Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Finbud Financial Services Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Finbud Financial Services Ltd

Industry: Finance

Listing At: NSE (SME)

Finance Buddha (Finbud Financial Services Limited) was set up in 2012 by a group of 3 founders with deep domain expertise, having worked in large financial institutions like Citibank. With the backing of marquee investors, Finance Buddha had a clear vision to get customers the best deal for all their loan needs by helping them at every step, from applications to disbursal. Today, with the help of a 700-strong team and with offices spread across 25+ cities, we help lakhs of customers get easier access to credit daily. With a segment-leading customer satisfaction score, there can be no better testament to our sole focus and vision.

Finance Buddha is a market-leading retail loan aggregation platform in India that enables customers to access personal loans, business loans, and home loans from banks and non-banking financial companies. The company follows a hybrid acquisition strategy – leveraging digital marketing and a wide network of external agents to connect with prospective borrowers. Once customer intent is established, Finance Buddha uses its advisory expertise to identify and recommend the most relevant loan options. Customers can then compare offers from multiple lending institutions, and are guided through every stage, from documentation to approval and final disbursement. The company has scaled to facilitate over 10,000 cr of loan disbursals through its platform annually.

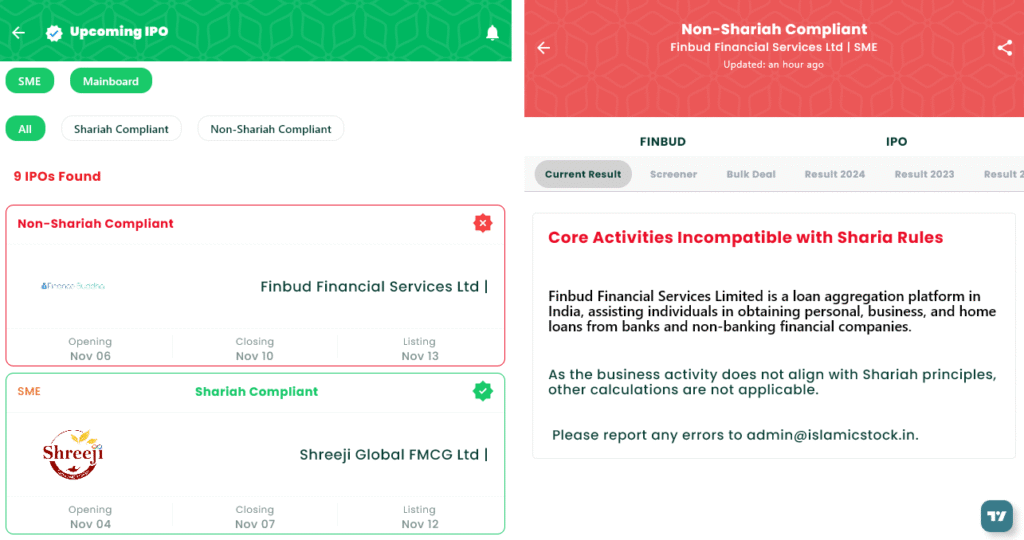

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Thu, Nov 6, 2025 |

| IPO Close Date | Mon, Nov 10, 2025 |

| Tentative Allotment | Tue, Nov 11, 2025 |

| Initiation of Refunds | Wed, Nov 12, 2025 |

| Credit of Shares to Demat | Wed, Nov 12, 2025 |

| Tentative Listing Date | Thu, Nov 13, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Mon, Nov 10, 2025 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.