Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Dhara Rail Projects Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Dhara Rail Projects Ltd

Industry: Railway Infrastructure

Listing At: NSE SME

Overview

Dhara Rail Projects Limited was established in 2010. The company is an ISO 9001:2015 certified organization, engaged in the business of executing various types of contractual railway projects and related services which includes Annual Maintenance Contracts (AMC) and repair services for a wide range of railway rolling stock systems.

The company’s services include annual maintenance and repair of train lighting equipment across all rolling stock categories, including the latest Vande Bharat trains, along with annual maintenance and repair for Overhead Equipment (OHE) maintenance vehicles (Tower Wagons), Power Car equipment and HVAC systems. In addition to maintenance services, the company undertakes the Supply, Installation, Testing, and Commissioning (SITC) of various electrical equipment across all types of rolling stock.

The company provides services to the Ministry of Railways, Government of India, either through directly awarded contracts secured via competitive tendering or through pre-bid arrangements with various OEM’s.

Shariah Status

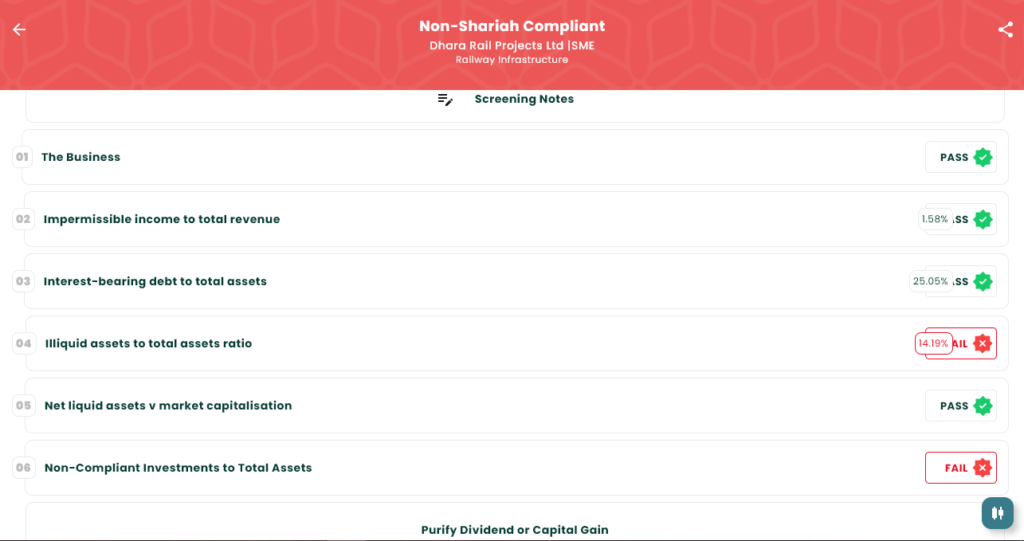

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Dec 23, 2025 |

| IPO Close Date | Dec 26, 2025 |

| Tentative Allotment | Dec 29, 2025 |

| Initiation of Refunds | Dec 30, 2025 |

| Credit of Shares to Demat | Dec 30, 2025 |

| Tentative Listing Date | Dec 31, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Dec 26, 2025 |

Financials

Dhara Rail Projects Limited demonstrated exceptional growth in FY25. Revenue increased 40% to ₹48.00 crore from ₹34.23 crore in FY24, while profit after tax surged 120% to ₹6.53 crore from ₹2.97 crore. EBITDA improved dramatically to ₹5.28 crore versus ₹1.33 crore, reflecting enhanced operational efficiency in railway maintenance contracts.

The company’s balance sheet showed mixed results. Assets declined to ₹46.24 crore from ₹47.29 crore in FY24, while net worth doubled to ₹12.89 crore from ₹6.36 crore, supported by higher reserves of ₹12.79 crore (₹6.26 crore). Total borrowings reduced to ₹21.33 crore from ₹28.17 crore, indicating improved debt management.

For the six months ending September 30, 2025, performance remained strong with total income at ₹28.83 crore, PAT at ₹7.06 crore, and EBITDA at ₹9.60 crore. The consistent profitability growth reflects the company’s strong positioning in India’s railway infrastructure sector, particularly in maintaining modern rolling stock including Vande Bharat trains and OHE maintenance systems.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.