Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Essex Marine Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Essex Marine Ltd

Company Name: Essex Marine Ltd

Industry: Diversified FMCG

Listing At: BSE SME

Overview:

Essex Marine Ltd, Midnapur, India is a modern seafood processing and exporting company, promoted by Sri. Debashish Sen, the Managing Director. The Registered office of the company is at 19, Pollock Street, Kolkata 700 001, WB. The objective of the company is to procure, process, store and export their safe and quality fish and aquaculture products to all the countries including European Union. The company is designed with all modern facilities in line with specifications of national and importing countries.

The Company is installed with the state-of-the-art machineries and equipments.

The company is constructed in an ideal unpolluted location having an advantages of availability of drinking water, skilled manpower, required electricity, uninterrupted communication system, near by port connected with wide NH- highways, abundance of wholesome raw materials and other in-puts.

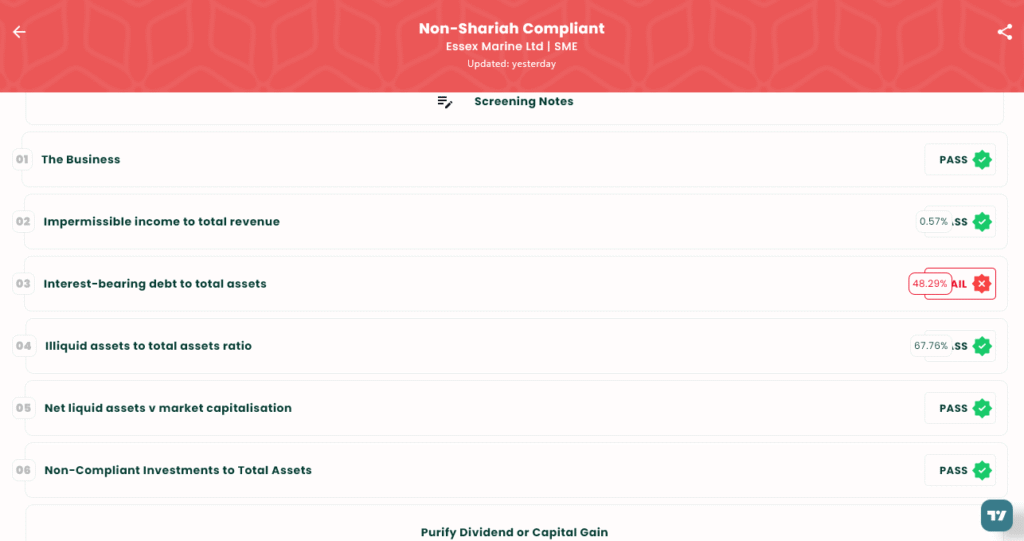

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 4, 2025 |

| IPO Close Date | Tue, Aug 6, 2025 |

| Tentative Allotment | Wed, Aug 7, 2025 |

| Initiation of Refunds | Thu, Aug 8, 2025 |

| Credit of Shares to Demat | Thu, Aug 8, 2025 |

| Tentative Listing Date | Fri, Aug 11, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 6, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 4,000 | ₹2,16,000 |

| Individual investors (Retail) (Max) | 2 | 4,000 | ₹2,16,000 |

| HNI (Min) | 3 | 6,000 | ₹3,24,000 |

Financials

Based on the provided financial data, Essex Marine Ltd. presents a mixed and potentially concerning performance, despite seemingly positive top-line growth. While the company’s revenue increased by a significant 89% and its profit after tax (PAT) rose by a substantial 156% between the fiscal years ending March 31, 2024, and March 31, 2025, a deeper analysis reveals some vulnerabilities. A key area of concern is the company’s total borrowing, which has risen sharply from ₹16.08 crore in 2024 to ₹23.90 crore in 2025. This heavy reliance on debt to fuel growth raises questions about the long-term sustainability and financial stability of the business. Additionally, the decrease in reserves and surplus from ₹7.51 crore to ₹6.68 crore over the same period suggests that despite the profit growth, the company’s internal financial strength may be eroding, making it more vulnerable to economic downturns.

KPI

| KPI | Values |

|---|---|

| ROE | 30.40% |

| ROCE | 18.87% |

| Debt/Equity | 2.40 |

| RoNW | 26.39% |

| PAT Margin | 12.53% |

| EBITDA Margin | 25.35% |

| Price to Book Value | 3.36 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.