Table of Contents

1. IPO Snapshot

Monolithisch India Ltd is coming up with its initial public offering (IPO) on the SME platform. The IPO aims to raise capital for business expansion, working capital requirements, and general corporate purposes.

Here are the key details:

- Ticker Code: MONOLITH

- IPO Open Date: June 12, 2025

- IPO Close Date: June 16, 2025

- Issue Size: ₹82.02 crore

- Price Band: ₹135 to ₹143 per share

- Lot Size: 1000 shares

- Minimum Investment: ₹135,000

- Listing Exchange: NSE SME

2. Company Overview

Monolithisch India Ltd is involved in the manufacturing and supply of specialized refractory materials and industrial products. These products are essential in high-temperature industrial applications, particularly in sectors like steel, cement, and glass manufacturing.

The company focuses on producing high-quality refractory castables, precast shapes, and other related products. These materials are designed to withstand extreme heat and mechanical stress, playing a crucial role in maintaining the operational efficiency and safety of industrial furnaces and kilns.

Monolithisch operates with a customer-centric approach and emphasizes quality assurance and continuous innovation. It has built long-term relationships with its clients by offering reliable solutions tailored to specific industrial needs.

The company is also committed to sustainability and responsible production methods. With a dedicated research and development team, Monolithisch strives to enhance product performance and durability. The team continuously works on new compositions and technologies to meet the evolving demands of the industry.

3. Grey Market Premium (GMP)

As of the latest data, the GMP for Monolithisch India Ltd is hovering around ₹36. This suggests a moderate level of investor interest in the grey market ahead of listing.

While GMP is not a guaranteed indicator of listing gains, it can help investors gauge early market sentiment. It is important to note that GMP figures fluctuate based on market conditions and should be viewed with caution.

4. Shariah Compliance Status

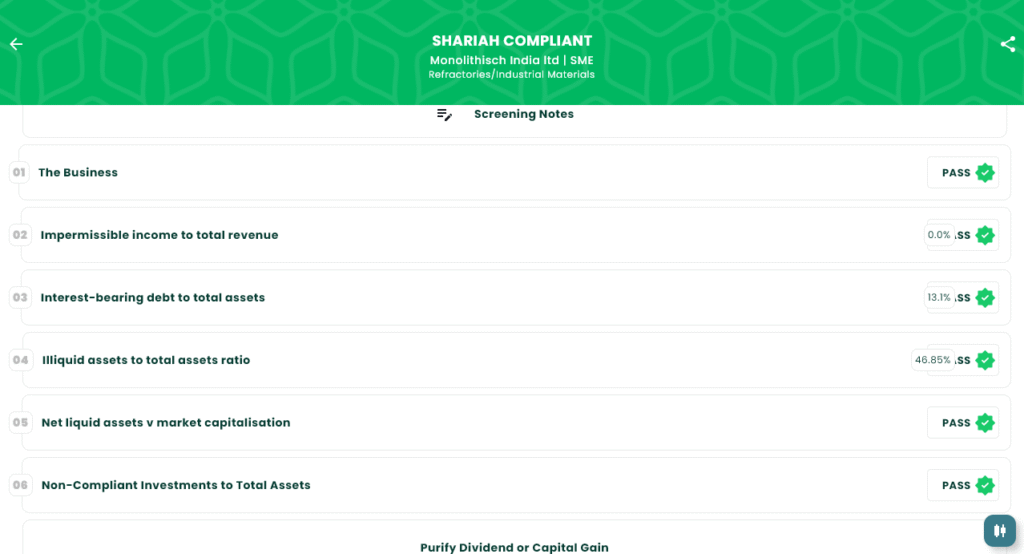

According to the IslamicStock app, Monolithisch India Ltd is Shariah compliant. The screening covers both financial and business-related aspects.

Key highlights include:

- The core business is halal and permissible.

- Impermissible income to total revenue is less than 5 percent.

- Interest-bearing debt to total assets is less than 33 percent.

- Illiquid assets to total assets ratio is more than 20 percent.

- Non-compliant investments to total assets is less than 33 percent.

- Net liquid assets to market capitalisation test is also passed.

A note from the screening mentions that interest-free borrowings of ₹11.12 lakhs from related parties have been excluded from the total interest-bearing debt. This detailed breakdown adds transparency and confirms that Monolithisch India Ltd is suitable for Shariah-conscious investors.

5. Subscription Status

As per the latest updates available, the IPO has received positive investor response:

- Retail Investors: Fully subscribed within the early hours

- HNI Investors: Steady demand building

- Overall Subscription: Expected to be oversubscribed based on current momentum

Investors are advised to follow official updates for final subscription figures.

6. Final Thoughts

Monolithisch India Ltd is entering the SME space with a focused product offering in the industrial materials segment. The company’s business is rooted in essential industries and supported by strong technical knowledge and customer loyalty.

The IPO is reasonably priced for a niche manufacturer catering to high-demand sectors. It has received Shariah compliance clearance and is already showing signs of strong investor interest in the grey market.

However, as with any SME IPO, there are risks associated with limited scale, liquidity concerns, and volatility on listing day. Conservative and long-term investors should review the red herring prospectus and assess alignment with their risk profile before investing.

7. Disclaimer

This article is for informational purposes only and does not constitute investment advice. Please read the red herring prospectus and consult your financial advisor before making any investment decisions. Investing in SME IPOs carries market risks. As per SEBI regulations, investors should make informed decisions after understanding all associated risks.