Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Medistep Healthcare Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Medistep Healthcare Ltd

Industry: Pharmaceuticals

Listing At: NSE SME

Overview:

Medistep Healthcare Limited is a dynamic and innovative pharmaceutical company that has carved a niche in the healthcare industry. The company’s expertise lies in manufacturing sanitary pads and energy powder, as well as trading a diverse range of pharmaceutical products. With a strong commitment to improving the well-being of individuals worldwide, Medistep Healthcare has become a trusted name in the market, known for delivering high-quality products and exceptional customer service.

The company specializes in trading high-quality pharmaceutical products and is dedicated to excellence and delivering innovative healthcare solutions. Medistep Healthcare has established itself as a reputable player in the pharmaceutical industry.

Mission

Medistep Healthcare’s mission is to enhance the quality of life by offering a diverse range of top-notch pharmaceutical products while maintaining the highest standards of ethics, quality, and customer satisfaction. The company also aims to achieve a turnover of INR 250 crore from business operations by the end of FY 2030, set a new benchmark in quality and services, and uphold its reputation for quality and safety.

Vision

The company’s vision is to become a preferred pharmaceutical company in India with leadership in quality, market share, and profit by cultivating a high-performance culture. Furthermore, Medistep Healthcare aspires to become a global leader in providing affordable and accessible healthcare solutions, thereby improving the well-being of communities worldwide.

Commitment

Medistep Healthcare is committed to developing unique steps by reinforcing its capabilities to operate across diverse geographies through the timely development of resources and systems.

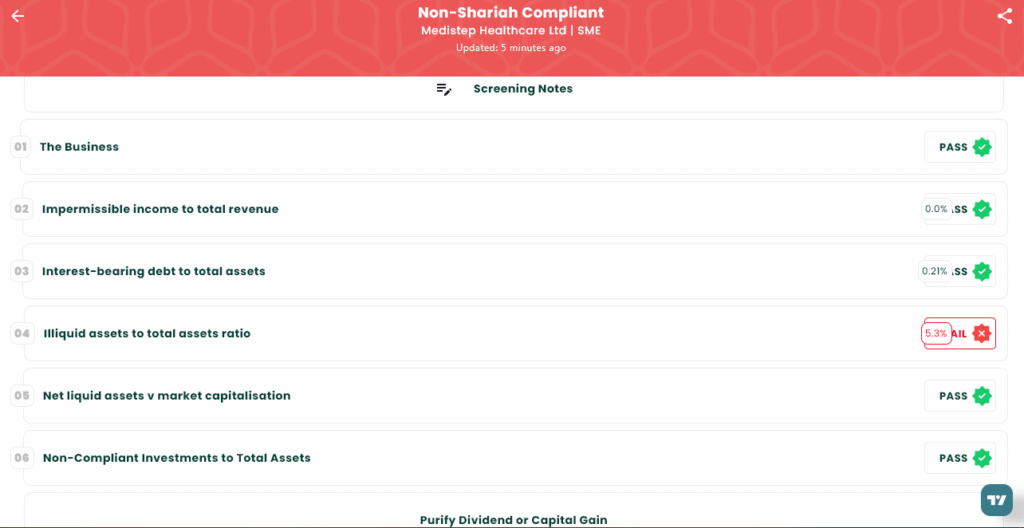

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 8, 2025 |

| IPO Close Date | Tue, Aug 12, 2025 |

| Tentative Allotment | Wed, Aug 13, 2025 |

| Initiation of Refunds | Thu, Aug 14, 2025 |

| Credit of Shares to Demat | Thu, Aug 14, 2025 |

| Tentative Listing Date | Mon, Aug 18, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 12, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 6,000 | ₹2,58,000 |

| Individual investors (Retail) (Max) | 2 | 6,000 | ₹2,58,000 |

| HNI (Min) | 3 | 9,000 | ₹3,87,000 |

Financials

While the company’s revenue and profit after tax showed growth, other financial indicators are troubling. The total income rose from ₹39.08 crore to ₹49.66 crore, and profit after tax increased from ₹3.33 crore to ₹4.14 crore, which are positive signs. However, a closer look at the balance sheet reveals some problematic trends. Reserves and surplus decreased significantly, falling from ₹6.79 crore to ₹6.37 crore, which is a negative indicator of the company’s financial health. Additionally, total borrowing nearly doubled, jumping from ₹0.33 crore to ₹0.64 crore, which could suggest a growing reliance on debt to finance operations or expansion. The substantial increase in borrowing and the decline in reserves raise doubts about the company’s long-term financial stability despite the reported growth in revenue and profit.

KPI

| KPI | Values |

|---|---|

| ROE | 29.06% |

| ROCE | 38.91% |

| RoNW | 29.06% |

| PAT Margin | 8.35% |

| EBITDA Margin | 11.27% |

| Price to Book Value | 2.67 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.