Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Highway Infrastructure Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Highway Infrastructure Ltd

Company Name: Highway Infrastructure Ltd

Industry: Civil Construction

Listing At: NSE & BSE Mainboard

Overview:

Highway Infrastructure Limited (HIL) is a company specializing in infrastructure development and management, with its business segments including tollway collection, EPC infrastructure, and real estate. The company, which began as a partnership firm in 1995 and was later converted into a public limited company on May 4, 2018, has a significant portion of its revenue driven by its tollway collection business.

Business Segments

Tollway Collection: This is a major revenue-generating segment for HIL. The company operates tolls across 11 states and one Union Territory, primarily on expressways with 3 to 4 lanes. HIL has implemented advanced technology for toll management, including Electronic Tollway Collection (ETC) systems that use Radio Frequency Identification (RFID) tags and digital payment platforms. This enhances operational efficiency and reduces congestion. HIL is also one of the few toll operators to use Automatic Number Plate Recognition (ANPR) technology on the Delhi-Meerut Expressway. The company conducts surveys to analyze traffic patterns, alternative routes, and revenue collections to inform its bidding process. Toll charges are set by the National Highways Authority of India (NHAI) and are typically revised annually.

EPC Infra: In this segment, HIL undertakes the development of roadways, bridges, and highways. The company also handles civil infrastructure projects for residential, commercial, and hospitality buildings, as well as other infrastructure developments. HIL works with both government departments and private parties, and it sometimes subcontracts portions of these projects by entering into agreements for both labor and materials.

Real Estate: HIL’s real estate business involves the ownership, development, construction, and sale of commercial and residential properties. The company has developed gated communities and housing projects. Noteworthy projects in Indore, Madhya Pradesh, include Karuna Sagar, a residential building with 400 flats, and New York City, a gated colony. HIL is also currently developing Beverly Plaza, a colony development project in the Tillore-Khurd area of Indore. The company has also acquired various land parcels for future development.

Financials and Corporate Structure

As of August 31, 2024, HIL’s consolidated order book was valued at ₹5,963.83 million. This total was comprised of ₹3,149.59 million from the tollway collection business and ₹2,814.24 million from the EPC Infra business.

The company’s journey began in 1995 as a partnership firm named Highway Enterprises. Due to significant growth, it evolved into a private limited company under the name Highway Infrastructure Private Limited. This was followed by its conversion to a public limited company on May 4, 2018, when it adopted its current name, Highway Infrastructure Limited.

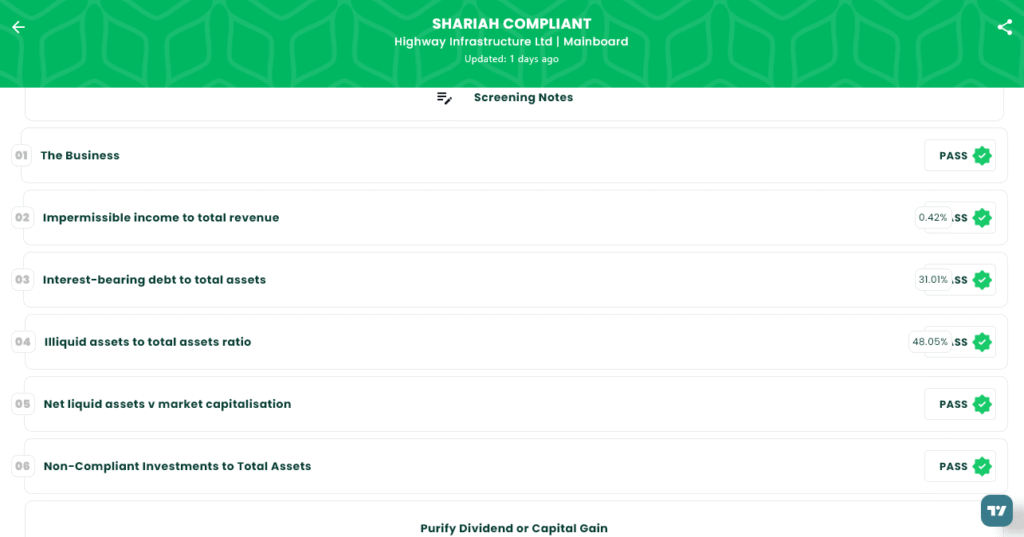

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 5, 2025 |

| IPO Close Date | Thu, Aug 7, 2025 |

| Tentative Allotment | Fri, Aug 8, 2025 |

| Initiation of Refunds | Mon, Aug 11, 2025 |

| Credit of Shares to Demat | Mon, Aug 11, 2025 |

| Tentative Listing Date | Tue, Aug 12, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 7, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 211 | ₹14,770 |

| Retail (Max) | 13 | 2,743 | ₹1,92,010 |

| S-HNI (Min) | 14 | 2,954 | ₹2,06,780 |

| S-HNI (Max) | 67 | 14,137 | ₹9,89,590 |

| B-HNI (Min) | 68 | 14,348 | ₹10,04,360 |

Financials

Highway Infrastructure Ltd. showcased a strong financial performance in a challenging environment. Despite a 13% decrease in revenue between the fiscal years ending March 31, 2024, and March 31, 2025, the company demonstrated exceptional resilience and operational efficiency. The company’s Profit After Tax (PAT) grew by 5%, rising from ₹21.41 crore in 2024 to ₹22.40 crore in 2025. This increase highlights HIL’s effective cost management and strategic focus on profitability. Furthermore, the company’s Net Worth increased significantly, climbing from ₹100.19 crore to ₹117.72 crore, indicating a strengthened financial position. The prudent management of resources is also evident in the healthy increase in Assets, which grew from ₹202.63 crore to ₹231.56 crore, reflecting the company’s commitment to building a robust foundation for future growth.

KPI

| KPI | Values |

|---|---|

| ROE | 19.03% |

| ROCE | 16.56% |

| Debt/Equity | 0.61 |

| RoNW | 19.03% |

| PAT Margin | 4.44% |

| EBITDA Margin | 6.32% |

| Price to Book Value | 3.44 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.