Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of KRM Ayurveda Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: KRM Ayurveda Ltd

Listing At: NSE (SME)

Overview

KRM Ayurveda Multispecialty Hospital, established in 2019, is a leading Ayurvedic healthcare institution aimed at improving mind, body, and soul balance with its restorative and rejuvenation treatment services. With Ayurveda unveiling its powerful therapeutic mysteries, our continuous effort has remained to understand and devise solutions catering to individual needs. We offer the world in class natural treatments addressing numerous diseases and lifestyle disorders. Every step of our patient’s care is conducted in a healing environment that instils the spirit of traditional Ayurvedic medicine into the space.

Fostering some of the best outpatient clinics, hospitals, and wellness centres in the world, KRM has revolutionised and gained fresh insight into the health dynamics. We hold the accreditations from respective authorities namely ISO, FSSAI, and NABH. Being the parent unit of Karma Ayurveda, we present to you the associated services with the same.

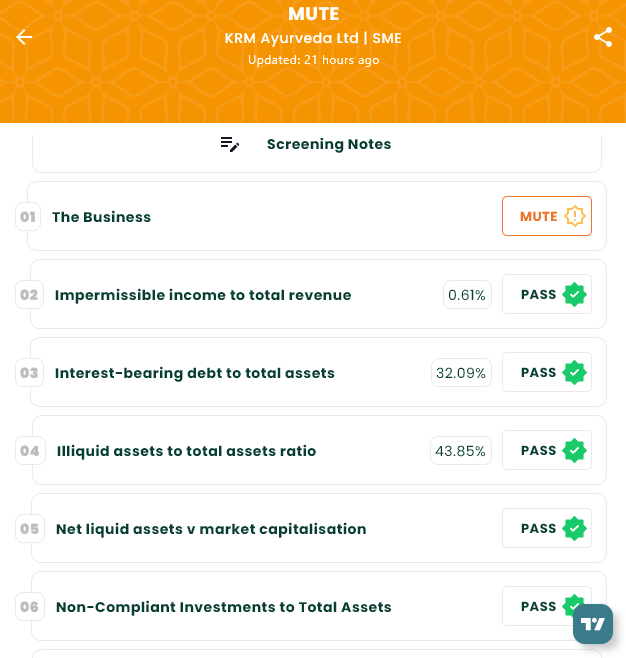

Shariah Status

The IPO is Mute, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 21, 2026 |

| IPO Close Date | Jan 23, 2026 |

| Tentative Allotment | Jan 27, 2026 |

| Initiation of Refunds | Jan 28, 2026 |

| Credit of Shares to Demat | Jan 28, 2026 |

| Tentative Listing Date | Jan 29, 2026 |

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.