The Indian IPO market continues to offer diverse investment opportunities, and the upcoming Neetu Yoshi Ltd (NEETUYOSHI) IPO is one to watch, especially for those interested in the manufacturing sector, particularly railway safety components. This article aims to give you a clear and easy-to-understand guide, covering its key details, how its subscription is shaping up, what its Grey Market Premium is looking like, and, importantly, its Shariah compliance status.

Making smart investment choices means understanding a company’s business, its financial health, and ethical considerations. Let’s dive into what Neetu Yoshi Ltd brings to the table.

About Neetu Yoshi Ltd: Innovating in Railway Safety Components

Neetu Yoshi Ltd, known by its IPO symbol NEETUYOSHI, is deeply rooted in the manufacturing industry. Their specialty? Railway safety components. This company has shown some impressive growth, tripling its revenue and turning a modest profit into double-digit crore earnings in just one year.

With a solid foundation in manufacturing critical railway safety parts, approval from RDSO (Research Designs & Standards Organisation), and a clear strategy to boost production using funds from this IPO, Neetu Yoshi Ltd seems set for good growth ahead. Their main goal is to enhance the safety and efficiency of railway infrastructure through their specialized components.

Table of Contents

Neetu Yoshi IPO Snapshot: All the Important Details

The Neetu Yoshi Ltd IPO is a BSE SME Bookbuilding issue. Here’s a quick rundown of the key information, based on the tentative schedule:

- IPO Open Date: Friday, June 27, 2025

- IPO Close Date: Tuesday, July 1, 2025

- Issue Price Band: ₹71 to ₹75 per equity share

- Face Value: ₹5 per share

- Sale Type: Fresh Capital

- Total Issue Size: 1,02,72,000 shares, aiming to raise up to ₹77.04 Crore

- Reserved for Market Maker: 5,20,000 shares (up to ₹3.90 Crore), with Nrm Securities Private Limited, R.K. Stock Holding Private Limited, and Choice Equity Broking Private Limited as market makers

- Net Offered to Public: 97,52,000 shares, aggregating up to ₹73.14 Crore

- Minimum Lot Size for Retail Investors: 1,600 Shares, meaning an investment of ₹1,20,000 at the upper price band

- Listing At: BSE SME

- Tentative Allotment Date: Wednesday, July 2, 2025

- Tentative Listing Date: Friday, July 4, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on July 1, 2025

(Source: Chittorgarh IPO Details – Neetu Yoshi IPO)

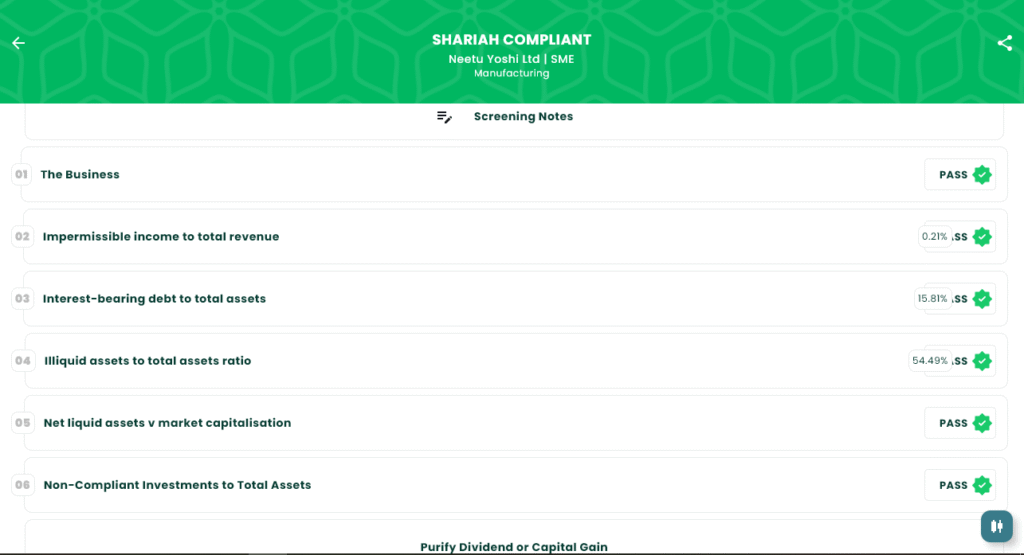

Understanding the Shariah Status of Neetu Yoshi Ltd IPO

For investors who follow Islamic finance principles, ensuring an investment is Shariah-compliant is incredibly important. This means checking that the company’s business activities and financial ratios align with Islamic law.

We’re pleased to report that after a thorough screening, the Shariah status for Neetu Yoshi Ltd is classified as “SHARIAH COMPLIANT.”

Here’s why it passes the screening:

- The Business: Passes (no impermissible activities identified).

- Impermissible Income to Total Revenue: Passes, as it’s below the acceptable threshold.

- Interest-bearing Debt to Total Assets: Passes, well within the limits.

- Illiquid Assets to Total Assets Ratio: Passes, indicating a healthy proportion of tangible assets.

- Net Liquid Assets vs Market Capitalisation: Passes.

- Non-Compliant Investments to Total Assets: Passes.

The screening notes highlight that Neetu Yoshi Ltd has shown excellent financial growth and has a clear plan for expansion. This robust financial standing, combined with its permissible business activities and healthy financial ratios, makes it a Shariah-compliant investment.

IPO Subscription Status: What the Numbers Say

The subscription status gives us a peek into how much demand there is for the shares from different types of investors: big institutions (QIBs), high-net-worth individuals (NIIs), and everyday retail investors (RIIs).

As of June 27, 2025, at around 05:00 PM (Day 1), here’s how the Neetu Yoshi IPO Subscription Status (Bidding Detail) stands:

- QIB (Qualified Institutional Buyers): 0.00 times subscribed

- NII (Non-Institutional Investors): 0.58 times subscribed

- Retail Individual Investors (RII): 0.91 times subscribed

- Total Subscription: 0.58 times

- Total Applications: 2,565

(Source: Chittorgarh IPO Subscription – Neetu Yoshi)

On its first day, the IPO is currently undersubscribed overall. Retail investors have shown the most interest, subscribing 91% of their allotted portion. It will be interesting to watch how these numbers evolve over the remaining bidding days as more investors participate.

Grey Market Premium (GMP) Insights

The Grey Market Premium (GMP) is an unofficial, speculative price at which IPO shares trade even before they officially list on the stock exchange. It’s essentially an early, unofficial sign of what the market thinks the shares might be worth, showing how much extra (or less) investors are willing to pay compared to the IPO’s issue price in this unofficial market.

For the Neetu Yoshi Ltd IPO, the current GMP is:

- Neetu Yoshi IPO GMP Today (as per image): ₹24

- Expected Listing Price (Upper Band + GMP): ₹75 (Upper Price Band) + ₹24 (GMP) = ₹99

- Expected % Gain/Loss: (₹24 / ₹75) * 100% = 32.00%

Important Note: Remember, GMP is not official or regulated. It’s highly speculative and can change very quickly based on news, market mood, and other factors. Treat it as a very rough guide, not a guarantee of how the shares will perform when they list. Always make your investment decisions based on solid research into the company’s fundamentals, its financial health, and the broader market conditions.

Making an Informed Investment Decision

Deciding whether to invest in an IPO like Neetu Yoshi Ltd’s requires careful thought. Here are some things potential investors should consider:

- Company Fundamentals: Look closely at Neetu Yoshi’s business model, how well it’s been performing financially, its plans for growth, and how it stands against competitors in the railway safety components manufacturing sector.

- Industry Outlook: Think about the future prospects of the railway infrastructure and manufacturing industries. Are there new projects, government initiatives, or technological advancements that could benefit the company?

- IPO Valuations: Compare the IPO’s price band to similar companies in the market to see if it offers a fair valuation, considering its growth potential.

- Risk Factors: Read the company’s Red Herring Prospectus (RHP) to understand any specific risks, such as market competition or supply chain challenges.

- Shariah Compliance: For those strictly adhering to Shariah principles, the “SHARIAH COMPLIANT” status is a significant positive, indicating that the company’s core business and financials align with Islamic guidelines.

Disclaimer

This article is for informational and educational purposes only and should not be taken as financial advice. Investing in IPOs always comes with risks, and there’s no promise of returns. We strongly recommend that you do your own thorough research, talk to a SEBI-registered financial advisor, and carefully read the Red Herring Prospectus (RHP) before making any investment decisions.

Ready to explore more Shariah-compliant investments?

To learn more about IPOs, get detailed company analyses, and find Shariah-compliant investment options, visit our website at IslamicStock Website, dive into insightful articles on our blog at IslamicStock Blog, and download our application, IslamicStock, for in-depth screenings and investment guidance tailored for you.