Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Urban Co. Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Urban Co. Ltd

Industry: Miscellaneous

Listing At: NSE & BSE (Mainboard)

Overview:

Urban Company is a technology-driven, full-stack online services marketplace that connects consumers with trained and independent service professionals for a variety of home and beauty services. Founded in December 2014, the company offers a wide range of services, including cleaning, pest control, plumbing, carpentry, appliance repair, beauty treatments, and massage therapy. These services are delivered at the consumer’s convenience, with a focus on providing a standardized, reliable, and quality-driven experience.

As of June 30, 2025, Urban Company had a presence in 59 cities across four countries: India, the United Arab Emirates, Singapore, and the Kingdom of Saudi Arabia (through a joint venture). The company boasts over 48,000 active service professionals and has served more than 13 million consumers.

In addition to its services marketplace, Urban Company has expanded into home solutions with its brand ‘Native,’ which includes products like water purifiers and electronic door locks. The company also supports its service professionals by providing them with training, tools, financing, insurance, and branding, which helps improve service quality and earning potential.

Urban Company earns revenue from three main sources: platform services for consumers, the sale of products to service professionals for use during service delivery, and the sale of its ‘Native’ products to consumers. The company’s competitive strengths include its multi-category, hyperlocal marketplace, an established brand trusted by consumers, a robust technology platform, and improved service quality through in-house training and access to professional tools. The company operates in over 12,000 service micro-markets and is the largest online home and beauty services platform in India by net transaction value.

Shariah Status

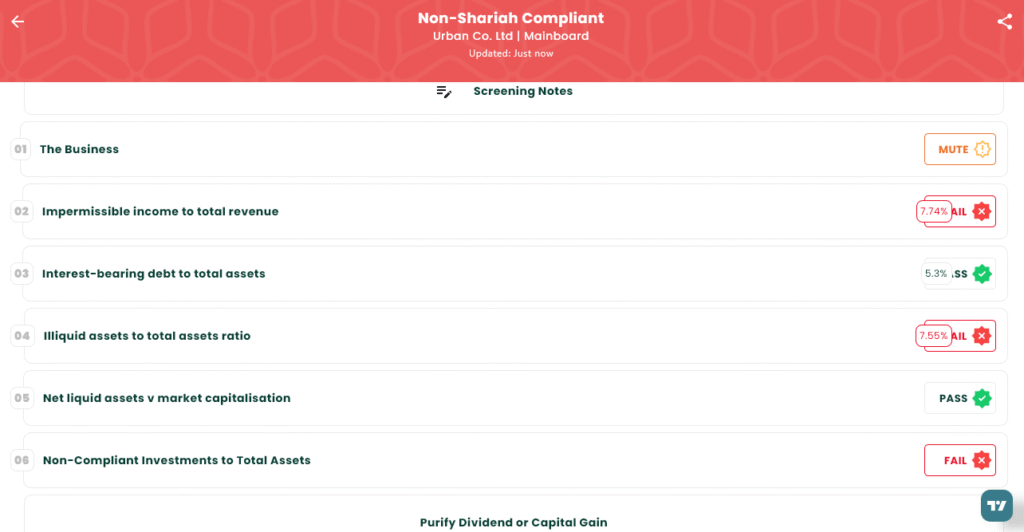

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 10, 2025

- IPO Close Date: Wednesday, September 12, 2025

- Tentative Allotment: Thursday, September 15, 2025

- Initiation of Refunds: Monday, September 16, 2025

- Credit of Shares to Demat: Monday, September 16, 2025

- Tentative Listing Date: Tuesday, September 17, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 12, 2025

Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 145 | ₹14,935 |

| Retail (Max) | 13 | 1,885 | ₹1,94,155 |

| S-HNI (Min) | 14 | 2,030 | ₹2,09,090 |

| S-HNI (Max) | 66 | 9,570 | ₹9,85,710 |

| B-HNI (Min) | 67 | 9,715 | ₹10,00,645 |

Financials

- Query successful

Urban Company’s financials show a significant turnaround, with the company becoming profitable in the fiscal year ending March 31, 2025. For the period ending March 31, 2025, the company had assets of ₹2,200.64 crore, total income of ₹1,260.68 crore, and a profit after tax of ₹239.77 crore. Their net worth was ₹1,781.28 crore, with reserves and surplus at ₹2,646.12 crore. This shows a significant improvement compared to the previous two years, as the company had a loss after tax of ₹92.77 crore in 2024 and ₹312.48 crore in 2023. Additionally, assets, total income, and net worth have all seen steady increases over the past three years.

KPI

| KPI | Values |

|---|---|

| RoNW | 13.35% |

| Price to Book Value | 8.27 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.