HDB Financial Services (HDBFS) Ltd IPO: A Deep Dive into the Upcoming Banking Offering & Its Shariah Status

The Indian stock market continues to be a hub of activity, with various companies making their way to public listing. Among the anticipated offerings, the HDB Financial Services Ltd IPO stands out as a significant event in the financial services sector. This article aims to provide a comprehensive guide for general consumers, industry experts, and potential investors, covering its key details, market sentiments, and, most critically, its Shariah compliance status.

Understanding the nature of financial services companies, especially in the context of Islamic finance, is paramount. This post will clarify the implications of HDB Financial Services’ core activities for Shariah-conscious investors.

Table of Contents

About HDB Financial Services Ltd: A Key Player in Financial Services

HDB Financial Services Ltd (IPO symbol, HDBFS) is a prominent non-banking financial company (NBFC) registered with the Reserve Bank of India. It operates as a subsidiary of HDFC Bank, one of India’s largest private sector banks. HDB Financial Services offers a wide array of financial products and services, including:

- Lending solutions: Vehicle loans, business loans, personal loans, and loans against property.

- Collection services: For various retail loans and other financial products.

Given its direct involvement in lending and borrowing activities, which are typically interest-based, HDB Financial Services plays a crucial role in the broader financial services ecosystem, serving both individuals and businesses across various segments.

HDB Financial IPO Snapshot: Key Details You Need to Know

The HDB Financial Services IPO is a Bookbuilding Mainboard issue. Here are its essential details, based on the tentative schedule:

- IPO Open Date: Wednesday, June 25, 2025

- IPO Close Date: Friday, June 27, 2025

- Issue Price Band: ₹700 to ₹740 per equity share

- Face Value: ₹10 per share

- Sale Type: Fresh Capital-cum-Offer for Sale

- Total Issue Size: 16,89,18,919 shares (aggregating up to ₹12,500 Crore)

- Fresh Issue: 3,37,83,784 shares (aggregating up to ₹2,500 Crore)

- Offer for Sale: 13,51,35,135 shares of ₹10 (aggregating up to ₹10,000 Crore)

- Minimum Lot Size for Retail: 20 Shares (Amount: ₹14,800 at upper price band)

- Listing At: BSE & NSE

- Tentative Allotment: Monday, June 30, 2025

- Tentative Listing Date: Wednesday, July 2, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on June 27, 2025

(Source: Chittorgarh.com – HDB Financial Services IPO)

Crucial Insight: Shariah Status of HDB Financial Services Ltd IPO (Failing Rule 1)

For investors committed to Islamic finance principles, the Shariah compliance of an investment is paramount. Islamic law, or Shariah, has strict guidelines regarding the nature of business activities and financial dealings. Investments in companies whose core operations are incompatible with Shariah are generally prohibited.

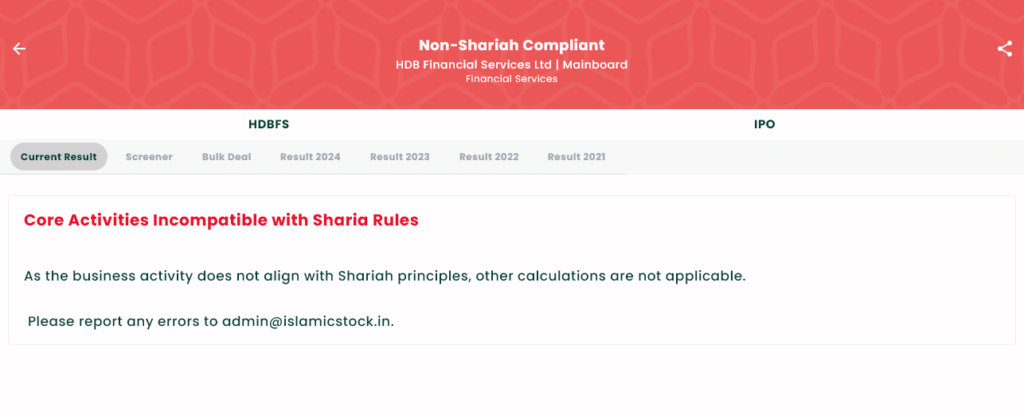

Based on our detailed screening, HDB Financial Services Ltd is explicitly categorized as “Non-Shariah Compliant.” This non-compliance is not due to financial ratios (like high debt) but stems from its core business activities:

As clearly stated in the screening, the reason for non-compliance is “Core Activities Incompatible with Sharia Rules.” As a financial services company primarily engaged in interest-based lending and borrowing, its fundamental business model directly conflicts with the foundational principles of Islamic finance. Consequently, as the screening notes, “As the business activity does not align with Shariah principles, other calculations are not applicable.” This means there is no need to examine other financial ratios (like debt, impermissible income, etc.) because the core business itself renders the company non-compliant.

This is a critical distinction for users of platforms like our app, IslamicStock, for whom the very nature of the business must align with Shariah before any other financial metrics are considered.

Understanding IPO Subscription Status

The subscription status of an IPO provides a real-time indication of the demand for the shares across different investor categories: Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs). As the HDB Financial Services Ltd IPO opens on June 25, 2025, its live subscription data will become available then.

Monitoring this data (which will be updated on platforms like Chittorgarh) helps gauge market sentiment and potential listing performance. High subscription rates, especially from QIBs, often signal strong confidence in the company’s prospects. Investors can track these daily updates once the bidding period commences.

Grey Market Premium (GMP) Insights

The Grey Market Premium (GMP) is an unofficial, speculative price at which IPO shares trade before their official listing on the stock exchange. It serves as an early, unofficial indicator of market sentiment, reflecting the premium (or discount) over the IPO’s issue price that investors are willing to pay in the unofficial market.

For the HDB Financial Services Ltd IPO, the current GMP is:

- HDB Financial IPO GMP Today (June 24, 2025): ₹71

- Expected Listing Price (Upper Band + GMP): ₹740 (Upper Price Band) + ₹71 (GMP) = ₹811

- Expected % Gain/Loss: (₹71 / ₹740) * 100% = 9.59%

Important Note: GMP is not an official indicator. It is highly speculative, unregulated, and can change drastically based on market news, sentiment, and other factors. It should only be used as a very rough guide and not as a guarantee of listing performance. Investors should always base their decisions on thorough research of the company’s fundamentals, financials, and the overall market.

Making an Informed Investment Decision

Investing in an upcoming IPO, especially in the financial sector, requires careful consideration. For the HDB Financial Services Ltd IPO, potential investors should review several factors:

- Company Fundamentals: Thoroughly evaluate HDBFS’s business model, financial performance, growth strategies, and competitive landscape within the NBFC sector.

- Industry Outlook: Assess the prospects of the broader financial services industry and any regulatory changes.

- IPO Valuations: Assess if the IPO price band offers a reasonable valuation compared to its peers.

- Risk Factors: Understand the specific risks detailed in the company’s Red Herring Prospectus (RHP).

- Shariah Compliance: For investors strictly adhering to Shariah principles, the “Non-Shariah Compliant” status due to the inherent nature of its core business activities (Rule 1 Fail) is the most crucial factor and renders the company unsuitable for such investments.

Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. IPO investments carry inherent risks, and there is no guarantee of returns. Readers are strongly encouraged to conduct their own due diligence, consult with a SEBI-registered financial advisor, and carefully read the Red Herring Prospectus (RHP) before making any investment decisions. The information on Shariah compliance is based on the provided screening and common interpretations of Islamic finance principles, specifically highlighting the incompatibility of the core business activities with Shariah.

To learn more about IPOs, detailed company analyses, and Shariah-compliant investment options, visit our website at IslamicStock Website, explore insightful articles on our blog at IslamicStock Blog, and download our application, IslamicStock, for in-depth screenings and investment guidance.