Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Krupalu Metals Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Krupalu Metals Ltd

Industry: Other Industrial Products

Listing At: BSE SME

Overview:

Krupalu Metals Limited is a prominent manufacturer of high-quality brass and copper products, with its operations centered in Jamnagar, Gujarat. The company, which was incorporated in 2012, traces its roots to 2009 when it began its journey as a trusted supplier to various industries. Its core business involves the precise manufacturing of a wide array of products, including brass and copper sheets, strips, and components. The product lineup is extensive, featuring items such as brass sheet metal components, brass press parts, brass and copper rods, washers, and stamping parts. Additionally, Krupalu Metals offers specialized job work services.

The company’s commitment to quality is a cornerstone of its business philosophy. It uses only the finest copper and zinc, sourced from reputable vendors, to ensure that every product meets stringent quality benchmarks for durability and performance. This focus on premium materials and expert craftsmanship has been a key factor in building long-lasting client relationships and establishing a respected position in the industry.

Located at its manufacturing facility in GIDC Phase-III, Dared Udhyognagar, the company leverages its expertise to produce a diverse product range. It is staffed by a team of 13 permanent employees and an additional 40 contract workers who are engaged as needed. This flexible workforce structure allows the company to meet varying production demands.

Krupalu Metals operates with a clear vision: to become a global leader in brass manufacturing, recognized for excellence and sustainable practices. Its mission is to achieve this by consistently delivering high-quality products through innovation, expertise, and a strong commitment to customer satisfaction. The company’s competitive strengths are rooted in its experienced management and well-trained workforce, its established client base, rigorous quality assurance standards, vast industry experience, and a culture that encourages innovative ideas. This customer-centric approach ensures tailored solutions and timely delivery, making Krupalu Metals a reliable partner in the brass industry.

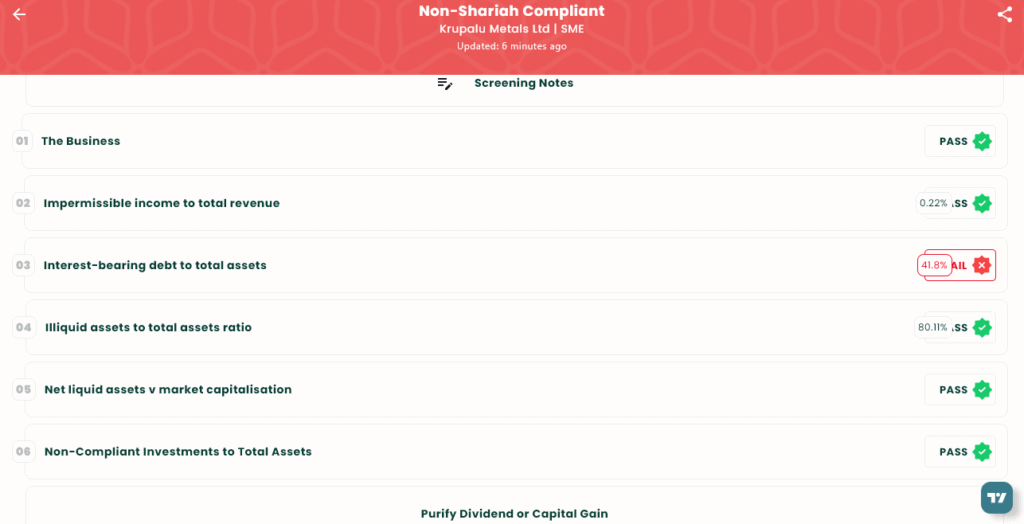

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 8, 2025

- IPO Close Date: Wednesday, September 11, 2025

- Tentative Allotment: Thursday, September 12, 2025

- Initiation of Refunds: Monday, September 15, 2025

- Credit of Shares to Demat: Monday, September 15, 2025

- Tentative Listing Date: Tuesday, September 16, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 11, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,30,400 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,30,400 |

| HNI (Min) | 3 | 4,800 | ₹3,45,600 |

Financials

Based on the financial data provided for the periods ending March 31, 2023, 2024, and 2025, the company has demonstrated strong growth across several key metrics.

The company’s Total Income saw consistent and significant growth, rising from ₹33.58 crore in 2023 to ₹37.12 crore in 2024, before a substantial increase to ₹48.50 crore by 2025. This top-line growth is mirrored in its profitability. Profit After Tax showed a dramatic year-on-year improvement, jumping from just ₹0.42 crore in 2023 to ₹1.55 crore in 2024, and further to ₹2.15 crore in 2025. Similarly, EBITDA increased from ₹1.08 crore in 2023 to ₹2.57 crore in 2024 and reached ₹3.70 crore in 2025, indicating strong operational performance.

The balance sheet also reflects this positive trend. Assets grew steadily from ₹15.25 crore in 2023 to ₹19.46 crore in 2024, and then slightly to ₹20.03 crore in 2025. This growth was accompanied by a significant increase in Net Worth, which more than doubled from ₹2.56 crore in 2023 to ₹6.12 crore in 2025. While Total Borrowing initially rose from ₹7.44 crore to ₹9.57 crore between 2023 and 2024, it was strategically reduced to ₹8.37 crore by 2025, suggesting an effort to manage debt.

KPI

| KPI | Value |

| ROCE | 48.45% |

| Debt/Equity | 1.37 |

| RoNW | 35.12% |

| PAT Margin | 4.45% |

| EBITDA Margin | 7.65% |

| Price to Book Value | 7.09 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.