Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Orkla India Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Orkla India Ltd

Industry: Agricultural Food & other Products

Listing At: NSE & BSE (Mainboard)

Orkla India: Heritage Brands, Modern Solutions

About Orkla India

Orkla India is a collection of iconic heritage Indian brands dedicated to serving all meal occasions with diverse, high-quality offerings. The company brings together three distinguished brands:

- MTR

- Eastern

- Rasoi Magic

Product Portfolio

The portfolio encompasses:

- Spices and Masalas

- Ready to Eat Sweets

- Breakfast mixes

- 3-minute range

- And many more

Organizational Structure

Corporate Office

Bangalore

Business Units

- MTR — Heritage brand offerings

- Eastern — Regional specialties

- International Business — Global reach across 42 countries serving local and migrant Indian populations

Parent Company

Orkla ASA — Industrial investment company based in Oslo, Norway

- One of 10 portfolio companies under Orkla ASA

- Listed on the Oslo Stock Exchange

Vision

“At Orkla India, we envision being your trusted friend in everyday life, through our products with authentically crafted recipes that blend tradition and innovation.”

Mission

“Our mission at Orkla India is to improve everyday life by providing enjoyable and sustainable local brands. Exceptional taste and convenience drive our product design.”

Core Values

| Value | Description |

|---|---|

| BRAVE | The value essential for driving us forward and compelling us to take necessary risk |

| TRUSTWORTHY | Sits at the core of how we behave and act; we build our relationships on trust |

| INSPIRING | Brings out the best in us; fuels our engagement and commitment |

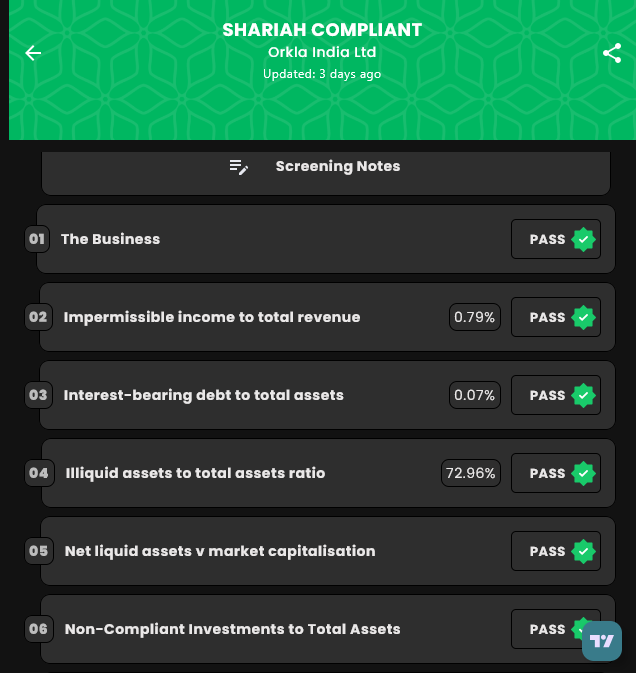

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Oct 29, 2025 |

| IPO Close Date | Fri, Oct 31, 2025 |

| Tentative Allotment | Mon, Nov 3, 2025 |

| Initiation of Refunds | Tue, Nov 4, 2025 |

| Credit of Shares to Demat | Tue, Nov 4, 2025 |

| Tentative Listing Date | Thu, Nov 6, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Fri, Oct 31, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 20 | ₹14,600 |

| Retail (Max) | 13 | 260 | ₹1,89,800 |

| S-HNI (Min) | 14 | 280 | ₹2,04,400 |

| S-HNI (Max) | 68 | 1,360 | ₹9,92,800 |

| B-HNI (Min) | 69 | 1,380 | ₹10,07,400 |

Financials

Orkla India Ltd. reported modest growth between the financial years ending March 31, 2024 and March 31, 2025. Total income rose to ₹2,455.24 crore in FY2025 from ₹2,387.99 crore in FY2024, an increase of about 3%. Profit after tax (PAT) improved to ₹255.69 crore in FY2025, up 13% from ₹226.33 crore a year earlier, reflecting stronger bottom‑line performance. EBITDA increased to ₹396.44 crore (FY2025) from ₹343.61 crore (FY2024), indicating healthier operating profitability. Net worth slightly declined to ₹1,853.47 crore as of March 31, 2025 from ₹2,201.48 crore a year earlier, while reserves and surplus stood at ₹2,445.80 crore. Total assets were ₹3,171.30 crore at March 31, 2025, broadly stable year‑on‑year. Borrowings remained minimal at ₹3.77 crore in FY2025. Interim six‑month figures to June 30, 2025 show assets of ₹3,158.20 crore, total income of ₹605.38 crore and PAT of ₹78.92 crore, suggesting continued steady performance into the new fiscal period.

KPI

| KPI | Values |

|---|---|

| ROCE | 32.7% |

| RoNW | 13.8% |

| PAT Margin | 10.70% |

| EBITDA Margin | 16.60% |

| Price to Book Value | 5.40 |

| Market Capitalization | 10000.21 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.