Table of Contents

Scoda Tubes Ltd, a stainless-steel pipes and tubes manufacturer based in India, has launched its Initial Public Offering (IPO). The IPO opened for subscription on May 28, 2025, and will close on May 30, 2025. The company aims to raise ₹220 crore through this public issue. This article provides comprehensive details about the IPO, including key dates, business overview, Grey Market Premium (GMP), and other relevant information.(Chittorgarh, The Economic Times)

IPO Snapshot

- IPO Name: Scoda Tubes Ltd IPO

- IPO Code: SCODATUBES

- Issue Type: Book Built Issue

- Price Band: ₹130 to ₹140 per share

- Face Value: ₹10 per share

- Issue Size: 15,714,286 equity shares aggregating up to ₹220 crore

- Lot Size: 100 shares

- Minimum Investment: ₹14,000

- IPO Opening Date: May 28, 2025

- IPO Closing Date: May 30, 2025

- Basis of Allotment: June 2, 2025

- Listing Date: June 4, 2025

- Listing Platform: BSE and NSE

- Registrar: MUFG Intime India Private Limited

- Lead Manager: Monarch Networth Capital Ltd(Investor Gain, Chittorgarh, Chittorgarh, Investor Gain, Investor Gain)

Company Overview

Established in 2008, Scoda Tubes Ltd specializes in manufacturing stainless steel pipes and tubes. The company’s product portfolio includes seamless and welded pipes, U-tubes, and instrumentation tubes. These products cater to various industries such as oil and gas, petrochemicals, power plants, and automotive sectors.

Scoda Tubes operates a solar-powered manufacturing facility, emphasizing its commitment to sustainable and environmentally friendly practices. The company’s focus on quality and innovation has enabled it to establish a strong presence in both domestic and international markets.

Grey Market Premium (GMP)

As of May 28, 2025, the Grey Market Premium (GMP) for Scoda Tubes Ltd IPO is reported to be around ₹23. Considering the upper price band of ₹140, the estimated listing price could be around ₹163, indicating a potential gain of approximately 16.43% on the listing day. Investors should note that GMP is an unofficial indicator and may fluctuate based on market conditions.(Investor Gain)

Shariah Compliance Status

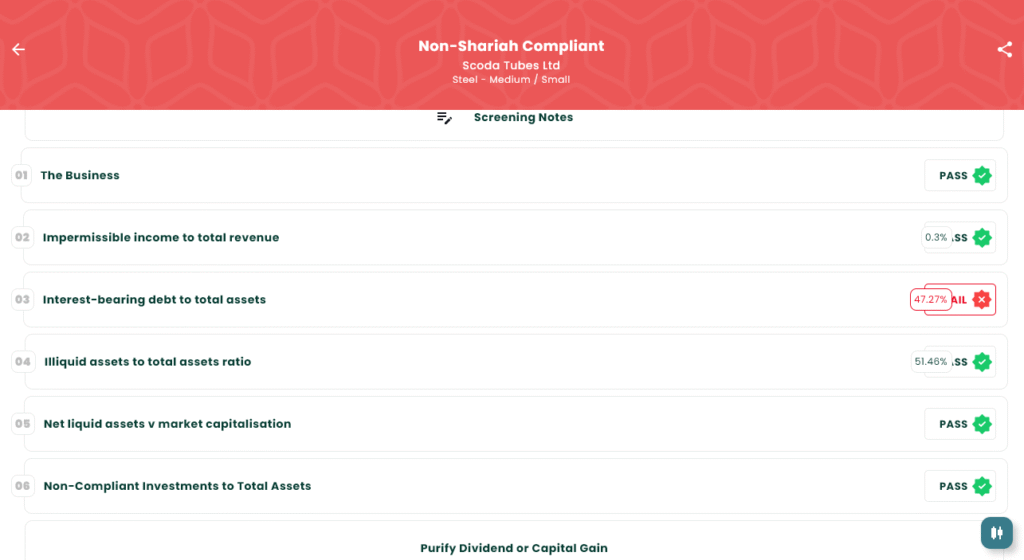

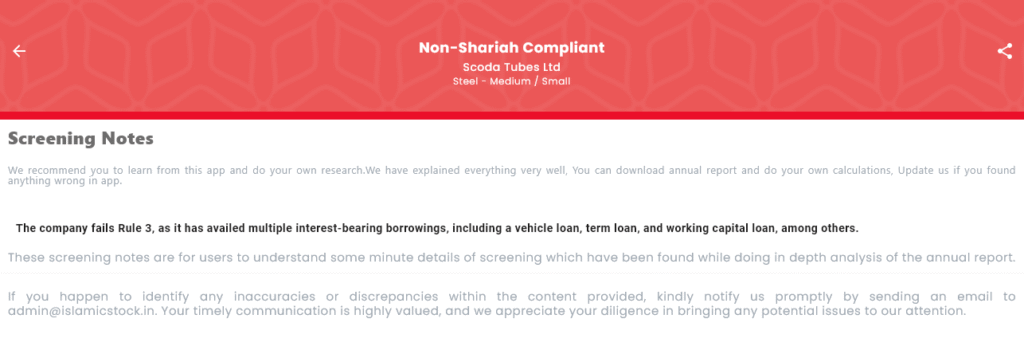

According to IslamicStock, Scoda Tubes Ltd has been classified as Non-Shariah Compliant. The screening notes mention that the company fails Rule 3 of the Shariah compliance screening. This is because Scoda Tubes has availed multiple interest-bearing loans, including vehicle loans, term loans, and working capital loans. While the company passes other screening criteria such as business activity and impermissible income, the presence of these loans makes it non-compliant from a Shariah perspective. Investors who follow Islamic finance principles should consider this status before making any decisions.

Screenshots from IslamicStock show the failed compliance status for interest-bearing debt, which stands at 47.27% of total assets, breaching the accepted limits for Shariah-compliant investments.

Subscription Status

On the first day of the IPO opening, Scoda Tubes Ltd’s public issue was fully subscribed, primarily driven by strong interest from Qualified Institutional Buyers (QIBs). This robust demand reflects investor confidence in the company’s prospects and the overall positive sentiment in the market. Retail investors and Non-Institutional Investors (NIIs) are also actively participating in the subscription process.(The Economic Times, Investor Gain)

Final Thoughts

Scoda Tubes Ltd’s IPO presents an opportunity for investors to participate in the growth of a company with a solid track record in the stainless-steel manufacturing sector. The company’s commitment to quality, sustainability, and innovation positions it well for future expansion. However, potential investors should carefully consider the company’s financials, industry outlook, and market conditions before making an investment decision.(The Economic Times)

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Investors are advised to consult with financial advisors and conduct their own research before investing in any IPO.