Table of Contents

IPO Snapshot

- Symbol: ICON

- IPO Open Date: June 24, 2025

- IPO Close Date: June 26, 2025

- IPO Allotment Date: June 27, 2025

- IPO Listing Date: July 1, 2025 (Tentative)

- Issue Size: ₹19.11 Cr (21,00,000 shares)

- Issue Type: Bookbuilding IPO

- Price Band: ₹85 to ₹91 per share

- Lot Size: 1,200 shares

- Minimum Investment: ₹1,09,200

- Listing Exchange: BSE SME

Company Overview

Icon Facilitators Limited, established in 2002 and based in Delhi, is a well-recognized name in the facilities management sector. The company provides a wide range of services across India, focusing on both technical and integrated facilities management. Its services include management of electrical systems, HVAC (heating, ventilation, and air conditioning), water treatment systems like STP/ETP, fire and safety systems, diesel generator operations, and overall building maintenance.

Icon offers both soft services such as housekeeping and pest control, and hard services like electrical and HVAC system management. The company operates mostly in North India with 127 active sites, and has recently expanded to Bengaluru. A dedicated regional team led by Mr. Basil Arun Keelor is focused on building its presence in the South.

As of May 15, 2025, the company employs 1,955 staff members. Over the years, Icon has built a strong reputation for quality service and client satisfaction. It serves a wide and diverse client base, many of whom have long-term relationships with the company.

Icon is known for its premium service portfolios and a business model that is scalable, cost-efficient, and reliable. It has expanded its footprint to Punjab, Rajasthan, and Maharashtra, with further plans for growth. The company’s leadership and experienced team aim to make Icon the preferred facility management partner in the region, combining efficiency with a sustainable approach. With a clear vision and dedicated workforce, Icon Facilitators Limited continues to grow in both size and strength.

Grey Market Premium (GMP)

As of now, the Grey Market Premium (GMP) for Icon Facilitators Limited IPO stands at ₹10, reflecting a premium of nearly 11% over the upper price band of ₹91. This early GMP suggests a moderate level of interest from the market, even before the IPO has officially opened for subscription. While the GMP can offer a glimpse of market sentiment and possible listing expectations, it is important to note that it is unofficial and can fluctuate quickly. Investors should wait for actual subscription figures and assess the company’s fundamentals before making any investment decisions.

Shariah Compliance Status

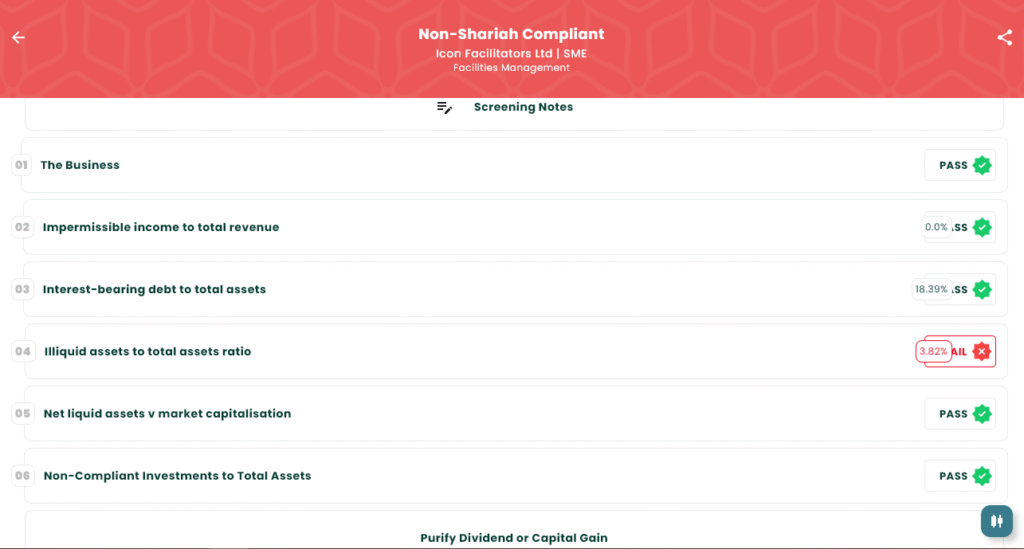

As per the IslamicStock screening, Icon Facilitators Ltd is marked as non-Shariah compliant. While the company passes most of the key financial and business-based Shariah criteria, it fails on one important parameter: the illiquid assets to total assets ratio. This ratio is reported at 3.82%, which is below the minimum threshold of 20% required to qualify as Shariah compliant.

All other metrics, such as interest-bearing debt, impermissible income, and non-compliant investments, are within acceptable limits under Islamic investment guidelines. This indicates the company maintains a clean balance sheet with no significant reliance on interest-based income or investments.

However, the failure to meet the minimum illiquid asset ratio suggests that a large portion of the company’s assets are in liquid form, such as cash or cash equivalents, which disqualifies it from being compliant under Shariah principles.

This non-compliance does not necessarily reflect poorly on the company’s business operations, but for faith-based investors who seek to invest only in Shariah-compliant securities, Icon Facilitators Ltd would not be a suitable choice at this time. Investors should continue to monitor the company’s financials in future periods in case this status changes.

Subscription Status

As of now, the IPO of Icon Facilitators Limited has not yet opened for public subscription. The bidding window is scheduled to begin on June 24, 2025, and will remain open until June 26, 2025. Since the IPO is still in the pre-subscription stage, no data is available on investor demand or subscription levels across different investor categories such as retail, HNI, or institutional segments. However, investors and market watchers are actively tracking grey market trends, company background, and sector outlook in anticipation of the IPO. Icon Facilitators, being a facilities management company with a strong presence in North India, may attract moderate interest depending on its valuation, business fundamentals, and overall market sentiment. Once the IPO opens, daily subscription data will provide a clearer picture of investor interest. Until then, potential investors are advised to study the company’s red herring prospectus and assess its strengths and risks before making any decision.

Final Thoughts

Icon Facilitators Limited appears to be a well-established player in the facilities management industry with a strong presence in North India and recent expansion into southern regions. The company offers a wide range of integrated services and has a large workforce, which supports its operational capabilities. Its focus on quality service delivery and long-standing client relationships adds to its credibility. However, since the IPO has not yet opened and the company is marked as non-Shariah compliant, investors should review all details carefully. Final decisions should be based on fundamentals, pricing, and personal investment goals once the IPO window begins.

Disclaimer

This content is intended solely for informational purposes and should not be interpreted as investment advice or a recommendation to apply for the IPO. Investing in the securities market involves risks. Please read all related offer documents carefully before making any investment decisions.

As per SEBI regulations, investors are advised to review the Red Herring Prospectus (RHP), understand the associated risks, and consult with a certified financial advisor if needed. Investment decisions should be based on individual financial goals and risk tolerance. Neither the author nor this platform shall be held responsible for any financial losses incurred based on the information provided above.