Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Shringar House of Mangalsutra Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Shringar House of Mangalsutra Ltd

Industry: Gems, Jewellery And Watches

Listing At: NSE & BSE (Mainboard)

Overview:

Established in January 2009, Shringar House of Mangalsutra Limited is a prominent Indian company that specializes in designing, manufacturing, and selling mangalsutras. The company has a legacy of over 40 years in craftsmanship and is known as the “House of Mangalsutra.”

Shringar focuses on creating pieces that blend contemporary trends with traditional Indian values. They offer a diverse range of mangalsutras that feature various stones, including American diamonds, cubic zirconia, pearls, and semi-precious stones. The jewelry is made with 18k and 22k gold.

The company operates on a business-to-business (B2B) model, serving a wide client base that includes corporate clients, wholesale jewelers, and retailers across India and internationally. As of March 31, 2025, Shringar had served 34 corporate clients, 1,089 wholesalers, and 81 retailers. Their notable clients include Malabar Gold, Titan, GRT Jewellers, and Reliance Retail. They have expanded their international reach to the UK, New Zealand, UAE, USA, and Fiji.

Shringar also manufactures mangalsutras on a job-work basis for its corporate clients. The company has shown consistent financial growth, with a revenue of ₹264.83 million in fiscal year 2025, an increase from ₹156.47 million in fiscal year 2023. As of June 30, 2025, the company had 237 employees.

Key strengths of the company include its established client base, innovative designs, an integrated manufacturing facility, and a focus on quality assurance.

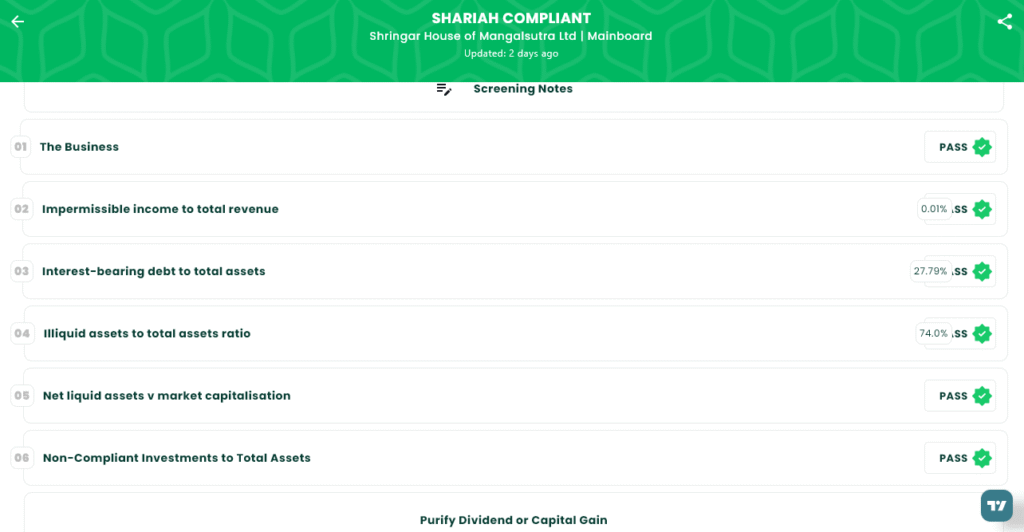

Shariah Status

The IPO currently Under Review, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 10, 2025

- IPO Close Date: Wednesday, September 12, 2025

- Tentative Allotment: Thursday, September 15, 2025

- Initiation of Refunds: Monday, September 16, 2025

- Credit of Shares to Demat: Monday, September 16, 2025

- Tentative Listing Date: Tuesday, September 17, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 12, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 90 | ₹14,850 |

| Retail (Max) | 13 | 1,170 | ₹1,93,050 |

| S-HNI (Min) | 14 | 1,260 | ₹2,07,900 |

| S-HNI (Max) | 67 | 6,030 | ₹9,94,950 |

| B-HNI (Min) | 68 | 6,120 | ₹10,09,800 |

Financials

Shringar House of Mangalsutra Ltd. showed strong financial growth across the three fiscal years ending March 31, 2023, 2024, and 2025. The company’s total income steadily increased from ₹951.29 crore in 2023 to ₹1,102.71 crore in 2024 and then to ₹1,430.12 crore in 2025. This growth was accompanied by a significant rise in profit after tax (PAT), which grew from ₹23.36 crore in 2023 to ₹31.11 crore in 2024 and jumped to ₹61.11 crore in 2025. Similarly, the company’s assets also increased from ₹211.55 crore in 2023 to ₹265.00 crore in 2024 and reached ₹375.75 crore in 2025. Net worth also followed an upward trend, rising from ₹105.72 crore in 2023 to ₹136.85 crore in 2024, and further to ₹200.85 crore in 2025. Total borrowing also increased over the period, from ₹93.19 crore in 2023 to ₹110.09 crore in 2024, and ₹123.11 crore in 2025. EBITDA also increased from ₹38.89 crore in 2023, to ₹50.76 crore in 2024, and ₹92.61 crore in 2025.

KPI

| KPI | Value |

| ROCE | 32.43% |

| Debt/Equity | 0.61 |

| RoNW | 36.20% |

| PAT Margin | 4.27% |

| EBITDA Margin | 6.48% |

| Price to Book Value | 5.93 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.