Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Vikram Solar Ltd (VIKRAMSOLR), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Vikram Solar Ltd

Industry: Other Electrical Equipment

Listing At: NSE & BSE (Mainboard)

Overview:

As of March 31, 2025, Vikram Solar Ltd. stands as one of India’s largest manufacturers of solar photo-voltaic (PV) modules, with over 17 years of industry experience. According to a CRISIL Report, the company has an installed manufacturing capacity of 4.50 GW and is recognized as one of the largest pure-play module manufacturers in the country. The company’s enlisted capacity on the Ministry of New & Renewable Energy’s Approved List of Modules and Manufacturers (ALMM) was 2.85 GW as of June 30, 2025.

Since commencing operations in 2009 with a 12.00 MW capacity, Vikram Solar has experienced significant growth. Its manufacturing facilities are strategically located in Kolkata, West Bengal, and Chennai, Tamil Nadu, providing excellent access for both domestic and international operations. To meet the increasing demand for solar energy, the company is undertaking substantial expansion plans. These include greenfield and brownfield projects aimed at increasing its solar PV module manufacturing capacity to up to 15.50 GW by fiscal year 2026 and up to 20.50 GW by fiscal year 2027.

The company is also strategically backward integrating its operations by establishing a solar cell manufacturing facility in Gangaikondan, Tamil Nadu, with a total capacity of 12.00 GW by fiscal year 2027. Furthermore, Vikram Solar is diversifying into battery energy storage systems (BESS) with a new greenfield project in Tamil Nadu, aiming for an initial capacity of 1.00 GWh, which is expandable to 5.00 GWh by fiscal year 2027. This move is designed to capitalize on the growing demand for energy storage and position the company as a leader in both energy generation and storage. The company has been repeatedly featured in BloombergNEF as a Tier 1 manufacturer and received the EUPD Top Brand PV Seal in May 2025.

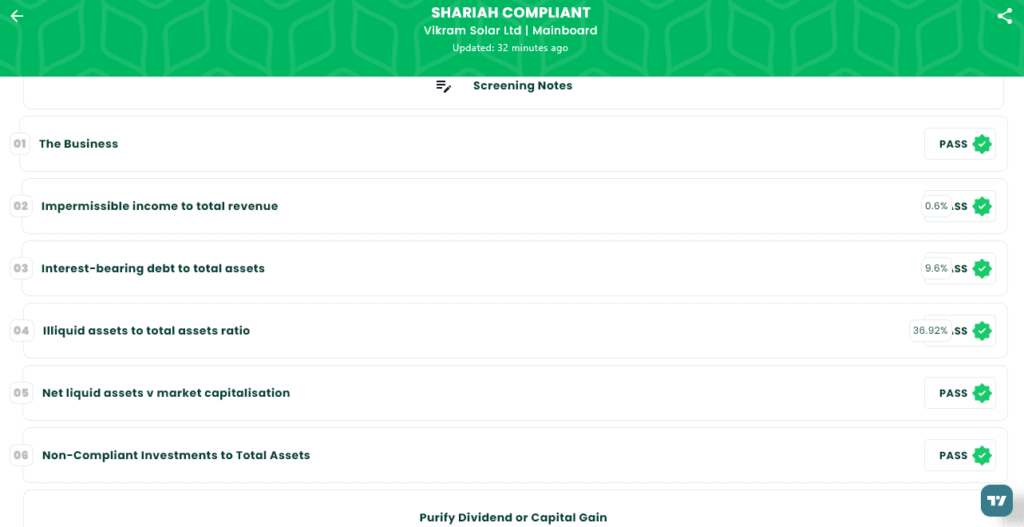

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 19, 2025 |

| IPO Close Date | Thu, Aug 21, 2025 |

| Tentative Allotment | Fri, Aug 22, 2025 |

| Initiation of Refunds | Mon, Aug 25, 2025 |

| Credit of Shares to Demat | Mon, Aug 25, 2025 |

| Tentative Listing Date | Tue, Aug 26, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 21, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 45 | ₹14,940 |

| Retail (Max) | 13 | 585 | ₹1,94,220 |

| S-HNI (Min) | 14 | 630 | ₹2,09,160 |

| S-HNI (Max) | 66 | 2,970 | ₹9,86,040 |

| B-HNI (Min) | 67 | 3,015 | ₹10,00,980 |

Financials

Vikram Solar Ltd. has shown notable growth in its financial performance over the last three years, reflecting consistent improvement in revenues, profitability, and overall strength. For the year ending March 31, 2025, the company recorded total assets of ₹2,832.15 crore, compared to ₹2,585.50 crore in 2024 and ₹2,476.29 crore in 2023, showing steady expansion in its asset base. Total income grew impressively to ₹3,459.53 crore in 2025, marking a strong 37% rise over the previous year’s ₹2,523.96 crore and significantly higher than ₹2,091.91 crore reported in 2023.

Profitability also improved considerably during this period. Profit after tax (PAT) rose by 75% from ₹79.72 crore in 2024 to ₹139.83 crore in 2025, a substantial turnaround when compared with ₹14.49 crore in 2023. Operating performance was equally strong, with EBITDA increasing to ₹492.01 crore in 2025, against ₹398.58 crore in 2024 and ₹186.18 crore in 2023.

The company’s net worth turned positive at ₹0.86 crore in 2025 after being negative in the prior two years. Reserves and surplus showed remarkable growth, reaching ₹932.60 crore in 2025, a significant jump from ₹192.16 crore in 2024 and ₹113.07 crore in 2023, underlining strengthened financial stability.

KPI

| KPI | Values |

|---|---|

| ROE | 16.57% |

| ROCE | 24.49% |

| Debt/Equity | 0.19 |

| RoNW | 11.26% |

| PAT Margin | 4.08% |

| EBITDA Margin | 14.37% |

| Price to Book Value | 8.46 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.