Table of Contents

About:

Spunweb Nonwoven Limited, an ISO 9001:2015 certified company, is making waves in the nonwoven fabric industry, both in India and internationally. As a leading manufacturer of PP (Polypropylene) spunbond nonwoven fabric, Spunweb operates five advanced production lines across two state-of-the-art units in Morbi, Gujarat. Their facilities boast cutting-edge technology and rigorous quality checks to ensure flawless products.

Spunweb is driven by a vision to become a global leader, developing innovative and high-quality products that span applications from healthcare and automotive to consumer goods. Their mission centers on upholding the highest quality standards, contributing to groundbreaking advancements, and continuously enhancing their offerings. Core values of honesty, trust, transparency, and a commitment to positive community impact guide their operations.

The company’s journey began in 2015, steadily expanding with new production lines in 2016 (first SS Line, India’s first twin-pattern roll calender), 2018 (second SS line), 2020 (third SS Spunbond line), 2022 (fourth production line at Unit 2), and 2023 (fifth production line with advanced SSS technology for hygiene products). Spunweb has also embraced green energy, installing rooftop solar systems in 2021 (0.5 MW), February 2024 (0.6 MW at Unit 1), and August 2024 (0.435 MW at Unit 2). In 2024, the company enhanced its product portfolio with lamination and sheet cutting services, transitioned from a Private Limited to a Limited entity in September, and acquired Spunweb India Private Limited in December. Their product range includes Non-Woven Fabric, Laminated Fabric, Hospitality Products, Agriculture Products, and Landscaping Products.

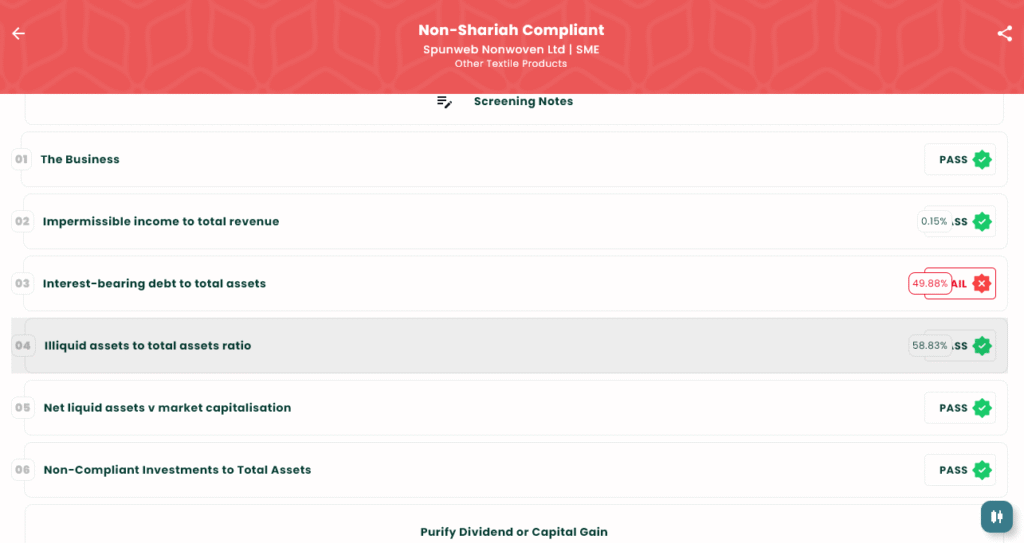

Shariah Status:

Spunweb Nonwoven Ltd is classified as Non-Shariah Compliant.

This is primarily because the company’s interest-bearing debt to total assets ratio is 49.88%, which exceeds Shariah compliance limits. The screening notes highlight that the company’s total borrowing significantly increased from ₹48.33 crore to ₹91.16 crore, causing it to fail Rule 3.

Spunweb Nonwoven IPO: At a Glance

The Spunweb Nonwoven IPO is a Bookbuilding Issue.

| IPO Details | Information |

| IPO Date | July 14, 2025 to July 16, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹90 to ₹96 per share |

| Sale Type | Fresh Capital |

| Total Issue Size | 63,51,600 shares (aggregating up to ₹60.98 Cr) |

| Listing At | NSE SME |

| Share Holding Pre Issue | 1,77,51,809 shares |

| Share Holding Post Issue | 2,41,03,409 shares |

Spunweb Nonwoven IPO Lot Size

Investors can bid for a minimum of 1,200 shares.

| Application | Lots | Shares | Amount (₹) |

| Individual Investors (Retail) (Min) | 2 | 2,400 | 2,30,400 |

| Individual Investors (Retail) (Max) | 2 | 2,400 | 2,30,400 |

| S-HNI (Min) | 3 | 3,600 | 3,45,600 |

| S-HNI (Max) | 8 | 9,600 | 9,21,600 |

| B-HNI (Min) | 9 | 10,800 | 10,36,800 |

Company Financials: Spunweb Nonwoven Limited

Spunweb Nonwoven Limited’s revenue increased by 47% and profit after tax (PAT) rose by 98% between the financial year ending March 31, 2025, and March 31, 2024.

| Period Ended | 31 Mar 2025 (₹ Crore) | 31 Mar 2024 (₹ Crore) | 31 Mar 2023 (₹ Crore) |

| Assets | 182.76 | 106.58 | 93.15 |

| Revenue | 227.14 | 154.24 | 117.68 |

| Profit After Tax | 10.79 | 5.44 | 1.13 |

| EBITDA | 31.23 | 15.01 | 10.80 |

| Net Worth | 43.15 | 25.09 | 20.15 |

| Reserves and Surplus | 27.30 | 15.77 | 10.33 |

| Total Borrowing | 91.16 | 48.33 | 49.50 |

Key Performance Indicator (KPI): Spunweb Nonwoven Ltd.

| KPI | Values |

| ROE | 31.63% |

| ROCE | 33.66% |

| Debt/Equity | 2.11 |

| RoNW | 31.63% |

| PAT Margin | 4.75% |

| EBITDA Margin | 13.75% |

| Price to Book Value | 3.95 |

Grey Market Premium (GMP):

The Grey Market Premium (GMP), as on July 14 at around 9 AM for Spunweb Nonwoven IPO was currently ₹35, representing 36.46%.

Objects of the Issue: Purpose of the IPO Funds

The company proposes to utilize the Net Proceeds from the Issue towards the following objectives:

- Funding the working capital requirements of the company

- Investment in the wholly owned subsidiary, SIPL, for funding its working capital requirements

- Repayment, in full or in part, of certain borrowings availed by the company

- General Corporate Purposes

Valuable Links:

Opening a trading account is your first step. Consider these trusted platforms:

- Zerodha: Open your account with Zerodha: https://zerodha.com/?c=NGT561&s=CONSOLE

- Angel One: Download the Angel One app: https://angel-one.onelink.me/Wjgr/92znd9xl

For more detailed information, company analyses, and investment options, visit our resources:

- Our Website: https://www.islamicstock.in/

- Our Blog: https://blog.islamicstock.in/

You can also download our application, IslamicStock, for in-depth screenings and investment guidance tailored for you:

- Google Play Store: https://play.google.com/store/apps/details?id=com.halal.stocks&hl=en_IN

- Apple App Store: https://apps.apple.com/in/app/islamicstock-screener-india/id1627541365

SEBI Disclaimer: Investment in securities markets are subject to market risks, read all the related documents carefully before investing. The information provided in this article is for educational and informational purposes only and does not constitute financial advice. Investors should consult with qualified financial professionals before making any investment decisions.