Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Indo SMC Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Indo SMC Ltd

Listing At: BSE (SME)

Overview

INDO SMC Pvt. Ltd. is a Ahmedabad-based manufacturer specializing in high-performance arrays of SMC, FRP/GRP, and composite products. The company designs, manufactures and supplies durable, low‑maintenance components noted for their compact design, corrosion resistance and long service life. INDO SMC works with Sheet Moulding Compound (SMC) — a high‑strength glass‑fiber reinforced thermoset typically used in compression moulding — and provides both ready‑to‑mould SMC and on‑site mixing options for customers seeking tighter control over resin chemistry and filler content.

Positioned as a diversified construction‑management, design‑build and general‑contracting partner, INDO SMC has built long‑standing relationships across multiple industries and serves an impressive roster of repeat clients. Its product range supports applications requiring robust, precision‑moulded parts and composite solutions, including switchgear components.

Vision: To be the partner of choice and market leader in composites and switchgear products by setting benchmarks for quality, innovation and trust, and by building products and relationships that endure.

Mission: To design, manufacture and supply high‑quality composites and switchgear products that deliver reliable, trusted solutions to customers.

Core values include quality, excellence, innovation and agility, integrity and respect, positivity and humility, team spirit, and a commitment to dreaming big while working hard.

Shariah Status

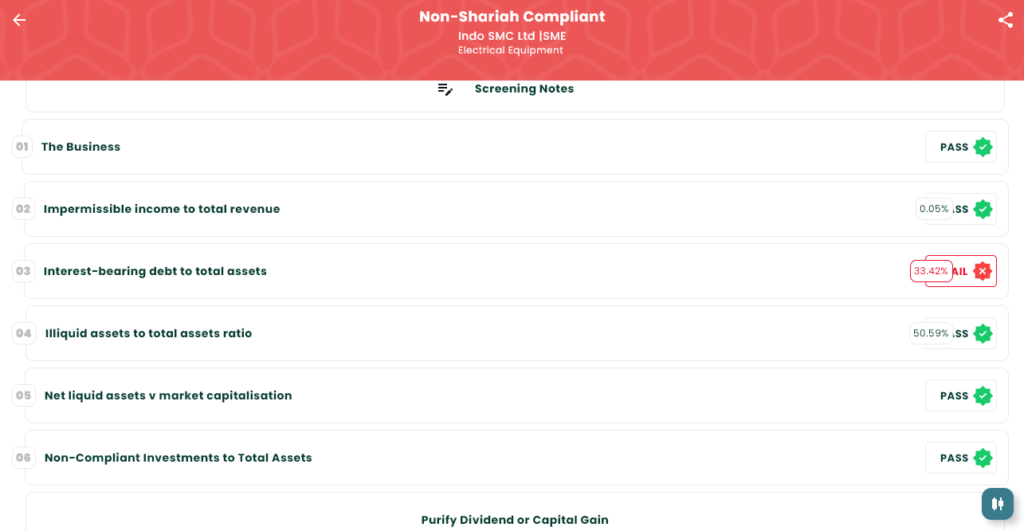

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 13, 2026 |

| IPO Close Date | Jan 16, 2026 |

| Tentative Allotment | Jan 19, 2026 |

| Initiation of Refunds | Jan 20, 2026 |

| Credit of Shares to Demat | Jan 20, 2026 |

| Tentative Listing Date | Jan 21, 2026 |

Financials

INDO SMC Pvt. Ltd.’s restated consolidated financials show a strong multi-year growth trajectory with improving scale, profitability, and equity as of 30 Sep 2025. Total assets expanded sharply from ₹13.85 crore (FY23) to ₹36.32 crore (FY24), ₹99.94 crore (31 Mar 2025) and reached ₹147.67 crore by Sep‑25, reflecting substantial capital deployment and working‑capital buildup to support expansion. Total income rose dramatically from ₹7.30 crore (FY23) to ₹28.06 crore (FY24), then to ₹138.78 crore (Mar‑25) and ₹112.62 crore for the nine months to Sep‑25, indicating a rapid revenue ramp and seasonal or timing effects across reporting periods.

Operating performance improved materially: EBITDA increased from ₹1.15 crore (FY23) to ₹5.08 crore (FY24), surged to ₹22.83 crore (Mar‑25) and stood at ₹17.19 crore by Sep‑25, showing enhanced margins and operational leverage. Profit after tax followed, growing from ₹0.46 crore (FY23) to ₹3.00 crore (FY24), then to ₹15.44 crore (Mar‑25) and ₹11.46 crore (Sep‑25), demonstrating stronger bottom‑line conversion. Net worth rose from ₹1.17 crore (FY23) to ₹5.79 crore (FY24), ₹35.69 crore (Mar‑25) and ₹47.14 crore (Sep‑25), supported by reserves increasing to ₹30.46 crore. Total borrowings moved up from ₹10.43 crore (FY23) to ₹17.70 crore (FY24), ₹35.76 crore (Mar‑25) and ₹49.35 crore (Sep‑25); leverage has grown alongside expansion and deserves monitoring for cash‑flow alignment with debt servicing. Overall, INDO SMC demonstrates robust scaling with strengthening profitability and equity, balanced by rising borrowings as it executes growth plans.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.