Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Vigor Plast India Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Vigor Plast India Ltd

Industry: Plastic Products – Industrial

Listing At: NSE SME

Overview:

Vigor Plast India Limited, based in Jamnagar, Gujarat, is a plumbing pipes and fittings company that has been growing since its start in 2014. The company is known for its wide range of quality products offered at competitive prices, making it one of the fastest-growing organizations in its region.

The company’s manufacturing unit spans 16,566 square meters and produces a full line of products for plumbing, including uPVC and CPVC plumbing pipes and fittings. Their product range is quite extensive, with uPVC and CPVC pipes and fittings available from 15mm to 100mm. The range for PVC pipes is from 20mm to 200mm and fittings from 20mm to 160mm. They also offer SWR pipes and fittings, with ring-fit pipes from 75mm to 160mm, self-fit pipes from 40mm to 160mm, and self-fit fittings from 75mm to 160mm.

To ensure high quality, Vigor Plast has a well-equipped laboratory where quality controllers check products from the initial stage of raw material deployment to the final dispatch of finished goods. The company holds BIS (Bureau of Indian Standards) certification for its CPVC, SWR, and PVC pipes and fittings, and is also ISO 9001:2015 certified for its quality management system.

Looking ahead, Vigor Plast has set ambitious goals. Their vision for 2025-26 is to reach a turnover of ₹100 crore and become one of the top 10 companies in their field. They also aim to expand their reach globally and plan to set up company depots across India to provide efficient and timely service.

The company’s mission is to offer a wide range of affordable and functional products for homes, buildings, industries, and agriculture. They attribute their success to several key factors, including a modern manufacturing facility, excellent transportation connections by air, sea, and road, and an advanced laboratory. They also have a proper storage system for raw materials and finished products, a complete product line, and a skilled workforce.

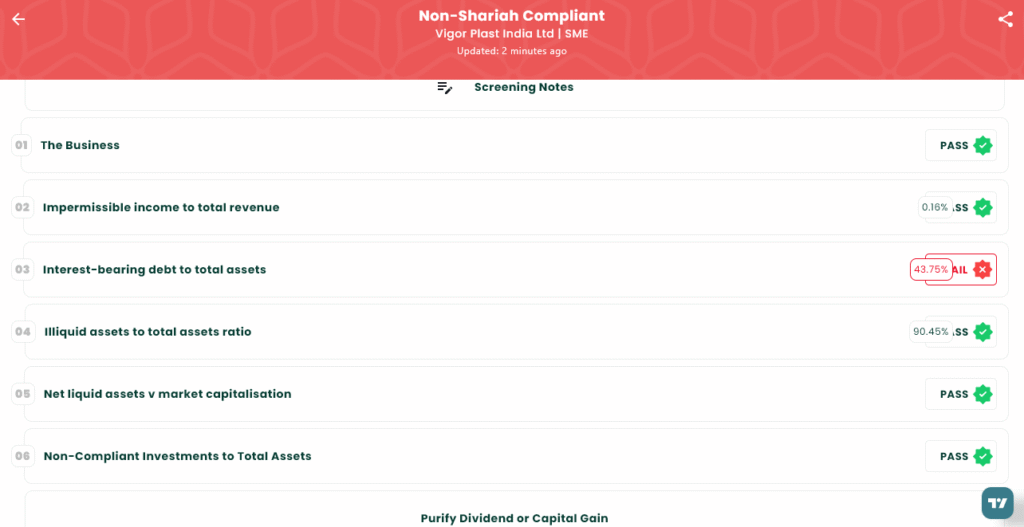

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 4, 2025

- IPO Close Date: Wednesday, September 9, 2025

- Tentative Allotment: Thursday, September 10, 2025

- Initiation of Refunds: Monday, September 11, 2025

- Credit of Shares to Demat: Monday, September 11, 2025

- Tentative Listing Date: Tuesday, September 12, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 9, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,59,200 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,59,200 |

| S-HNI (Min) | 3 | 4,800 | ₹3,88,800 |

| S-HNI (Max) | 7 | 11,200 | ₹9,07,200 |

| B-HNI (Min) | 8 | 12,800 | ₹10,36,800 |

Financials

Based on the financial data of Vigor Plast India Ltd., it shows significant growth across several key metrics. The company’s Total Income increased by 8% from ₹42.52 Crore in the fiscal year ending March 31, 2024, to ₹46.02 Crore by March 31, 2025.

Similarly, Profit After Tax (PAT) saw a substantial rise of 76%, climbing from ₹2.93 Crore to ₹5.15 Crore during the same period. The company’s EBITDA also grew, increasing from ₹7.55 Crore to ₹12.08 Crore.

While Assets expanded to ₹40.51 Crore by 2025, Total Borrowing decreased to ₹17.72 Crore, suggesting a reduction in debt. The Net Worth and Reserves and Surplus also show positive trends, with Net Worth rising to ₹12.78 Crore and Reserves and Surplus reaching ₹4.93 Crore.

KPI

| KPI | Value |

| ROE | 59.39% |

| ROCE | 28.24% |

| Debt/Equity | 1.39 |

| RoNW | 59.39% |

| PAT Margin | 11.30% |

| EBITDA Margin | 26.51% |

| Price to Book Value | 4.97 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.