Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Jyoti Global Plast Ltd IPO (JYOTIGLOBAL), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Jyoti Global Plast Ltd (JYOTIGLOBAL)

Company Name: Jyoti Global Plast Ltd

Industry: Industrial Products

Listing At: NSE SME

Overview:

Jyoti Global Plast began its journey as a manufacturer of plastic packaging solutions, building a strong reputation for quality and innovation in sectors like FMCG and pharmaceuticals. Leveraging its expertise in advanced plastic molding, the company strategically diversified its portfolio beyond traditional packaging.

The company expanded into injection molding, successfully venturing into the manufacturing of industrial pails for various industries, as well as producing precision-molded automotive components for the automobile sector. To further broaden its reach, Jyoti also entered the toy manufacturing segment, demonstrating its ability to cater to a wide range of consumer-centric products with a focus on quality and safety.

Pushing its boundaries, Jyoti Global Plast made a significant leap into the highly specialized defense and aerospace industries. Through strategic investments in R&D and advanced engineering, the company developed lightweight, high-strength components for aircraft, drones, and defense equipment. This move solidified its position as a key manufacturing partner for mission-critical parts in high-tech fields. Jyoti Global Plast’s evolution from a packaging firm to a diversified player in advanced manufacturing showcases its adaptability and commitment to innovation.

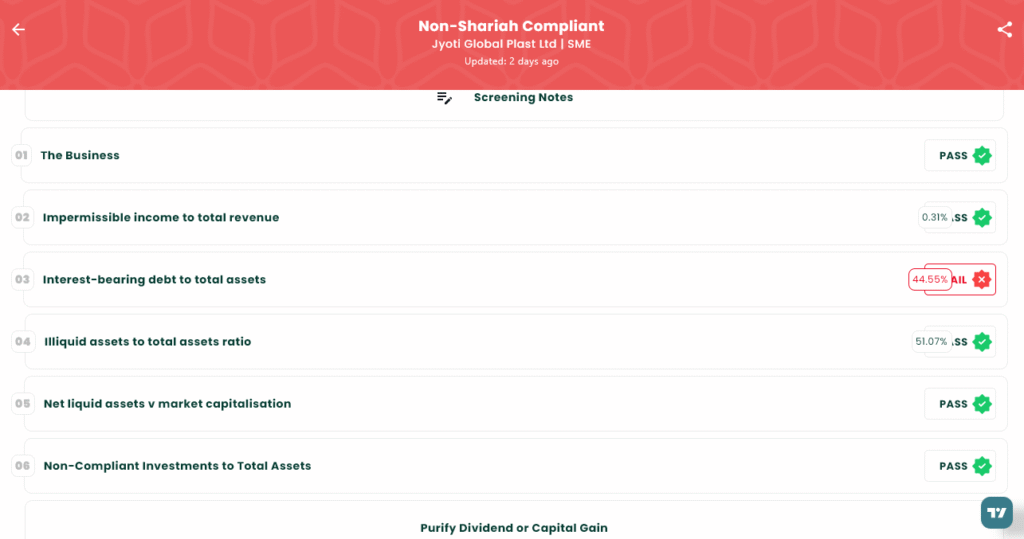

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 4, 2025 |

| IPO Close Date | Tue, Aug 6, 2025 |

| Tentative Allotment | Wed, Aug 7, 2025 |

| Initiation of Refunds | Thu, Aug 8, 2025 |

| Credit of Shares to Demat | Thu, Aug 8, 2025 |

| Tentative Listing Date | Fri, Aug 11, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 6, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 4,000 | ₹2,64,000 |

| Individual investors (Retail) (Max) | 2 | 4,000 | ₹2,64,000 |

| S-HNI (Min) | 3 | 6,000 | ₹3,96,000 |

| S-HNI (Max) | 7 | 14,000 | ₹9,24,000 |

| B-HNI (Min) | 8 | 16,000 | ₹10,56,000 |

Financials

Jyoti Global Plast Ltd. posted strong financials for the year ending March 31, 2025. Total Income grew by 7% to ₹93.80 crore, and Profit After Tax surged an impressive 68% to ₹6.08 crore. EBITDA also saw a significant rise to ₹11.66 crore, while Net Worth improved to ₹21.34 crore. Notably, the company reduced its Total Borrowing to ₹25.31 crore from ₹28.95 crore. Despite this reduction, the company’s debt-to-total-assets ratio remains at approximately 45%, meaning a substantial portion of its assets is still debt-financed, which could be a point of concern for some investors.

KPI

| KPI | Values |

|---|---|

| ROE | 33.22% |

| ROCE | 22.35% |

| Debt/Equity | 1.19 |

| RoNW | 28.49% |

| PAT Margin | 6.50% |

| EBITDA Margin | 12.47% |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.