Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Mangal Electrical Industries Ltd (MANGAL), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Mangal Electrical Industries Ltd

Industry: Other Industrial Products

Listing At: NSE & BSE (Mainboard)

Overview:

About Mangal Electrical Industries Limited

Mangal Electrical Industries Limited is in the business of processing a wide range of transformer components and related products. The company’s core activities include the processing of transformer laminations, CRGO slit coils, amorphous cores, coil and core assemblies, wound cores, toroidal cores, and oil immersed circuit breakers. They also have a trading arm for CRGO and CRNO coils and amorphous ribbons. In addition to these components, they manufacture a variety of transformers, ranging in capacity from single-phase 5 KVA to three-phase 10 MVA units, and provide customized products for the power infrastructure industry. Furthermore, Mangal Electrical Industries offers comprehensive EPC (Engineering, Procurement, and Construction) services for the setup of electrical sub-stations.

Mission, Vision, and Values

Under the leadership of Founder and Managing Director, Mr. Rahul Mangal, the company’s mission is to become the premier global manufacturer and distributor of CRGO and transformer accessories. They aim to achieve this by building strong customer relationships, delivering exceptional value, and focusing on innovation and excellence. A key part of their mission is a commitment to sustainability and energy savings through continuous product innovation and environmentally friendly practices.

The vision of Mangal Electrical Industries is to be a global leader in the transformer component manufacturing industry. They aspire to set the highest standards of excellence by delivering innovative, high-quality products that consistently meet and exceed client expectations. The company fosters a culture of integrity, innovation, and collaboration to drive growth and excellence, positioning itself as a trusted partner in the global electrical industry. They are committed to continuous innovation, sustainability, and building lasting client relationships by providing tailor-made solutions.

At the core of the business are values that guide every aspect of their operations. These include a strong sense of commitment and trust, a dedication to innovation and new ideas to stay competitive, and an unwavering focus on ensuring exceptional quality in all their manufacturing processes and customer service. Through these values, Mangal Electrical Industries aims to set new benchmarks in the transformer component industry.

Shariah Status

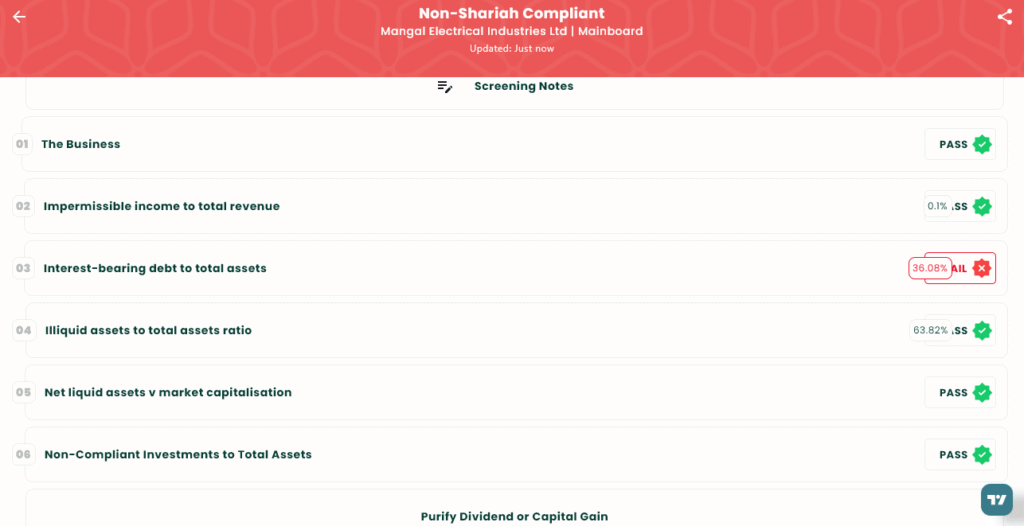

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Aug 20, 2025 |

| IPO Close Date | Fri, Aug 22, 2025 |

| Tentative Allotment | Mon, Aug 25, 2025 |

| Initiation of Refunds | Tue, Aug 26, 2025 |

| Credit of Shares to Demat | Tue, Aug 26, 2025 |

| Tentative Listing Date | Thu, Aug 28, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 22, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 26 | ₹14,586 |

| Retail (Max) | 13 | 338 | ₹1,89,618 |

| S-HNI (Min) | 14 | 364 | ₹2,04,204 |

| S-HNI (Max) | 68 | 1,768 | ₹9,91,848 |

| B-HNI (Min) | 69 | 1,794 | ₹10,06,434 |

Financials

Mangal Electrical Industries Ltd.’s financials highlight some red flags despite reported growth. While revenue rose 22% in FY 2025, much of this came with increasing reliance on debt, as total borrowings jumped sharply from ₹92.12 crore in FY 2024 to ₹149.12 crore in FY 2025. Profit after tax, though up 126%, reflects a low base effect from the previous year’s weak ₹20.95 crore, making the growth less impressive. EBITDA nearly doubled but still remains modest against rising liabilities. Overall, the numbers suggest vulnerability, with financial progress overshadowed by mounting borrowings and inconsistent profit levels.

KPI

| KPI | Values |

|---|---|

| ROE | 29% |

| ROCE | 25.38% |

| Debt/Equity | 0.92 |

| RoNW | 34.14% |

| PAT Margin | 8.61% |

| EBITDA Margin | 14.90% |

| Price to Book Value | 7.09 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.