Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Nilachal Carbo Metalicks Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Nilachal Carbo Metalicks Ltd

Industry: Trading & Distributors

Listing At: BSE SME

Overview:

Established in 2003, Nilachal Carbo Metalicks Limited has become a specialized manufacturer of high-quality, low-sulfur metallurgical coke, including FAP grade Ultra & Low Phosphorus–Low Ash Metallurgical Coke. The company’s vision is to be a leading provider of sustainable coke products, driving innovation and fostering environmental stewardship, while its mission is to deliver superior coke through eco-friendly practices. With a focus on quality, safety, and sustainability, the company is committed to customer satisfaction and a greener future.

Since its inception, the company has shown steady growth in both production capacity and financial performance. In the fiscal year 2003-04, commercial production began with a single battery of 32 ovens, an annual capacity of 20,000 metric tons (MT), and a turnover of ₹16.58 crores. By 2005-06, a second battery was installed, doubling the capacity to 40,000 MT per annum (MTPA) and increasing turnover to ₹35.42 crores. The expansion continued, with a third battery added in 2010-11, bringing the total capacity to 60,000 MTPA and pushing turnover to ₹111.02 crores. In 2021-22, the company strategically augmented its capacity to 84,000 MTPA through a conversion arrangement for a fourth battery. This growth was reflected in a turnover of ₹199.19 crores. By 2022-23, Nilachal Carbo Metalicks expanded into the Southern India market by leasing a plant with an 18,000 MTPA capacity, bringing its total annual capacity to 1,02,000 MT. The turnover for that year reached ₹266.21 crores.

The company’s main facility is located in Chadheidhara, Jajpur, Odisha, and operates three non-recovery, Bee Hive-type coke oven batteries with a production capacity of 60,000 MTPA. An additional 42,000 MTPA capacity is managed through tolling arrangements in Odisha and Andhra Pradesh. Looking ahead, the company plans to expand its Jajpur plant by 48,000 MT with two new coke plants, which would increase its total capacity to 150,000 MTPA. Furthermore, the company plans to add a battery with 36 ovens at its Baramana, Jajpur plant, boosting its LAM Coke capacity by 34,400 MTPA to 94,400 MTPA, for a total of 1,12,400 MTPA, including leased capacity. As of July 5, 2025, the company has 65 employees.

Nilachal Carbo Metalicks Limited is dedicated to sustainability and has implemented notable environmental initiatives. Since fiscal year 2021-22, the company has achieved zero usage of groundwater for production. It has developed an innovative method of drawing water from an abandoned stone quarry through a dedicated 2 km pipeline, ensuring a long-term, sustainable water source for its cooling processes, which require over 50,000 kiloliters of water daily. The company has also demonstrated its commitment to the environment by planting more than 1,500 grown trees within and around its plant premises. In fiscal year 2024-25, the company developed a niche product: Ultra Low Phosphorus (ULP) Coke, which serves as an import substitute.

The company’s product portfolio includes Foundry Grade Coke, Ferro Alloys Grade LAM Coke (Nut Coke), Blast Furnace Grade Coke, and Coke Fines. These products cater to various industrial applications, including melting metals in foundries, ferro-alloy production, and iron production in blast furnaces. The high-carbon, low-phosphorus Coke Fines are also used in iron ore pellets, sintering, and steel melting. The company attributes its competitive strengths to its strategic location, an experienced management team, and a commitment to producing high-quality coke. It has also established a strong customer base, operates its own fleet for Just-In-Time (JIT) delivery, and maintains flexible operations to meet specific customer requirements.

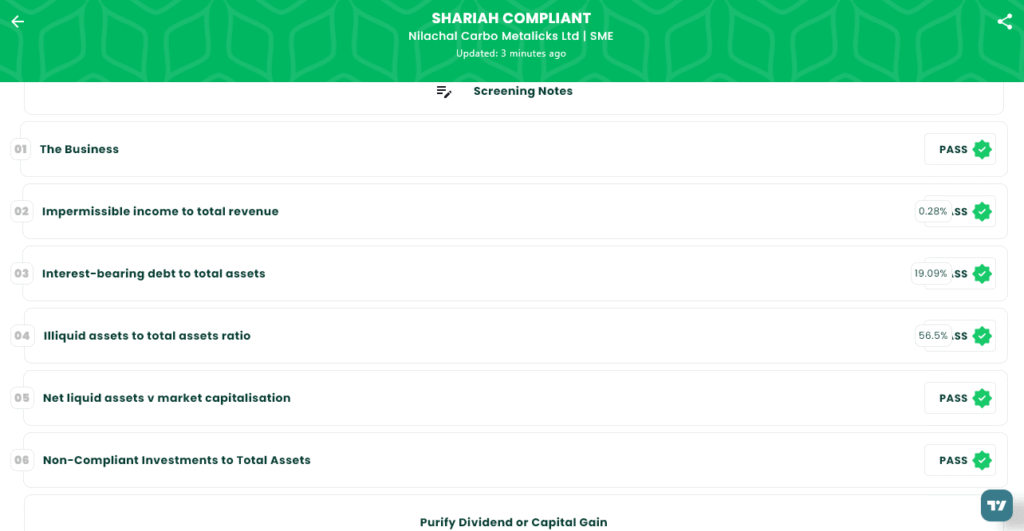

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 8, 2025

- IPO Close Date: Wednesday, September 11, 2025

- Tentative Allotment: Thursday, September 12, 2025

- Initiation of Refunds: Monday, September 15, 2025

- Credit of Shares to Demat: Monday, September 15, 2025

- Tentative Listing Date: Tuesday, September 16, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 11, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,72,000 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,72,000 |

| HNI (Min) | 3 | 4,800 | ₹4,08,000 |

Financials

Nilachal Carbo Metalicks Ltd. experienced a decline in its performance from March 2023 to March 2025. The company’s total income saw a steady decrease, dropping from ₹268.46 crore in March 2023 to ₹202.79 crore in March 2025. This income drop was particularly steep between March 2024 and March 2025. Despite the fall in income, the company’s Profit After Tax (PAT) remained relatively stable, fluctuating between ₹14.02 crore and ₹15.82 crore. The company’s assets and net worth have shown consistent growth over the three-year period, with assets growing from ₹93.22 crore to ₹123.34 crore and net worth increasing from ₹48.46 crore to ₹78.30 crore. Reserves and surplus also grew steadily, indicating that the company is retaining more of its profits. Total borrowing, after increasing from March 2023 to March 2024, slightly decreased by March 2025. The company’s EBITDA, or earnings before interest, taxes, depreciation, and amortization, has fluctuated but ended higher in March 2025 than it was in March 2024.

KPI

| KPI | Value |

| ROE | 17.90% |

| ROCE | 22.74% |

| Debt/Equity | 0.30 |

| RoNW | 17.90% |

| PAT Margin | 6.96% |

| EBITDA Margin | 13.46% |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.