The Indian IPO market continues to offer diverse investment opportunities, and the upcoming Pushpa Jewellers Ltd (PUSHPA) IPO is one to watch, especially for those interested in the manufacturing sector, particularly in the traditional and ever-sparkling world of jewellery. This article aims to give you a clear and easy-to-understand guide, covering its key details, how its subscription is shaping up, what its Grey Market Premium is looking like, and, importantly, its Shariah compliance status.

Making smart investment choices means understanding a company’s business, its financial health, and ethical considerations. Let’s dive into what Pushpa Jewellers Ltd brings to the table.

Table of Contents

About Pushpa Jewellers Ltd: Crafting Elegance and Value

PPushpa Jewellers Ltd, known by its IPO symbol PUSHPA, is deeply rooted in the manufacturing and sale of a diverse range of gold and diamond jewellery. Nestled in the heart of Kolkata, the company has built a legacy of trust and craftsmanship. Their commitment to quality, design, and customer satisfaction is evident in their operations, serving various occasions from daily wear to elaborate wedding collections, blending traditional designs with contemporary aesthetics.

As an SME, Pushpa Jewellers has focused on developing in-house design and production capabilities, ensuring control over quality and cost. Their strong FY 2025 results, with significant revenue and profit growth, underscore t

Pushpa Jewellers IPO Snapshot: All the Important Details

The Pushpa Jewellers Ltd IPO is an NSE SME Bookbuilding issue. Here’s a quick rundown of the key information, based on the tentative schedule:

- IPO Open Date: Monday, June 30, 2025

- IPO Close Date: Wednesday, July 2, 2025

- Issue Price Band: ₹143 to ₹147 per equity share

- Face Value: ₹10 per share

- Sale Type: Fresh Capital-cum-Offer for Sale (Fresh Issue of 50,34,000 shares aggregating ₹74.00 Cr; Offer for Sale of 13,41,000 shares aggregating ₹19.71 Cr)

- Total Issue Size: 67,11,000 shares, aiming to raise up to ₹98.65 Crore

- Reserved for Market Maker: 3,36,000 shares (up to ₹4.94 Crore)

- Net Offered to Public: 63,75,000 shares, aggregating up to ₹93.71 Crore

- Minimum Lot Size for Retail Investors: 1,000 Shares, meaning an investment of ₹1,47,000 at the upper price band

- Minimum Lot Size for HNI Investors: 2,000 Shares, meaning an investment of ₹2,94,000 at the upper price band

- Listing At: NSE SME

- Tentative Allotment Date: Thursday, July 3, 2025

- Tentative Listing Date: Monday, July 7, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on July 2, 2025

Understanding the Shariah Status of Pushpa Jewellers Ltd IPO

For investors who follow Islamic finance principles, ensuring an investment is Shariah-compliant is incredibly important. This means checking that the company’s business activities and financial ratios align with Islamic law.

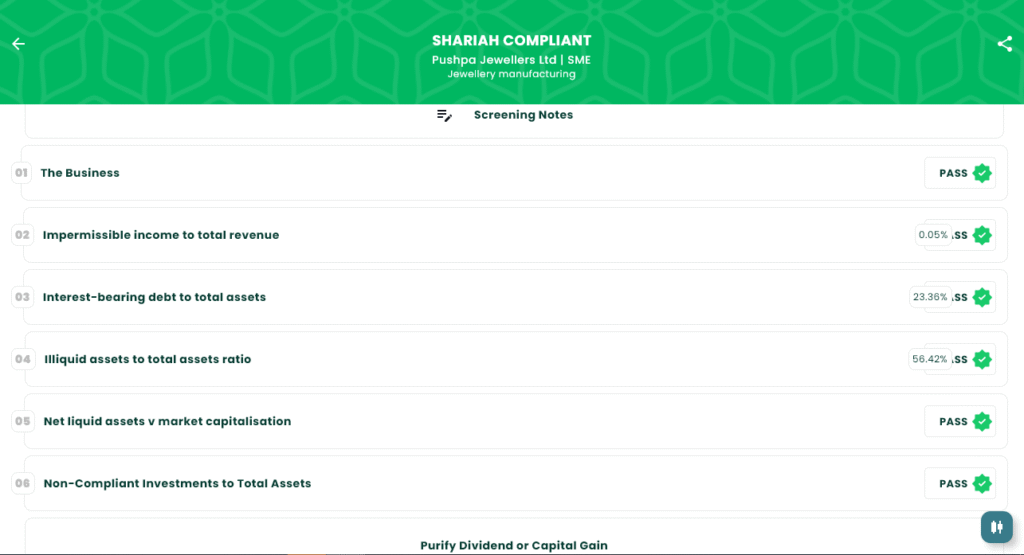

We’re pleased to report that after a thorough screening, the Shariah status for Pushpa Jewellers Ltd is classified as “SHARIAH COMPLIANT.”

Here’s why it passes the screening:

- The Business: Passes (no impermissible activities identified).

- Impermissible Income to Total Revenue: Passes, as it’s below the acceptable threshold.

- Interest-bearing Debt to Total Assets: Passes, well within the limits.

- Illiquid Assets to Total Assets Ratio: Passes, indicating a healthy proportion of tangible assets.

- Net Liquid Assets vs Market Capitalisation: Passes.

- Non-Compliant Investments to Total Assets: Passes.

The screening notes highlight that Pushpa Jewellers Ltd has shown excellent financial growth and has a clear plan for expansion. This robust financial standing, combined with its permissible business activities and healthy financial ratios, makes it a Shariah-compliant investment.

Financial Performance: A Glimpse into the Books (as of FY 2025)

Pushpa Jewellers Ltd. has demonstrated strong financial health in the recent fiscal year:

- Revenue from Operations (FY 2025): ₹281 Crores

- Net Profit After Tax (FY 2025): ₹22.29 Crores

The company has significantly improved its margins, reflecting better efficiency in its operations. While debt has increased, the overall financial health remains sound, and the growth outlook is positive, suggesting a robust foundation for future expansion.

IPO Subscription Status: What the Numbers Say

The subscription status gives us a peek into how much demand there is for the shares from different types of investors: big institutions (QIBs), high-net-worth individuals (NIIs), and everyday retail investors (RIIs).

As of June 30, 2025, at around 05:00 PM (Day 1), here’s how the Pushpa Jewellers IPO Subscription Status (Bidding Detail) stands:

- QIB (Qualified Institutional Buyers): 0.76 times subscribed

- NII (Non-Institutional Investors): 0.02 times subscribed

- Retail Individual Investors (RII): 0.11 times subscribed

- Total Subscription: 0.36 times

- Total Applications: 252

On its first day, the IPO is currently undersubscribed overall. While the QIB category shows some early interest, the overall subscription levels indicate a cautious start. It will be interesting to watch how these numbers evolve over the remaining bidding days as more investors participate.

Grey Market Premium (GMP) Insights

The Grey Market Premium (GMP) is an unofficial, speculative price at which IPO shares trade even before they officially list on the stock exchange. It’s essentially an early, unofficial sign of what the market thinks the shares might be worth, showing how much extra (or less) investors are willing to pay compared to the IPO’s issue price in this unofficial market.

For the Pushpa Jewellers Ltd IPO, an early indication suggests a premium:

- Pushpa Jewellers IPO GMP Today (as per image): ₹31

- Expected % Gain/Loss (approx.): 21.09% (based on the image)

Important Note: Remember, GMP is not official or regulated. It’s highly speculative and can change very quickly based on news, market mood, and other factors. Treat it as a very rough guide, not a guarantee of how the shares will perform when they list. Always make your investment decisions based on solid research into the company’s fundamentals, its financial health, and the broader market conditions.

Strengths: What Makes Pushpa Shine?

- Established Brand & Experience: A long-standing presence in the jewellery market often translates to brand recall and customer loyalty, especially in their regional focus.

- Strong FY 2025 Performance: Significant revenue and profit growth indicate strong operational capabilities and market acceptance.

- Improved Margins: Suggests better cost management and operational effectiveness.

- Shariah Compliant Status: Opens the door to a specific segment of ethical and Islamic investors, broadening the investor base.

- Diverse Product Portfolio: Offering a wide range of jewellery across different price points can cater to a broader customer base and market demand.

- In-house Manufacturing Capabilities: Provides better control over quality, design, and cost, a critical advantage in the jewellery sector.

- Growth in Jewellery Sector: India’s jewellery market continues to grow, driven by cultural factors, rising disposable incomes, and urbanization.

Risks & Challenges: The Hidden Flaws?

- Highly Competitive Market: The jewellery industry is fragmented with many organized and unorganized players, leading to intense competition.

- Volatility in Gold/Diamond Prices: Fluctuations in raw material prices can significantly impact margins and profitability.

- Economic Sensitivity: Jewellery being a discretionary purchase, an economic downturn could directly impact sales and revenue.

- SME Listing Risks: SME IPOs can have lower liquidity and higher price volatility compared to mainboard IPOs, potentially impacting investor exit opportunities.

- Dependent on Key Personnel: Reliance on skilled karigars (craftsmen) and management expertise can pose a risk if key talent is lost.

Making an Informed Investment Decision

Deciding whether to invest in an IPO like Pushpa Jewellers Ltd’s requires careful thought. Here are some things potential investors should consider:

- Company Fundamentals: Look closely at Pushpa Jewellers’ business model, its historical financial performance, its plans for growth outlined in the RHP, and its competitive positioning in the jewellery manufacturing and retail sector.

- Industry Outlook: Think about the future prospects of the Indian jewellery market. Are there new trends, consumer preferences, or economic factors that could positively or negatively impact the company?

- IPO Valuations: Compare the IPO’s price band to similar listed companies to see if it offers a fair valuation, considering its growth potential and recent performance.

- Risk Factors: Read the company’s Red Herring Prospectus (RHP) thoroughly to understand any specific risks, such as market competition, supply chain challenges, or regulatory changes.

- Shariah Compliance: For those strictly adhering to Shariah principles, the “SHARIAH COMPLIANT” status is a significant positive, indicating that the company’s core business and financials align with Islamic guidelines.

Disclaimer

This article is for informational and educational purposes only and should not be taken as financial advice. Investing in IPOs always comes with risks, and there’s no promise of returns. We strongly recommend that you do your own thorough research, talk to a SEBI-registered financial advisor, and carefully read the Red Herring Prospectus (RHP) before making any investment decisions.

Make an Informed Decision

Ready to explore more Shariah-compliant investments, or considering the Pushpa Jewellers IPO?

- Visit our website: Explore in-depth analyses and guides on Islamic finance at https://islamicstock.in/.

- Dive into our blog: Find insightful articles on IPOs, market trends, and Shariah-compliant investment options at https://blog.islamicstock.in/.

- Download our application, IslamicStock: Get access to detailed screenings and personalized investment guidance tailored for you.