The Indian IPO market is always bringing fresh opportunities, and for those with an eye on the fashion world, particularly footwear, the Marc Loire Fashions Ltd IPO is certainly grabbing attention. This article is designed to be your friendly guide, offering a clear and simple breakdown of this new offering, including its key details, how well it’s being subscribed to, what the Grey Market Premium (GMP) suggests, and most importantly, its Shariah compliance status.

Making smart investment choices, especially in a dynamic industry like fashion, means truly understanding the company’s core business, its financial health, and ensuring it aligns with ethical principles. Let’s delve into the world of Marc Loire Fashions Ltd, known by its IPO symbol MARCLOIRE.

Table of Contents

About Marc Loire Fashions Ltd: Crafting Footwear with Style

Marc Loire Fashions Ltd, known by its IPO symbol MARCLOIRE, is a vibrant player in the fashion retail space, specializing exclusively in footwear. The company is dedicated to offering a diverse collection of footwear that caters to various styles and preferences, providing trendy options for its customers and reinforcing the brand identity of MARCLOIRE.

The company isn’t just about selling shoes; they’re actively building a strong market presence. They’ve recently launched a new brand and are strategically expanding, including through a new e-commerce website. What’s really interesting is that they manage their own manufacturing units right in Delhi. This hands-on control over production ensures both quality and efficiency across all their product lines, from design to delivery.

Essentially, Marc Loire Fashions Ltd is all about providing quality, diverse footwear for its customers, backed by their own manufacturing prowess, aiming to grow their footprint in the ever-evolving retail landscape.

Marc Loire Fashions IPO Snapshot: The Key Details

The Marc Loire Fashions Ltd IPO is an SME Fixed Price IPO issue set to list on the BSE. Here’s a quick overview of its essential details:

- IPO Open Date: Monday, June 30, 2025

- IPO Close Date: Wednesday, July 2, 2025 (which is today!)

- Issue Price Band: ₹100 per equity share

- Face Value: ₹10 per share

- Sale Type: Fresh Capital

- Total Issue Size: 21,00,000 shares, aiming to raise up to ₹21.00 Crore

- Reserved for Market Maker: 1,05,600 shares (up to ₹1.06 Crore)

- Net Offered to Public: 19,94,400 shares, aggregating up to ₹19.94 Crore

- Minimum Lot Size for Retail Investors: 1,200 Shares, meaning an investment of ₹1,20,000 at the upper price band

- Listing At: BSE SME

- Tentative Allotment Date: Tuesday, July 3, 2025

- Tentative Listing Date: Thursday, July 4, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on July 2, 2025

(Source: Chittorgarh IPO Details – Marc Loire IPO)

Crucial Insight: Shariah Status of Marc Loire Fashions Ltd IPO

For investors who live by Islamic finance principles, ensuring an investment is Shariah-compliant is a top priority. This means checking that the company’s business activities and financial health align with Islamic law.

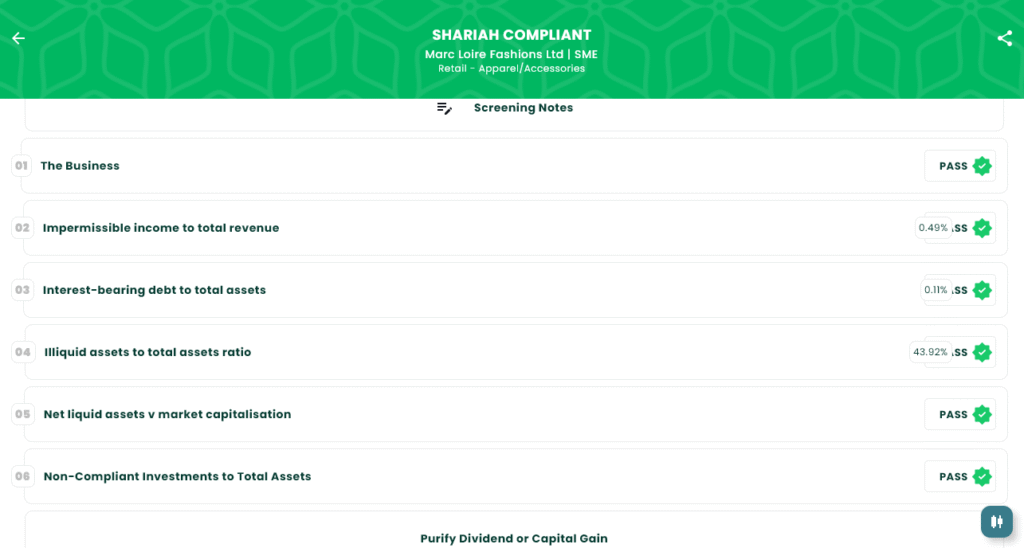

We’re happy to share that after a thorough screening, Marc Loire Fashions Ltd is classified as “SHARIAH COMPLIANT.”

Here’s why it passes our screening:

- The Business: Passes. The company’s core activities primarily deal with permissible goods (footwear). There are no indications of involvement in prohibited industries such as alcohol, gambling, or interest-based financial services.

- Impermissible income to total revenue: Passes.

- Interest-bearing debt to total assets: Passes.

- Illiquid assets to total assets ratio: Passes.

- Net liquid assets vs market capitalisation: Passes.

- Non-Compliant Investments to Total Assets: Passes.

This strong performance across all screening parameters makes Marc Loire Fashions Ltd a suitable option for investors looking for Shariah-compliant opportunities, as assessed by platforms like our IslamicStock app.

IPO Subscription Status: How It’s Looking on Day 1

The subscription status gives us a real-time snapshot of how much demand there is for the shares from different investor groups: big institutions (QIBs), high-net-worth individuals (NIIs), and everyday retail investors (RIIs).

As of June 30, 2025, at around 05:00 PM (Day 1), here’s how the Marc Loire Fashions IPO Subscription Status (Bidding Detail) stands:

- NII (Non-Institutional Investors): 0.61 times subscribed

- Retail Individual Investors (RII): 0.08 times subscribed

- Total Subscription: 0.35 times

- Total Applications: 76

(Source: Chittorgarh IPO Subscription – Marc Loire Fashions)

As of Day 1, the IPO is currently undersubscribed across all categories. It’s important to remember that the bidding for this IPO closes on July 02, 2025. The final hours of bidding can often see a surge in applications, so it’s worth checking for the very latest updates.

Grey Market Premium (GMP) Insights

The Grey Market Premium (GMP) is an unofficial, speculative price at which IPO shares trade even before they officially list on the stock exchange. Think of it as an early, informal peek into market sentiment, showing how much extra (or less) investors are willing to pay for the shares in this unofficial market, compared to the IPO’s issue price.

For the Marc Loire Fashions Ltd IPO, the current GMP is:

- Marc Loire Fashions IPO GMP Today (as per image): ₹6

- Expected Listing Price (Upper Band + GMP): ₹100 (Upper Price Band) + ₹6 (GMP) = ₹106

- Expected % Gain/Loss: Based on the GMP, this suggests a potential gain of 6%.

Important Note: Please remember that GMP is not official or regulated. It’s highly speculative and can change very quickly based on news, market mood, and other factors. Treat it as a very rough guide, not a guarantee of how the shares will perform when they list. Always make your investment decisions based on solid research into the company’s fundamentals, its financial health, and the broader market conditions.

Making a Smart Investment Decision

Deciding whether to invest in an IPO like Marc Loire Fashions Ltd’s calls for careful consideration. Here are some key factors potential investors should think about:

- Company Fundamentals: Dive deep into Marc Loire’s business model, how well it’s performed financially, its plans for growth, and how it stands against competitors in the dynamic footwear market.

- Industry Outlook: Consider the future prospects of the footwear retail industry, including consumer trends, e-commerce growth, and supply chain dynamics.

- IPO Valuations: Compare the IPO’s price band to similar companies in the market to see if it offers a reasonable valuation, considering its growth potential.

- Risk Factors: Make sure you understand any specific risks detailed in the company’s Red Herring Prospectus (RHP), such as market competition or changing fashion trends.

- Shariah Compliance: For those strictly adhering to Shariah principles, the “SHARIAH COMPLIANT” status is a significant positive, indicating that the company’s core business (footwear) and financials align with Islamic guidelines.

Disclaimer

This article is for informational and educational purposes only and should not be taken as financial advice. Investing in IPOs always comes with risks, and there’s no promise of returns. We strongly encourage you to do your own thorough research, talk to a SEBI-registered financial advisor, and carefully read the Red Herring Prospectus (RHP) before making any investment decisions.

Ready to explore more Shariah-compliant investments?

To learn more about IPOs, get detailed company analyses, and find Shariah-compliant investment options, visit our website at IslamicStock Website, explore insightful articles on our blog at IslamicStock Blog, and download our application, IslamicStock, for in-depth screenings and investment guidance tailored for you.