Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of JSW Cement Ltd (JSWCEM), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing JSW Cement Ltd (JSWCEM)

Company Name: JSW Cement Ltd

Industry: Cement & Cement Products

Listing At: NSE & BSE Mainboard

Overview:

JSW Cement Ltd., a part of the JSW Group, is a prominent player in the cement industry. The company leverages its affiliation with the multinational conglomerate, which has diversified interests in sectors like steel, energy, and infrastructure. This relationship provides JSW Cement with significant benefits, including access to raw materials such as blast furnace slag from JSW Steel and power from JSW Energy. The company also benefits from the established “JSW” brand name.

Since beginning its operations in 2009 with a single grinding unit in Vijayanagar, Karnataka, JSW Cement has expanded its footprint across the southern, western, and eastern regions of India, as well as the UAE. Its product portfolio is extensive, including blended cements (PSC and PCC), GGBS, Ordinary Portland Cement (OPC), clinker, and a variety of allied cementitious products such as ready-mix concrete (RMC), screened slag, construction chemicals, and waterproofing compounds.

As of March 31, 2024, the company’s Installed Grinding Capacity stood at 20.60 MMTPA. This capacity is distributed across India, with 11.00 MMTPA in the southern region, 4.50 MMTPA in the western region, and 5.10 MMTPA in the eastern region. Additionally, the company had an Installed Clinker Capacity of 6.44 MMTPA, which includes the capacity of JSW Cement FZC. Much of this expansion has been developed organically by the company’s in-house project management team, showcasing its strong project execution capabilities. JSW Cement is currently pursuing further expansion plans, including greenfield and brownfield projects in the northern and central regions of India. These projects are aimed at increasing its Installed Grinding Capacity to 40.85 MMTPA and Installed Clinker Capacity to 13.04 MMTPA, thereby establishing a pan-India presence.

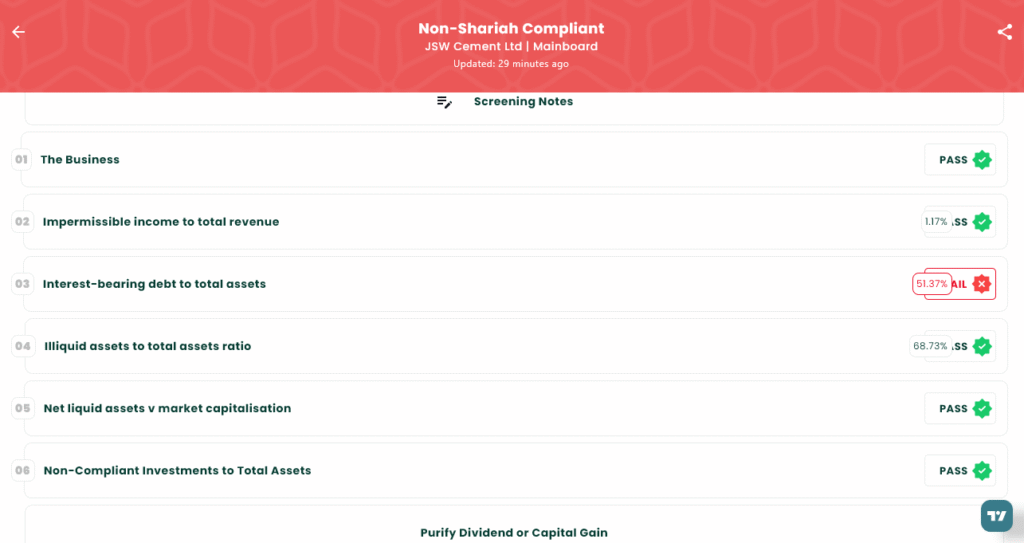

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Thu, Aug 7, 2025 |

| IPO Close Date | Mon, Aug 11, 2025 |

| Tentative Allotment | Tue, Aug 12, 2025 |

| Initiation of Refunds | Wed, Aug 13, 2025 |

| Credit of Shares to Demat | Wed, Aug 13, 2025 |

| Tentative Listing Date | Thu, Aug 14, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 11, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 102 | ₹14,994 |

| Retail (Max) | 13 | 1,326 | ₹1,94,922 |

| S-HNI (Min) | 14 | 1,428 | ₹2,09,916 |

| S-HNI (Max) | 66 | 6,732 | ₹9,89,604 |

| B-HNI (Min) | 67 | 6,834 | ₹10,04,598 |

Financials

JSW Cement Ltd. faced a challenging period, marked by a significant downturn in its financial performance. The company’s revenue saw a 3% decrease, dropping from ₹6,114.60 crore to ₹5,914.67 crore between the fiscal years ending March 31, 2024, and March 31, 2025. This revenue decline was overshadowed by a catastrophic collapse in profitability, with the Profit After Tax (PAT) plummeting by 364%. The company swung from a profit of ₹62.01 crore to a substantial loss of ₹163.77 crore. This severe reversal in earnings, coupled with a decline in Net Worth and Reserves and Surplus, points to considerable operational and financial distress, raising serious concerns about the company’s future stability and performance.

KPI

| KPI | Values |

|---|---|

| ROE | -6.90 |

| ROCE | 7.05% |

| Debt/Equity | 0.98 |

| RoNW | -4.85% |

| PAT Margin | -2.77% |

| EBITDA Margin | 13.78% |

| Price to Book Value | 6.16 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.