,000 shares |

5. Brigade Hotel Ventures IPO Lot Size

The minimum application for individual retail investors requires a bid for 166 shares, amounting to ₹14,940 at the upper price band.

| Application | Lots | Shares | Amount (₹) |

| Individual investors (Retail) (Min) | 1 | 166 | 14,940 |

| Individual investors (Retail) (Max) | 13 | 2,158 | 1,94,220 |

| S-HNI (Min) | 14 | 2,324 | 2,09,160 |

| S-HNI (Max) | 66 | 10,956 | 9,86,040 |

| B-HNI (Min) | 67 | 11,122 | 10,00,980 |

6. Key Performance Indicators (KPI): Brigade Hotel Ventures Ltd.

The market capitalization of Brigade Hotel Ventures IPO is ₹3418.47 Cr.. KPI as of Mon, Mar 31, 2025.

| KPI | Values |

| ROCE | 13.62% |

| Debt/Equity | 7.40 |

| RoNW | (30.11%) |

| PAT Margin | (5.03%) |

| EBITDA Margin | 35.45% |

| Price to Book Value | 32.26 |

7. Objects of the Issue: Purpose of the IPO Funds

The Company Brigade Hotel Ventures IPO proposes to utilise the Net Proceeds from the Issue towards the following objects:

- Repayment/ prepayment, in full or in part, of certain outstanding borrowings availed by the company and Material Subsidiary, namely, SRP Prosperita Hotel Ventures Limited (₹468.14 Cr)

- Payment of consideration for buying of undivided share of land from the Promoter, BEL (₹107.52 Cr)

- Pursuing inorganic growth through unidentified acquisitions and other strategic initiatives and general corporate purposes

8. Grey Market Premium (GMP) as on July 25, 2025, 11:47 PM:

The Grey Market Premium (GMP) for Brigade Hotel Ventures IPO as on 26th July is ₹5 (5.56%).

9. Conclusion and Investment Resources

Brigade Hotel Ventures Ltd. presents an opportunity to invest in a subsidiary of a well-known real estate group, operating in the hospitality sector. While the company demonstrates significant asset base and revenue growth, it has also recorded losses in recent fiscal years and carries substantial debt. It is crucial for investors to note that Brigade Hotel Ventures Ltd. is Non-Shariah Compliant. The current GMP is ₹5. Potential investors should carefully weigh these factors, consider the financial performance, and understand the industry risks before making any investment decisions.

Opening a trading account is your first step. Consider these trusted platforms:

- Zerodha: Open your account with Zerodha: https://zerodha.com/?c=NGT561&s=CONSOLE

- Angel One: Download the Angel One app: https://angel-one.onelink.me/Wjgr/92znd9xl

For more detailed information, company analyses, and investment options, visit our resources:

- Our Website: https://www.islamicstock.in/

- Our Blog: https://blog.islamicstock.in/

You can also download our application, IslamicStock, for in-depth screenings and investment guidance tailored for you:

- Google Play Store: https://play.google.com/store/apps/details?id=com.halal.stocks&hl=en_IN

- Apple App Store: https://apps.apple.com/in/app/islamicstock-screener-india/id1627541365

SEBI Disclaimer: Investment in securities markets are subject to market risks, read all the related documents carefully before investing. The information provided in this article is for educational and informational purposes only and does not constitute financial advice. Investors should consult with qualified financial professionals before making any investment decisions.