Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of L.T.Elevator Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: L.T.Elevator Ltd

Industry: Industrial Products

Listing At: BSE SME

Overview:

L.T. Elevator Ltd., with its headquarters in Kolkata, India, is a leading provider of innovative vertical mobility solutions. Established in August 2008, the company has built a strong reputation over more than a decade for its commitment to quality, engineering excellence, and customer-first philosophy. With a vast network spanning 21 states in India and six countries, L.T. Elevator is one of the largest elevator manufacturers in the nation, providing comprehensive services from manufacturing and installation to maintenance and operations.

The company’s expansive 80,000 sq. ft. manufacturing plant in Chakchata, West Bengal, is a cornerstone of its operations. This state-of-the-art facility, equipped with advanced Indo-Italian-German technology and a TRUMPF assembly line, ensures a high degree of quality and efficiency. A key differentiator is L.T. Elevator’s integrated production line, where approximately 80% of its products are manufactured in-house. This dedication to local production champions the “Make In India” initiative and allows the company to create custom solutions specifically designed to meet local needs. The plant has an annual production capacity of 800 elevators and 5,000 mechanical car parking systems, reflecting its robust operational scale.

Pioneering Smart Parking Solutions

Beyond its core elevator business, L.T. Elevator has ventured into addressing one of the most pressing urban challenges: parking. Recognizing that rapid urbanization and population growth have led to an inverse relationship between the number of vehicles and available space, the company launched LT ParkSmart. This initiative aims to tackle the multifaceted problems caused by parking predicaments, including traffic congestion, environmental pollution, and driver frustration. The company’s research indicates that on-street parking is a significant cause of traffic congestion, reducing usable road space by as much as 50%, while drivers spend nearly 20% of their driving time searching for a parking spot. This “cruising” contributes to a 20% increase in vehicular pollution in urban areas.

LT ParkSmart’s mission is to make urban mobility hassle-free by offering progressive smart parking solutions. These systems optimize the use of available space, ensuring a smoother traffic flow and reducing the need for drivers to cruise for long periods. The benefits are substantial: less fuel wastage, reduced time consumption, and a significant decrease in environmental pollution. The solutions also provide users with a better, more secure, and cost-effective parking experience. By combining technology and innovation, LT ParkSmart maximizes benefits while minimizing resource use, aligning with the company’s broader sustainability goals.

A Commitment to Excellence and Sustainability

L.T. Elevator’s success is built on a foundation of strong competitive strengths. The company’s manufacturing plant, equipped with the latest machinery, enables it to design and produce a wide range of products, including high-speed apartment lifts, bungalow lifts, hospital lifts, escalators, and mechanical car parking systems. The company boasts a team of over 319 employees, including a highly skilled in-house design team of more than 25 engineers specializing in mechanical, electrical, embedded systems, and robotics. This technical expertise, combined with a well-equipped R&D and quality control process, allows the company to maintain its reputation for excellence in manufacturing customized systems.

Customer service is a core tenet of L.T. Elevator’s business model. The company’s “Customer First Philosophy” is evident in its comprehensive solutions, which include 24/7 service support. With 20 branch offices across India, a trained maintenance team of approximately 250 technicians can provide in-person support for breakdowns within 60 minutes. As of March 31, 2025, the company had over 8,000 installations under service contracts, including elevators, escalators, and car parking systems.

Beyond its focus on quality and customer satisfaction, L.T. Elevator is dedicated to sustainable practices. The company’s core values guide its commitment to ethical, relationship-based, and cost-conscious operations. It continually works to be a responsible steward of the environment, providing sustainable solutions that help clients achieve their project goals while saving money and creating a lasting legacy. L.T. Elevator’s sustainable approach is a key part of its business, ensuring that it not only delivers effective solutions but also contributes to a cleaner, more efficient, and better tomorrow for its clients and communities.

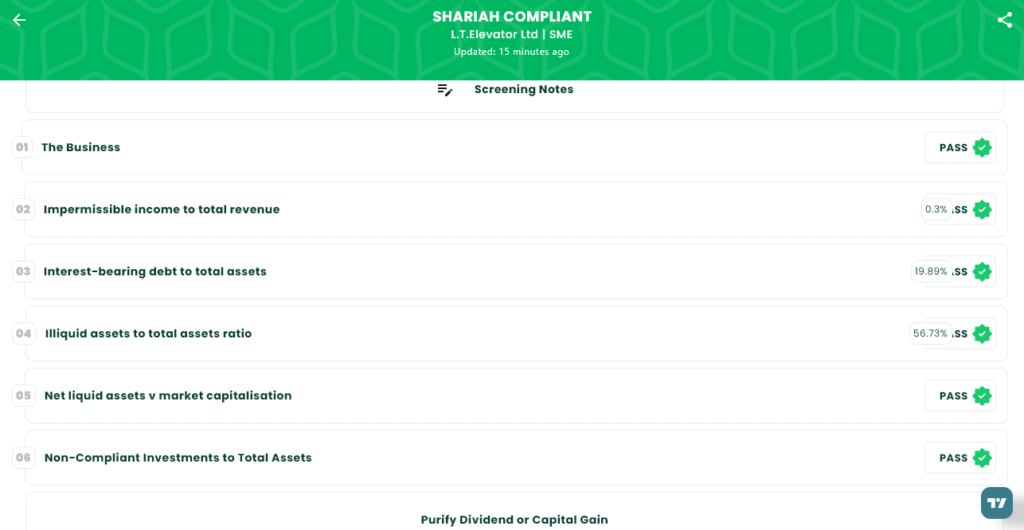

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 12, 2025

- IPO Close Date: Wednesday, September 16, 2025

- Tentative Allotment: Thursday, September 17, 2025

- Initiation of Refunds: Monday, September 18, 2025

- Credit of Shares to Demat: Monday, September 18, 2025

- Tentative Listing Date: Tuesday, September 19, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 16, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,49,600 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,49,600 |

| S-HNI (Min) | 3 | 4,800 | ₹3,74,400 |

| S-HNI (Max) | 8 | 12,800 | ₹9,98,400 |

| B-HNI (Min) | 9 | 14,400 | ₹11,23,200 |

Financials

Based on the financial data, L.T. Elevator Ltd. experienced a period of remarkable growth between the financial years ending March 31, 2024, and March 31, 2025. The company’s revenue, or Total Income, increased by 40%, rising from ₹40.63 crore to ₹56.74 crore. Even more impressively, its Profit After Tax (PAT) soared by 182%, from ₹3.17 crore to ₹8.94 crore, demonstrating a significant improvement in profitability.

This strong performance is reflected across multiple key financial metrics. The company’s Assets more than doubled, jumping from ₹42.78 crore to ₹86.99 crore. This suggests a substantial expansion of its resource base. Similarly, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) saw a sharp increase, rising from ₹6.67 crore to ₹15.23 crore.

The company’s Net Worth also showed a dramatic improvement, increasing from ₹10.74 crore to ₹45.43 crore. This growth in net worth is supported by a significant increase in Reserves and Surplus, which grew from ₹6.13 crore to ₹31.77 crore. While Total Borrowing also increased, it did so at a more moderate pace, rising from ₹14.02 crore to ₹17.30 crore, which indicates that the company’s growth was not solely fueled by debt. The overall picture is one of robust financial health and a strong growth trajectory, particularly between the 2024 and 2025 financial years.

KPI

| KPI | Values |

|---|---|

| ROE | 20.52% |

| ROCE | 30.50% |

| Debt/Equity | 0.38 |

| RoNW | 19.68% |

| PAT Margin | 15.82% |

| EBITDA Margin | 26.94% |

| Price to Book Value | 2.35 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.