Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of E to E Transportation Infrastructure Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: E to E Transportation Infrastructure Ltd

Industry: Industrial Products

Listing At: NSE SME

Overview

E To E Transportation Infrastructure Limited was incorporated in 2010. The company is an ISO 9001:2015 certified organization engaged in providing system integration and engineering solutions for the railway sector.

Service Offerings: Signaling and Telecommunications (S&T), Overhead Electrification (OHE), Track Projects and System Integration, Private Sidings and Engineering Design and Research Centre (EDRC). The company operates across mainline, urban transit, and private siding segments, offering end-to-end rail engineering services including design, procurement, installation, and testing.

The company’s expertise spans signaling and telecommunication systems, track electrification, and turnkey railway infrastructure projects involving civil and track components. Over the years, it has executed projects for zonal railways, public sector undertakings under Indian Railways, corporate entities with private rail sidings, and infrastructure development companies in India and select international markets.

Major projects include CBTC signaling for Hyderabad and Nagpur Metro, signaling and telecommunication modernisation for Vizag Steel Plant and NUPPL Power Plant, electronic interlocking system upgrades for Hosur–Salem, siding expansion for Gujarat Pipavav Port with DFCC connectivity, and platform screen door installations for Mumbai Metro Line 3 and Chennai Metro Phase 1.

As of September 30, 2025, the company’s order book comprised 50 ongoing contracts valued at ₹40,110.37 lakhs. As of November 30, 2025, the company has 353 full-time employees.

E To E Rail is an ISO 9001:2015 certified organization providing rail engineering expertise to rail infrastructure projects for mainline and mass transit systems in India and abroad. The company designs and builds high-quality customized solutions for track, signaling, communication systems and electrification projects in India and abroad.

Shariah Status

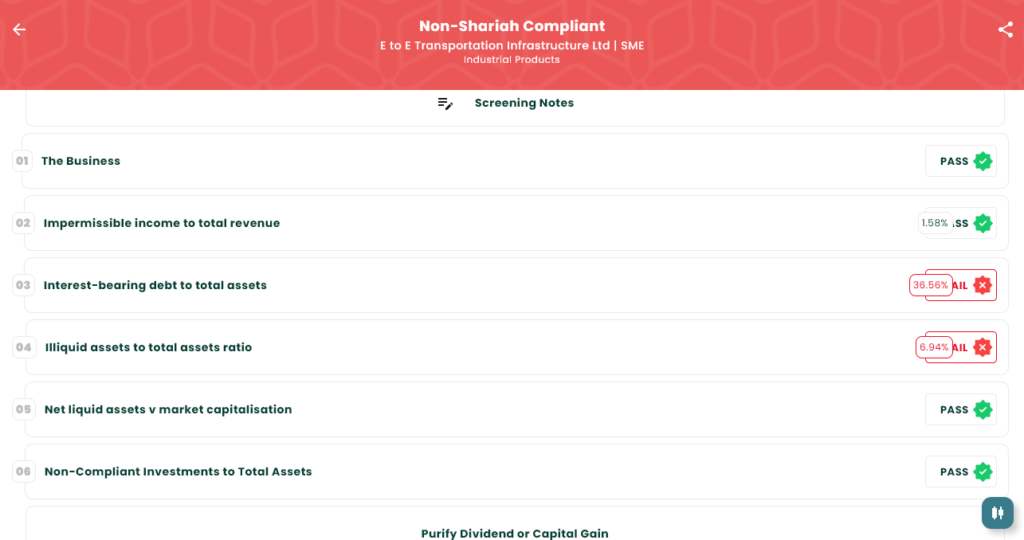

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Dec 26, 2025 |

| IPO Close Date | Dec 30, 2025 |

| Tentative Allotment | Dec 31, 2025 |

| Initiation of Refunds | Jan 01, 2025 |

| Credit of Shares to Demat | Jan 01, 2025 |

| Tentative Listing Date | Jan 02, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Dec 30, 2025 |

Financials

E To E Transportation Infrastructure Limited demonstrated strong growth trajectory through FY25. Revenue increased 47% to ₹253.82 crore from ₹172.50 crore in FY24, while profit after tax rose 36% to ₹13.99 crore from ₹10.26 crore. EBITDA improved to ₹26.57 crore versus ₹18.34 crore, reflecting operational efficiency gains in rail engineering solutions.

The company’s balance sheet strengthened significantly. Assets grew to ₹295.44 crore from ₹200.89 crore in FY24, while net worth expanded to ₹116.05 crore from ₹66.86 crore, supported by reserves of ₹115.68 crore (₹66.67 crore). Total borrowings increased to ₹66.18 crore from ₹61.18 crore, indicating strategic debt utilization for project execution and growth.

However, in H1 FY26 (September 30, 2025), the company faced challenges with negative PAT of ₹-7.49 crore and EBITDA of ₹-3.88 crore on revenue of ₹112.78 crore. Despite interim headwinds, the order book of ₹40,110.37 lakhs across 50 contracts positions the company well for sustained growth in India’s expanding railway infrastructure sector.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.