Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Shivashrit Foods Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Shivashrit Foods Ltd

Industry: Packaged Foods

Listing At: NSE SME

Overview:

Established in 2017, Shivshrit is a leading manufacturer and exporter of premium-quality potato flakes based in Aligarh, Uttar Pradesh, India. The company operates a dedicated potato processing and manufacturing facility in Aligarh, equipped with advanced machinery sourced from top European and Indian OEMs. This facility, capable of processing 28.8 metric tons of potatoes per day, underscores a commitment to innovation, operational excellence, and sustainability.

Shivshrit operates on a B2B model, supplying its products to industrial clients in the food and snacks industry, both domestically and internationally. In addition, the company is now expanding into the B2C segment, targeting the retail market through e-commerce channels with its brand, Shree Aahar. Their mission is to exceed industry standards by consistently delivering high-quality products and fostering strong client relationships.

The company’s journey began with the recognition of an opportunity for high-quality processed potato flakes. A state-of-the-art manufacturing facility was established in 2018. By 2019, they achieved an initial production capacity of over 4,000 metric tons per annum (MTPA). To enhance credibility, Shivshrit obtained ISO certification in 2021 and HALAL certification in 2022, the same year they fulfilled their first export order. In 2023-24, the company expanded its processing line, increasing production capacity to over 8,000 MTPA to meet growing demand. This expansion led to a doubling of export sales, a transition from a Private Limited to a Limited company, and a venture into the retail market.

Shivshrit’s global reach extends to numerous countries, including Argentina, Lebanon, Brasil, Malaysia, Chile, Mexico, Dubai, Turkey, Indonesia, Uruguay, Isreal, USA, and Kuwait, alongside its strong domestic market presence.

Shariah Status

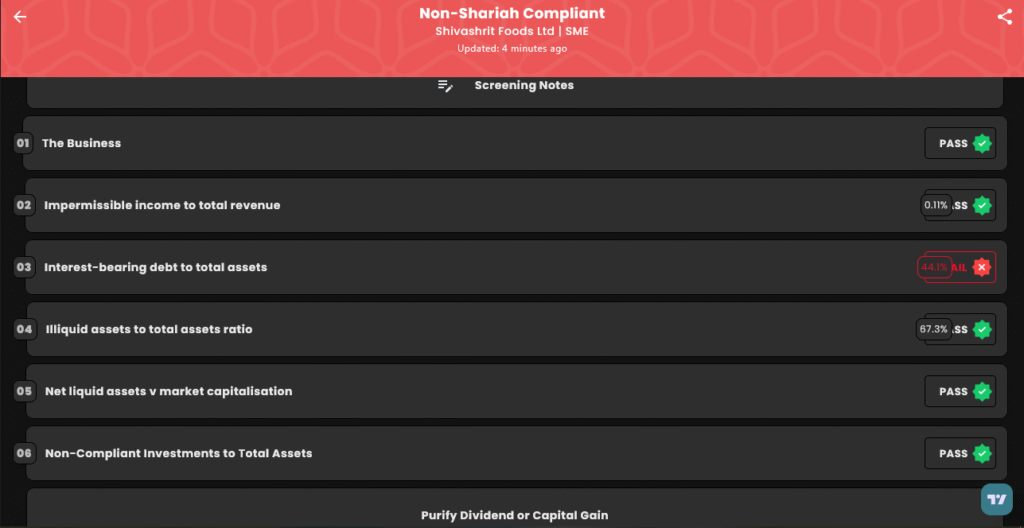

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 22, 2025 |

| IPO Close Date | Tue, Aug 26, 2025 |

| Tentative Allotment | Thu, Aug 28, 2025 |

| Initiation of Refunds | Thu, Aug 28, 2025 |

| Credit of Shares to Demat | Fri, Aug 29, 2025 |

| Tentative Listing Date | Mon, Sep 1, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 26, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,000 | ₹2,84,000 |

| Individual investors (Retail) (Max) | 2 | 2,000 | ₹2,84,000 |

| S-HNI (Min) | 3 | 3,000 | ₹4,26,000 |

| S-HNI (Max) | 7 | 7,000 | ₹9,94,000 |

| B-HNI (Min) | 8 | 8,000 | ₹11,36,000 |

Financials

Shivshrit Foods Ltd.’s performance between the fiscal years ending March 31, 2024, and March 31, 2025, presents a concerning picture despite a reported revenue increase. While the company’s total income grew by a notable 36%, this top-line expansion failed to translate into a comparable improvement in profitability. A mere 4% rise in Profit After Tax (PAT) suggests significant operational inefficiencies or surging costs that are eating into the company’s margins.

A closer look at the balance sheet reveals a substantial increase in Total Borrowing, which climbed from 36.97 crore to 47.96 crore. This heavy reliance on debt to fuel growth raises serious questions about the sustainability of the company’s business model and could expose it to greater financial risk. The modest increase in PAT, coupled with the aggressive accumulation of debt, indicates that the company’s growth is leveraged, rather than being driven by organic, profitable operations. This disparity points to potential future challenges in managing debt service and maintaining financial stability.

KPI

| KPI | Values |

|---|---|

| ROE | 42% |

| ROCE | 42.73% |

| Debt/Equity | 1.39 |

| RoNW | 34.85% |

| PAT Margin | 11.51% |

| EBITDA Margin | 22.06% |

| Price to Book Value | 1.91 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.