Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Repono Ltd IPO (REPONO), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

- What is Shariah Compliance?

- Analyzing Shree Refrigerations Ltd IPO (SHREEREF)

- Shariah Status

- IPO Timeline (Tentative Schedule)

- Lot Size

- Financials

- KPI

- Grey Market Premium (GMP)

- LINKS

- SEBI Disclaimer

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Repono Ltd IPO (REPONO)

Company Name: Repono Ltd

Industry: Logistics Solution Provider

Listing At: BSE SME

Overview From Company’s Website:

Repono Limited is a company specialized in offering warehousing services for varied industries across India.

Our company holds an independent strategic business unit that provides Warehousing services for industries as diverse as Petrochemicals, Oil & Gas, Lube Oil, and Speciality Chemical Industry.

We are an experienced company having the expertise and experience in providing prompt, reliable, and affordable services to clients. Apart from our core services of Warehousing, we also provide secondary transportation & logistic support to provide our clients seamless end to end solution.

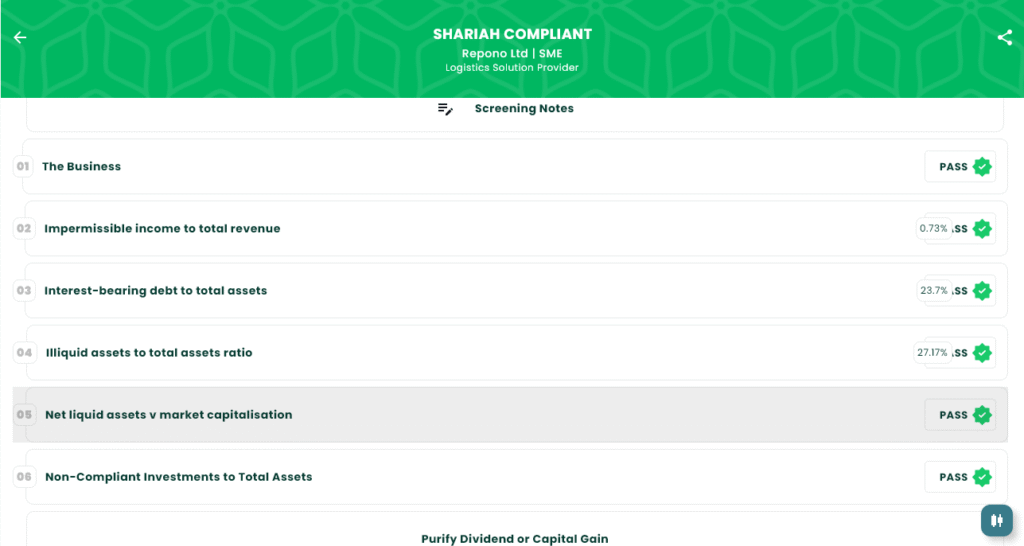

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Mon, Jul 28, 2025 |

| IPO Close Date | Wed, Jul 30, 2025 |

| Tentative Allotment | Thu, Jul 31, 2025 |

| Initiation of Refunds | Fri, Aug 1, 2025 |

| Credit of Shares to Demat | Fri, Aug 1, 2025 |

| Tentative Listing Date | Mon, Aug 4, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 30, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,30,400 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,30,400 |

| S-HNI (Min) | 3 | 3,600 | ₹3,45,600 |

| S-HNI (Max) | 8 | 9,600 | ₹9,21,600 |

| B-HNI (Min) | 9 | 10,800 | ₹10,36,800 |

Financials

Repono Ltd. showed strong financial growth in FY 2025. Its revenue rose by 51% to ₹51.59 crore from ₹34.14 crore in FY 2024. Profit After Tax also increased by 23%, reaching ₹5.15 crore from ₹4.18 crore. Assets grew to ₹25.87 crore, while EBITDA improved to ₹8.13 crore from ₹6.04 crore. The company’s net worth rose from ₹9.07 crore to ₹14.22 crore. Reserves and surplus slightly increased to ₹6.72 crore. However, total borrowing also went up to ₹6.13 crore from ₹3.54 crore. Overall, the financials reflect a healthy year-on-year performance across key metrics.

KPI

| KPI | Values |

|---|---|

| ROE | 44.22% |

| ROCE | 38.39% |

| Debt/Equity | 0.43 |

| RoNW | 36.21% |

| PAT Margin | 10.07% |

| EBITDA Margin | 15.91% |

| Price to Book Value | 5.06 |

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Repono Ltd IPO is currently ₹21, representing 21.88% premium over the issue price.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.