Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Nanta Tech Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Nanta Tech Ltd

Industry: Technology

Listing At: BSE SME

Overview

Nanta Technology is engaged in the business of supplying, installation, testing and commissioning of Audio Visual (AV) products, Service Robots and IT Networking solutions (i.e., wired/wireless system cabling) which serves different verticals like retail, hospitality, enterprise, educational and infrastructure, among others. Along with Cables and AV, the company is also engaged in the selling of AI based Robots and software. The Company is registered on the Government e-marketplace (GEM) portal.

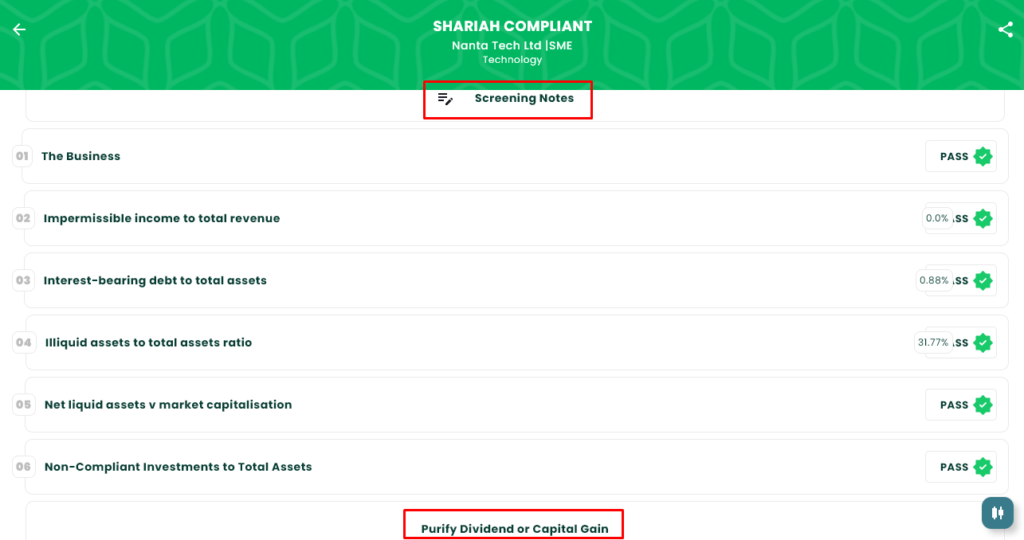

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Dec 23, 2025 |

| IPO Close Date | Dec 26, 2025 |

| Tentative Allotment | Dec 29, 2025 |

| Initiation of Refunds | Dec 30, 2025 |

| Credit of Shares to Demat | Dec 30, 2025 |

| Tentative Listing Date | Dec 31, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Dec 26, 2025 |

Financials

Nanta Tech Ltd. demonstrated strong financial growth between FY24 and FY25. Revenue increased by 93% from ₹26.60 crore to ₹51.24 crore, while profit after tax rose 84% from ₹2.59 crore to ₹4.76 crore. EBITDA grew to ₹6.48 crore from ₹3.90 crore, indicating improved operational efficiency.

The company’s balance sheet strengthened significantly, with total assets doubling from ₹15.54 crore to ₹31.23 crore. Net worth more than doubled from ₹6.06 crore to ₹14.14 crore, while reserves and surplus increased from ₹5.94 crore to ₹10.45 crore. Total borrowings remained minimal at ₹0.50 crore, showing conservative debt management.

In the first half of FY26 (ending September 30, 2025), the momentum continued with total income at ₹21.55 crore and PAT at ₹1.93 crore. Assets grew further to ₹37.35 crore, and net worth reached ₹16.07 crore. This consistent growth reflects the company’s successful expansion in AV products, IT networking, and AI-based robotics solutions.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.