Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Parth Electricals & Engineering Ltd (PARTH), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Parth Electricals & Engineering Ltd (PARTH)

Company Name: Parth Electricals & Engineering Ltd

Industry: Electrical Equipment

Listing At: NSE SME

Overview:

Parth Electricals has been delivering quality products and services in the power sector since 2005. Starting as a service provider, they became a private limited company in 2007 and established a state-of-the-art manufacturing facility in 2009, equipped with advanced Japanese machinery and a modern powder coating plant by 2010. With a strong team, robust infrastructure, and seamless coordination, they have consistently achieved key milestones, contributing to major installation, commissioning, and electrification projects across India.

Their vision is to be a preferred and reliable supplier and service provider in power transmission and distribution. They continue to invest in expanding our product range and capabilities, committed to exceeding customer expectations and driving mutual growth.

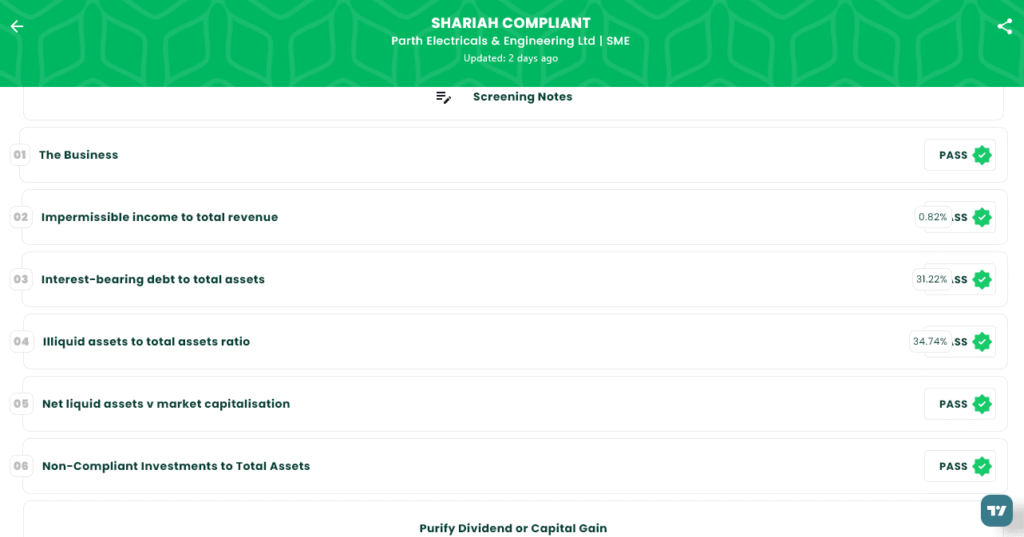

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 4, 2025 |

| IPO Close Date | Tue, Aug 6, 2025 |

| Tentative Allotment | Wed, Aug 7, 2025 |

| Initiation of Refunds | Thu, Aug 8, 2025 |

| Credit of Shares to Demat | Thu, Aug 8, 2025 |

| Tentative Listing Date | Fri, Aug 11, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 6, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 1,600 | ₹2,72,000 |

| Individual investors (Retail) (Max) | 2 | 1,600 | ₹2,72,000 |

| S-HNI (Min) | 3 | 2,400 | ₹4,08,000 |

| S-HNI (Max) | 7 | 5,600 | ₹9,52,000 |

| B-HNI (Min) | 8 | 6,400 | ₹10,88,000 |

| Employee (Min) | 2 | 1,600 | ₹2,72,000 |

| Employee (Max) | 1 | 800 | ₹1,36,000 |

Financials

Based on the financial summary for Parth Electricals & Engineering Ltd., the company has demonstrated robust growth across a three-year period. The data reveals a significant increase in key financial indicators, with revenue soaring by 102% and profit after tax (PAT) rising by 119% between the fiscal years ending March 31, 2024, and March 31, 2025. Furthermore, the company’s assets, total income, EBITDA, and net worth have all shown consistent upward trends, indicating strong operational performance and effective financial management. The increase in total borrowing is also noted, yet the growth in reserves and surplus suggests a healthy and expanding financial position.

KPI

| KPI | Values |

|---|---|

| ROE | 24.92% |

| ROCE | 23.38% |

| Debt/Equity | 0.82 |

| RoNW | 24.92% |

| PAT Margin | 5.79% |

| EBITDA Margin | 10.04% |

| Price to Book Value | 4.13 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.