Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Dev Accelerator Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Dev Accelerator Ltd

Industry: Diversified Commercial Services

Listing At: NSE & BSE (Mainboard)

Overview:

DevX, officially known as Dev Accelerator Limited, is a company established in 2017 that provides flexible office spaces, including managed offices and coworking environments. The company’s core mission is to empower individuals and businesses by providing them with the necessary tools, facilities, and infrastructure to excel in their work. This commitment to a higher standard is a cornerstone of DevX’s philosophy, as they consistently strive to exceed customer expectations. Their business model is built on a “Bias for Action,” which means they actively seek out opportunities, implement solutions, and measure the results to ensure effective execution.

A key aspect of DevX’s approach is their focus on creating better services rather than simply unique ones. They aim to understand the specific needs of their clients and then deliver a superior experience that directly addresses those needs. The company also fosters a culture of open debate and constructive disagreement, a principle they refer to as “Having a Spine.” This belief in the power of strong opinions, loosely held, allows them to find optimal solutions through robust discussion and collaboration.

Since its inception, DevX has experienced significant growth, expanding its presence across India. Initially, the company had 15 centers in major cities like Delhi-NCR, Hyderabad, Mumbai, and Pune. However, as of May 31, 2025, DevX has scaled its operations to 28 centers across 11 cities in India. This expansion reflects the increasing demand for flexible and adaptable workspace solutions. The company’s reach extends to a diverse clientele, including large corporations, multinational companies (MNCs), and small to medium-sized enterprises (SMEs).

The company’s offerings are designed to cater to the evolving landscape of modern work, accommodating trends such as remote work and the need for flexible lease terms. They provide customizable desks and suites, allowing businesses to tailor their workspace to their specific requirements. This flexible model enables clients to scale up or down as their needs change, providing a cost-effective and efficient solution. As of May 31, 2025, DevX serves over 250 clients, managing a total area of 860,522 square feet with 14,144 seats.

DevX is also actively pursuing further expansion, both domestically and internationally. They have signed Letters of Intent (LOIs) for three new centers. One of these will mark their first foray into the international market with a new center in Sydney, Australia. Additionally, the company has leased space for a new center in Surat, India. These upcoming centers are set to significantly increase DevX’s capacity, adding 11,500 seats across a total area of 897,341 square feet.

In addition to its core business of providing flexible office spaces, DevX has a subsidiary, Neddle and Thread Designs LLP, which specializes in design and execution services. This allows the company to offer a more comprehensive solution to its clients, from the initial design of a workspace to its full implementation. By combining these services, DevX provides a holistic approach to workspace management, ensuring that businesses have a seamless experience from start to finish. This integrated model underscores their commitment to providing a complete suite of services that goes beyond just renting out a space.

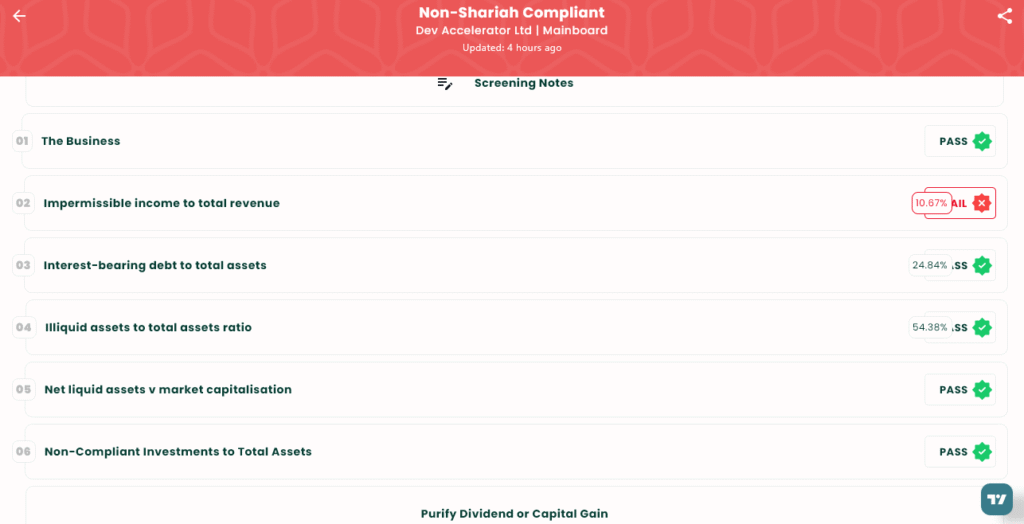

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 10, 2025

- IPO Close Date: Wednesday, September 12, 2025

- Tentative Allotment: Thursday, September 15, 2025

- Initiation of Refunds: Monday, September 16, 2025

- Credit of Shares to Demat: Monday, September 16, 2025

- Tentative Listing Date: Tuesday, September 17, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 12, 2025

Lot Size

| Investor Category | Application (Lots) | Shares | Amount (₹) |

| Retail (Min) | 1 | 235 | 14,335 |

| Retail (Max) | 13 | 3,055 | 1,86,355 |

| S-HNI (Min) | 14 | 3,290 | 2,00,690 |

| S-HNI (Max) | 69 | 16,215 | 9,89,115 |

| B-HNI (Min) | 70 | 16,450 | 10,03,450 |

Financials

Dev Accelerator Ltd.’s financial performance for the years ending March 31, 2025, March 31, 2024, and March 31, 2023, is detailed in the provided table. The data is presented in ₹ Crore.

Assets: The company’s assets have shown a consistent increase over the three years. They grew from ₹282.42 Crore in 2023 to ₹411.09 Crore in 2024, and further to ₹540.38 Crore in 2025. This indicates a steady expansion of the company’s resource base.

Total Income: Total income has also seen a remarkable upward trend. It more than doubled from ₹71.37 Crore in 2023 to ₹110.73 Crore in 2024, and then surged to ₹178.89 Crore in 2025. This signifies strong revenue growth and improved business operations.

Profit After Tax (PAT): A significant turnaround is visible in the company’s profitability. From a loss of ₹12.83 Crore in 2023, the company turned a profit of ₹0.43 Crore in 2024. This profit then jumped dramatically to ₹1.74 Crore in 2025, reflecting a 303% increase from the previous year.

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) also demonstrated a strong upward trajectory, growing from ₹29.88 Crore in 2023 to ₹64.74 Crore in 2024, and then to ₹80.46 Crore in 2025. This shows an improvement in the company’s core operational profitability.

Net Worth: The net worth of the company has increased significantly, from ₹1.22 Crore in 2023 to ₹28.79 Crore in 2024, and finally to ₹54.79 Crore in 2025. This indicates a growing equity base and financial stability.

Total Borrowing: The company’s borrowings have also increased, from ₹33.20 Crore in 2023 to ₹101.05 Crore in 2024, and then to ₹130.67 Crore in 2025. While this is a rise, it’s essential to analyze it in the context of the company’s growing assets and income to assess its financial leverage.

Overall, the data suggests that Dev Accelerator Ltd. has experienced substantial growth across all key financial metrics over the past three years. This is particularly evident in the significant turnaround from a loss in 2023 to a substantial profit in 2025.

KPI

Based on the information provided, here are the Key Performance Indicator (KPI) values presented in a table format:

| KPI | Value |

| ROCE (Return on Capital Employed) | 25.95% |

| Debt/Equity | 2.39 |

| RoNW (Return on Net Worth) | 3.24% |

| PAT Margin | 1.00% |

| EBITDA Margin | 50.64% |

| Price to Book Value | 7.94 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.