Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Game Changers Texfab Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

- Analyzing The Company

- Shariah Status

- IPO Timeline (Tentative Schedule)

- Lot Size

- Financials

- KPI

- LINKS

- SEBI Disclaimer

Analyzing The Company

Company Name: Game Changers Texfab Ltd

Industry: Textiles & Apparels

Listing At: BSE (SME)

TradeUNO Fabrics: Revolutionizing India’s Textile B2B Marketplace

TradeUNO Fabrics stands as India’s pioneering curated B2B marketplace for fabrics, operating under the umbrella of Game Changers Texfab Pvt. Ltd. This innovative supply chain orchestration company has been transforming the fabric domain for seven years, driven by visionary entrepreneurs who identified a critical opportunity to create a profitable ecosystem for all stakeholders in India’s textile industry.

Comprehensive Product Portfolio

The company offers an extensive range of fabric products that span the entire textile spectrum. From plain fabrics and ready-made garments to sophisticated designer wear, TradeUNO Fabrics has positioned itself as a one-stop destination for diverse textile requirements. What sets the company apart is its commitment to going beyond conventional business practices, consistently delivering quality and convenience to customers across the nation.

TradeUNO’s customer-centric approach is evident in its willingness to fulfill requirements that may not be readily available in their standard catalogue. The company has developed robust capabilities in custom design printing and maintains the flexibility to deliver any quantity to any location across India, ensuring that geographical barriers never limit business opportunities.

Industry Context and Challenges

India’s textile sector represents one of the country’s oldest and most dynamic industries, serving as a repository of traditional skills, heritage, and culture. With an estimated value projected to exceed $250 billion by 2025, the industry encompasses both organized and unorganized sectors, ranging from traditional handloom and handicrafts to modern spinning, weaving, knitting, processing, and garment manufacturing.

Despite its significant economic contribution, the textile industry has historically faced numerous challenges that have limited its potential. These include low productivity levels, insufficient innovation, inconsistent quality standards, fragmented supply chains, and inadequate infrastructure development. The industry’s complex structure, involving multiple intermediaries and inefficient processes, often resulted in increased costs and reduced profitability for both buyers and sellers.

The TradeUNO Solution

Recognizing these industry pain points, the founders of TradeUNO Fabrics established the company with a clear purpose: to bridge the persistent gap between buyers and sellers through a sophisticated, curated B2B marketplace. The platform caters to the entire textile value chain, leveraging advanced supply-chain efficiencies, cutting-edge technology, and extensive networks to empower Small and Medium Enterprises (SMEs) to source and sell more effectively.

The company’s approach focuses on eliminating traditional barriers that have historically hindered smooth business operations in the textile sector. By providing a transparent, technology-driven platform, TradeUNO enables SMEs to access broader markets and optimize their business processes.

Mission and Strategic Objectives

TradeUNO Fabrics operates with a clearly defined mission to offer customers a curated experience characterized by wide product selection and exceptional value through a risk-free, technology-enabled marketplace. The company is committed to creating win-win situations for both buyers and sellers by prioritizing quality assurance, operational transparency, and trust-building initiatives.

This mission translates into practical benefits for users, including streamlined procurement processes, verified supplier networks, quality guarantees, and comprehensive support services that reduce business risks and enhance operational efficiency.

Vision for Industry Transformation

The company’s vision extends beyond immediate business objectives to encompass broader industry transformation. TradeUNO Fabrics aims to serve as a force multiplier for the Indian Textile SME sector by providing a marketplace of choice where SMEs can engage in online buying and selling activities without traditional barriers or restrictions.

This vision includes empowering customers with access to the best products and services at competitive prices, while simultaneously providing sellers with expanded market reach and improved business opportunities. Through this approach, TradeUNO Fabrics is positioning itself as a catalyst for the modernization and digitization of India’s textile industry.

Impact and Future Outlook

By addressing critical industry challenges through innovative technology solutions and customer-focused services, TradeUNO Fabrics is contributing to the overall growth and efficiency of India’s textile sector. The company’s commitment to supporting SMEs aligns with broader national objectives of promoting entrepreneurship and strengthening the manufacturing ecosystem.

As the textile industry continues evolving toward digitization and efficiency optimization, TradeUNO Fabrics remains well-positioned to lead this transformation, driving sustainable growth for all stakeholders in the textile value chain.

Shariah Status

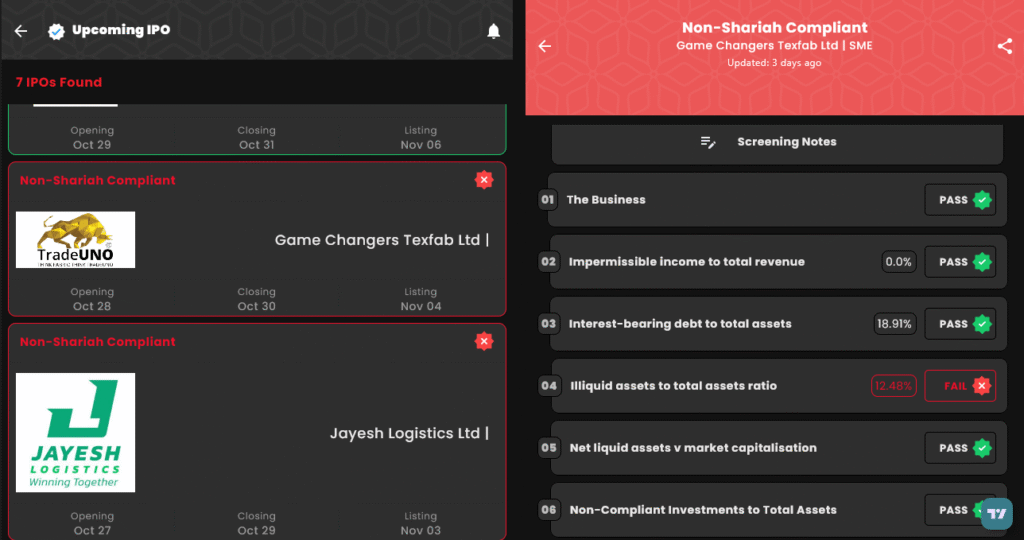

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| Event | Date/Time |

|---|---|

| IPO Open Date | Tue, Oct 28, 2025 |

| IPO Close Date | Thu, Oct 30, 2025 |

| Tentative Allotment | Fri, Oct 31, 2025 |

| Initiation of Refunds | Mon, Nov 3, 2025 |

| Credit of Shares to Demat | Mon, Nov 3, 2025 |

| Tentative Listing Date | Tue, Nov 4, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Thu, Oct 30, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,44,800 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,44,800 |

| S-HNI (Min) | 3 | 3,600 | ₹3,67,200 |

| S-HNI (Max) | 8 | 9,600 | ₹9,79,200 |

| B-HNI (Min) | 9 | 10,800 | ₹11,01,600 |

Financials

Game Changers Texfab Ltd. demonstrated strong financial momentum in the latest periods. Total income rose to ₹115.59 crore for the year ended 31 March 2025 from ₹97.86 crore a year earlier, reflecting healthy top-line growth. Profit after tax (PAT) surged markedly to ₹12.07 crore in FY2025 from ₹4.27 crore in FY2024, driven by improved margins and higher operational efficiency. EBITDA increased to ₹18.59 crore in FY2025, indicating better core profitability versus ₹6.73 crore in FY2024. The company’s asset base expanded to ₹51.32 crore by 31 March 2025 from ₹41.37 crore in FY2024, while net worth strengthened to ₹21.01 crore, up from ₹8.94 crore. Reserves and surplus rose to ₹8.49 crore, supporting balance sheet resilience. Total borrowings were modest at ₹5.66 crore as of 31 March 2025, helping maintain a conservative leverage profile. Interim results to 30 June 2025 show continued progress, with assets at ₹52.25 crore and PAT of ₹4.27 crore.

KPI

| KPI | Values |

|---|---|

| ROE | 80.59% |

| ROCE | 65.97% |

| Debt/Equity | 0.27 |

| RoNW | 80.59% |

| PAT Margin | 10.44% |

| EBITDA Margin | 16.09% |

| Price to Book Value | 6.08 |

| Market Capitalization | 182.51 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.