Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Taurian MPS Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Taurian MPS Ltd

Industry: Civil Construction

Listing At: NSE SME

Overview:

Taurian MPS is a leading Indian manufacturer of crushing and screening equipment for the mining, aggregates, and mineral processing industries, with a global presence built on more than two decades of expertise. Founded by industry veterans, the company began as a family business and has since grown into a public limited company, distinguishing itself as the only one of its kind in India. Its core mission is to transform the future of the mining sector by integrating innovation and sustainability into its operations, helping miners meet the growing demands of modern industries while reducing their environmental impact.

The company’s commitment to excellence and reliability is evident in its “Taurian” brand, which has earned a strong reputation worldwide. Taurian MPS focuses on delivering long-term value and quick returns on investment for its customers by offering cutting-edge technology and comprehensive services. To ensure its products meet global standards, the company has established strategic partnerships with top firms in the U.S. and Europe. With a legacy of engineering prowess, it has successfully completed over 2,000 installations globally, each one customized to address specific customer challenges, whether for optimizing aggregate production, enhancing mineral beneficiation, or improving waste recycling processes.

Under the leadership of Managing Director Yashvardhan Bajla, the company is also a dedicated sustainability partner. It provides efficient, low-impact solutions for mineral processing through continuous innovation, energy-efficient designs, and responsible resource management. This approach helps customers minimize their carbon footprint, contributing to a greener and more sustainable future for the entire industry.

Taurian MPS operates a state-of-the-art 64,773-square-foot manufacturing facility in Roorkee, Haridwar. This unit is equipped with advanced processing capabilities and a skilled team that rigorously tests both raw materials and finished goods to ensure high-quality products. The company’s comprehensive product portfolio includes a wide range of machinery, such as Jaw crushers, cone crushers, VSI crushers, vibrating screens, and complete crushing plants.

With a strong focus on “Make in India,” Taurian MPS has established a wide distribution network, supplying its products across many Indian states, including Uttarakhand, Karnataka, Maharashtra, and Rajasthan, among others. The company’s competitive strengths are its diverse product range, strict quality control processes that anticipate issues before they occur, an experienced management team, and a broad customer base, with significant sales concentrated in Rajasthan and Maharashtra. As of July 31, 2025, the company has a dedicated workforce of 94 employees. Overall, Taurian MPS is a leader in its field, known for its deep industry knowledge, commitment to quality, and forward-thinking approach to sustainability.

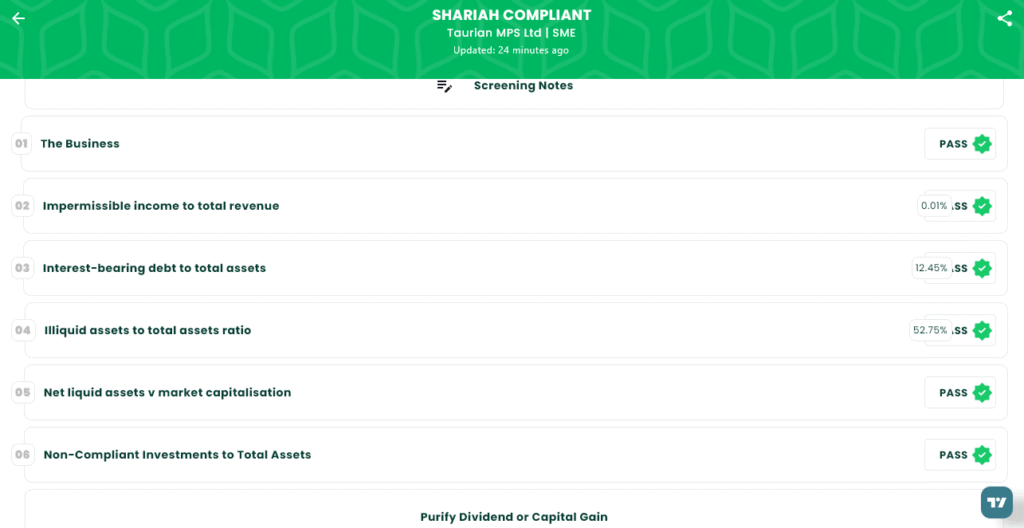

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 9, 2025

- IPO Close Date: Wednesday, September 11, 2025

- Tentative Allotment: Thursday, September 12, 2025

- Initiation of Refunds: Monday, September 15, 2025

- Credit of Shares to Demat: Monday, September 15, 2025

- Tentative Listing Date: Tuesday, September 16, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 11, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 1,600 | ₹2,73,600 |

| Individual investors (Retail) (Max) | 2 | 1,600 | ₹2,73,600 |

| S-HNI (Min) | 3 | 2,400 | ₹4,10,400 |

| S-HNI (Max) | 7 | 5,600 | ₹9,57,600 |

| B-HNI (Min) | 8 | 6,400 | ₹10,94,400 |

Financials

Based on the financial data, the company experienced a period of significant growth from 2023 to 2025. Total Income grew by 66.85% and Assets increased by 87.05% from 2024 to 2025, which reflects continued business expansion. However, despite this revenue growth, Profit After Tax surprisingly dropped by 16.08% in 2025 compared to the previous year. This suggests that while the company is earning more, its costs may have increased at an even faster rate. On a positive note, Net Worth saw a healthy rise of 77.81% and Reserves and Surplus more than doubled, increasing by 110.08%, indicating a strengthening of the company’s financial foundation.

KPI

| KPI | Value |

| ROE | 35.44% |

| ROCE | 31.64% |

| Debt/Equity | 0.27 |

| RoNW | 27.69% |

| PAT Margin | 12.92% |

| EBITDA Margin | 20.51% |

| Price to Book Value | 3.19 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.