The infrastructure and logistics sectors are the very backbone of economic development, facilitating movement and building foundational structures that drive progress. For discerning investors, understanding the intricate operations and financial health of companies within these domains is crucial. This comprehensive analysis will delve into the Savy Infra and Logistics Ltd. IPO, meticulously examining its business model, financial performance, the specifics of its public offering, and, critically, its Shariah compliance status.

Table of Contents

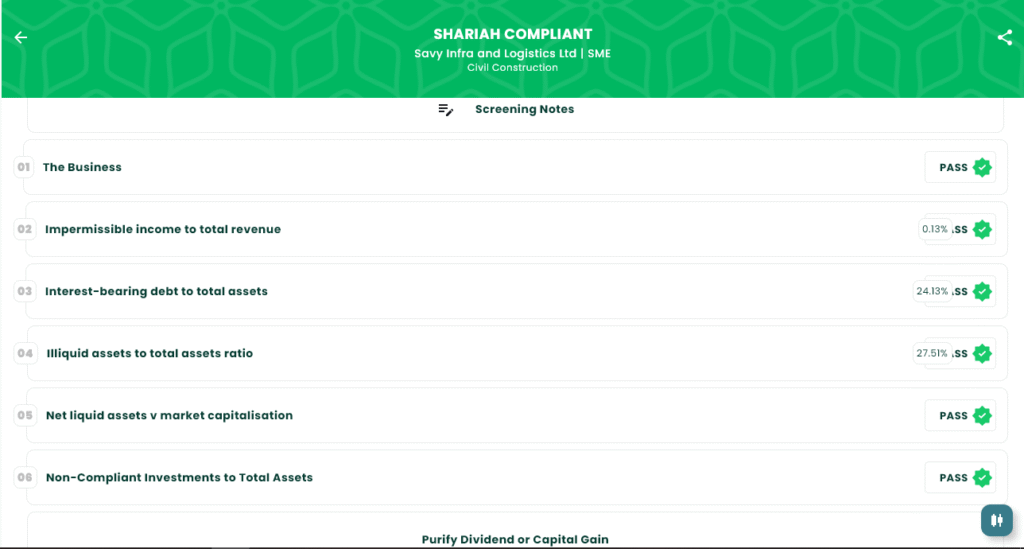

Crucial Shariah Status

For investors whose financial principles are anchored in Islamic Shariah, the adherence of an investment to these guidelines is a non-negotiable prerequisite. Following a rigorous screening process, Savy Infra and Logistics Ltd. is definitively categorized as Shariah Compliant.

The company’s core business operations, focused on earthwork, foundation preparation, and logistics services for infrastructure projects, align completely with Shariah principles.

Therefore, for Muslim investors seeking ethically sound and permissible investment avenues, the Savy Infra and Logistics Ltd. IPO presents itself as a fully compliant and attractive opportunity.

Valuable Screening Notes for Our Users

The company has experienced extraordinary growth over the three-year period. Assets have surged dramatically from ₹10.10 Crore in 2023 to ₹185.81 Crore in 2025. Similarly, revenue skyrocketed from a mere ₹6.19 Crore to ₹283.77 Crore, indicating a significant expansion in business operations.

Profit After Tax shows an impressive leap from ₹0.34 Crore to ₹23.88 Crore. EBITDA also saw substantial growth, increasing from ₹0.57 Crore to ₹35.62 Crore, reflecting improved profitability. Net Worth grew from ₹0.64 Crore to ₹52.25 Crore, and Reserves and Surplus followed a similar upward trend. While Total Borrowing increased from ₹3.12 Crore to ₹44.84 Crore, this growth is accompanied by massive increases in assets and revenue, suggesting strategic investments.

About Savy Infra and Logistics Ltd.: Building Foundations, Connecting Futures

Established in January 2006, Savy Infra and Logistics Limited has carved a significant niche as an EPC (Engineering, Procurement, and Construction) company, specializing in the foundational stages of large-scale infrastructure projects. Their expertise spans critical earthwork and meticulous foundation preparation, essential for the successful execution of diverse undertakings, from expansive road networks to robust embankments, precise sub-grade preparation, and durable surface paving. The company’s commitment extends beyond construction, integrating sophisticated logistics solutions to offer a holistic service portfolio.

Savy Infra and Logistics Limited offers a diversified line of services in Infrastructure and Transportation. The company is in the race of becoming a market leader, dealing majorly in Logistics and EPC work.

- Comprehensive Infrastructure Specialization: Savy Infra and Logistics excels in providing a diversified line of services within the infrastructure domain. This includes comprehensive earthwork solutions, ranging from initial ground preparation to the intricate processes required for road construction and large embankments. They also offer specialized services like demolition, ensuring the safe and efficient dismantling of existing structures to pave the way for new developments. The company has expertise in Civil, EPC, and earthwork services which involves moving and shaping large volumes of soil and other materials, creating a strong and reliable base for buildings, roads, or other infrastructure work for clients in the infrastructure, Mining, and Steel sectors. Additionally, their services also cover demolition where they safely and efficiently dismantle existing structures to clear space for new projects. Expertise includes construction and civil tasks such as paving, grading, earthwork and water, sewer and drainage replacement and connections, demolition, repair, and debris removal. They undertake constructions of Roads, culverts, cross drains, embankments of roads, sub-grade tops, granular sub bays & bituminous/concrete tops. They are involved in Hard Rock Excavation, Blasting, and Soil excavation work and have completed many projects Excavations for Infra and Mining Projects in extreme working conditions.

- Specialized Equipment and Techniques: The company’s operational capabilities are bolstered by its strategic approach to equipment. They expertly rent and deploy advanced machinery like rock breakers and heavy excavators, crucial for extensive excavation work. Their services further encompass vital aspects like shoring, strutting, and side protection, alongside efficient slush removal and environmentally responsible disposal of excavated materials. They utilize mechanical excavators for efficient excavation and manage all related processes, such as shoring, strutting, and side protection to prevent collapses and slush removal. They also handle the carting away and disposal of excavated materials.

- Asset-Light, Service-Rich Model: A distinctive feature of Savy Infra and Logistics is its asset-light business model. By primarily renting trucks and drivers, and meticulously managing the execution of transportation, the company offers specialized logistics services without the burden of extensive asset ownership. This strategic approach enhances flexibility and operational efficiency. The company operates an asset-light business model offering specialized services by renting trucks and drivers and managing the execution of transportation.

- Geographical Footprint: Savy Infra and Logistics Limited has successfully executed and completed numerous EPC and logistics projects across a wide geographical expanse within India. Their impressive track record includes significant projects in Gujarat, Maharashtra, Andhra Pradesh, Telangana, Madhya Pradesh, Chhattisgarh, Karnataka, and Odisha, demonstrating their national reach and capability to operate in diverse terrains and regulatory environments.

- Visionary Leadership and Green Logistics: Under the able guidance and vision of Mr. Tilak Mundhra, Savy Infra and Logistics Limited aims to be a leading player in the Logistics Sector, Earthmoving & EPC work, deploying EV Trucks (Green Logistics) thereby providing a clean and sustainable solution to its clients.

- Dedicated Team: As of April 30, 2025, the company is supported by a dedicated team of 33 full-time staff at its various project sites, ensuring efficient on-ground execution and project management.

Competitive Strengths:

- Asset Light Business Model.

- Integrated Business Operations.

- Strong Financial Performance.

- Experienced Promoter and Management Team.

Company Snapshot

Savy Infra and Logistics Ltd. has accomplished over 30 projects.

They have deployed over 100 fleets.

They plan to deploy an additional 150+ EV trucks.

They have over 12 projects under execution, worth ₹89.42 Crores.

Their order book in hand is over ₹240 Crores.

They have a presence in over 4 states: Odisha, Jharkhand, Gujarat, and Andhra Pradesh.

Key Facts

- Over 10,00,000+ cubic meter of earthwork completed.

- Asset light logistics business model.

- Reputed clients like KEC International & Dilip Buildcon.

- Foraying into Green logistics by deploying EV Trucks which are cost effective.

- More than 100 trucks deployed as of now which will be increased to 250+ trucks.

- Long term contracts to be signed with clients on introduction of electric trucks.

- Availability of Carbon credit on deploying EV trucks.

- Ahead of time in terms of new technological adaption.

Infrastructure: Cutting-Edge Infrastructure Powering Progress

Business Facts FY 2023-24:

- 10 lakh cubic meter Excavation Work done.

- 3 lakh+ Tons Logistics handled in Mining Sector.

- 350+ Workers (Mix of Skilled, Unskilled Workers along with Qualified & Experienced Engineers on the site).

- 100+ Trucks Deployed to handle EPC & Logistic Work at Mines & Excavation sites.

Business Facts FY 2024-25:

- 15 lakh cubic meter Proposed Excavation Work to be done.

- 4.5 lakh+ Tons Proposed Logistics to be handled.

- 550+ Workers (Mix of Skilled, Unskilled Workers along with Qualified & Experienced Engineers on the site).

- 250+ Trucks (Incl. 150+ EV Trucks) Deployed to handle EPC & Logistic Work at Mines & Excavation sites.

Transportation Logistics

The company provides Full Truck Load (FTL) services to the clients in the infrastructure, steel and mining sectors.

Their FTL services involve the efficient and reliable movement of large volumes of freight from one location to another, tailored to meet the unique needs of each client.

They ensure point-to-point delivery, meaning that the freight is transported directly from the client’s designated starting location to the final destination without intermediate stops or transfers. This minimizes handling, reduces the risk of damage, and ensures timely delivery.

Excavation & EPC Work

The company has expertise in Civil, EPC, and earthwork services which involves moving and shaping large volumes of soil and other materials, creating a strong and reliable base for buildings, roads, or other infrastructure work for clients in the infrastructure, Mining, and Steel sectors. Additionally, their services also cover demolition where they safely and efficiently dismantle existing structures to clear space for new projects.

The company has a reputation for superior service, efficiency, and safety with extensive experience in earthwork and paving, as well as utility work.

Expertise includes construction and civil tasks such as paving, grading, earthwork and water, sewer and drainage replacement and connections, demolition, repair, and debris removal. Undertaking constructions of Roads, culverts, cross drains, embankments of roads, sub-grade tops, granular sub bays & bituminous/concrete tops.

They are involved in Hard Rock Excavation, Blasting, and Soil excavation work and have completed many projects Excavations for Infra and Mining Projects in extreme working conditions.

They utilize mechanical excavators for efficient excavation and manage all related processes, such as shoring, strutting, and side protection to prevent collapses and slush removal. They also handle the carting away and disposal of excavated materials.

Savy Infra and Logistics Ltd. IPO: Key Details

The Initial Public Offering of Savy Infra and Logistics Ltd. is structured as a Bookbuilding IPO. The IPO opened on Monday, July 21, 2025, and is scheduled to close on Wednesday, July 23, 2025. The total issue size is 58,32,000 shares, aggregating up to ₹69.98 Crores. This offering is entirely a Fresh Capital issue.

- IPO Open Date: July 21, 2025 (Monday)

- IPO Close Date: July 23, 2025 (Wednesday)

- Face Value: ₹10 per share

- Issue Price Band: ₹114 to ₹120 per share

- Sale Type: Fresh Capital

- Total Issue Size: 58,32,000 shares (aggregating up to ₹69.98 Crores)

- Reserved for Market Maker: 2,92,800 shares (aggregating up to ₹3.51 Crores)

- Net Offered to Public: 55,39,200 shares (aggregating up to ₹66.47 Crores)

- Issue Type: Bookbuilding IPO

- Listing At: NSE SME

- Tentative Allotment Date: Thursday, July 24, 2025

- Initiation of Refunds: Friday, July 25, 2025

- Credit of Shares to Demat: Friday, July 25, 2025

- Tentative Listing Date: Monday, July 28, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on July 23, 2025

Share Holding Pre Issue: 1,49,76,480 shares.

Share Holding Post Issue: 2,08,08,480 shares.

Lot Size Details:

Individual investors (Retail) (Min): 2 lots, 2,400 shares, ₹2,88,000 amount.

Individual investors (Retail) (Max): 2 lots, 2,400 shares, ₹2,88,000 amount.

S-HNI (Min): 3 lots, 3,600 shares, ₹4,32,000 amount.

S-HNI (Max): 6 lots, 7,200 shares, ₹8,64,000 amount.

B-HNI (Min): 7 lots, 8,400 shares, ₹10,08,000 amount.

Financial Performance: A Snapshot of Savy Infra and Logistics Ltd.

Savy Infra and Logistics Limited has exhibited an extraordinary financial trajectory over the three-year period. Assets have surged dramatically from ₹10.10 Crore in March 2023 to ₹185.81 Crore in March 2025. Similarly, revenue skyrocketed from a mere ₹6.19 Crore to ₹283.77 Crore, indicating a significant expansion in business operations.

- Assets: Increased from ₹10.10 Crores in March 2023 to ₹185.81 Crores in March 2025.

- Revenue: Grew from ₹6.19 Crores in March 2023 to ₹283.77 Crores in March 2025.

- Profit After Tax: Showed a consistent and healthy upward trend, rising from ₹0.34 Crores in March 2023 to ₹23.88 Crores in March 2025.

- EBITDA: Increased significantly from ₹0.57 Crores in March 2023 to ₹35.62 Crores in March 2025.

- Net Worth: Grew considerably from ₹0.64 Crores in March 2023 to ₹52.25 Crores in March 2025.

- Reserves and Surplus: Increased from ₹0.54 Crores to ₹37.27 Crores during the same period.

- Total Borrowing: Increased from ₹3.12 Crores in March 2023 to ₹44.84 Crores in March 2025.

Key Performance Indicator (KPI): Savy Infra and Logistics Ltd.

Key Performance Indicators offer insightful metrics into Savy Infra and Logistics Ltd.’s operational efficiency and valuation as of Monday, March 31, 2025. The market capitalization of the Savy Infra IPO is ₹249.70 Crores.

- ROE (Return on Equity): 76.10%

- ROCE (Return on Capital Employed): 36.69%

- Debt/Equity: 0.86

- RoNW (Return on Net Worth): 45.70%

- PAT Margin: 8.43%

- EBITDA Margin: 12.57%

- Price to Book Value: 3.44

Objects of the Issue: Strategic Deployment of IPO Capital

Savy Infra and Logistics Ltd. intends to strategically utilize the net proceeds generated from this Fresh Issue for the following core objectives:

- Funding working capital requirements of the company: ₹49.00 Crores.

- General Corporate Purposes.

Grey Market Premium (GMP)

As of July 21, 2025, at around 09:00 PM, the Grey Market Premium (GMP) for Savy Infra and Logistics Ltd. IPO is ₹15. This suggests an expected listing price of ₹135 (calculated as the Cap Price of ₹120 + GMP of ₹15). This indicates an expected gain of 12.50% at listing based on the GMP. Please note that GMP is an unofficial indicator that reflects market sentiment and can fluctuate significantly.

Conclusion and Investor Outlook

Savy Infra and Logistics Ltd. presents a compelling investment proposition within the vital infrastructure and logistics sectors. Its strong financial performance, asset-light business model, extensive project experience across multiple states, and a visionary approach towards green logistics position it favorably for future growth. Critically, its confirmed Shariah Compliant status makes it a highly attractive option for Muslim investors.

For all prospective investors, a thorough review of the Red Herring Prospectus (RHP) remains indispensable. This document offers a detailed exposition of the company’s business model, an exhaustive list of risk factors, and its forward-looking strategies. An informed investment decision is always best forged through diligent research, aligned meticulously with individual investment objectives and risk tolerance.

Ready to explore more Shariah-compliant investments?

To learn more about IPOs, access detailed company analyses, and discover Shariah-compliant investment options, we invite you to visit our website at IslamicStock Website, delve into insightful articles on our blog at IslamicStock Blog, and download our application, IslamicStock, for in-depth screenings and personalized investment guidance.

Download IslamicStock on Google Play Store

Download IslamicStock on Apple App Store

Here are some referral links for opening trading accounts:

AngelOne: https://angel-one.onelink.me/Wjgr/92znd9xl

Zerodha: https://zerodha.com/?c=NGT561&s=CONSOLE

SEBI Disclaimer: Investment in securities markets are subject to market risks, read all the related documents carefully before investing. The information provided in this article is for educational and informational purposes only and does not constitute financial advice. Investors should consult with qualified financial professionals before making any investment decisions.